If you would like to receive weekly updates like this, sign up here.

So, what exactly is it already!

Why can’t you see consensus on this subject? It’s really starting to drive me a bit mad.

Here’s what I mean.

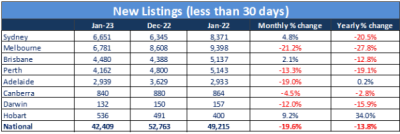

On the one hand, the Australian real estate data provider, SQM Research, published the following table of new homes for sale that have been listed for 30 days or less.

Source – headtopics

This has been savaged by the negative news camp that desperately wants to see a real estate collapse. This is because the monthly listings numbers on the right, measured as a percentage, are mostly negative.

This is proof, they say, that prices are falling and will continue to do so.

The connection they want their readers to make is this: listed homes that are subsequently taken down is proof the broader market is falling, and vendors now can no longer capture the price they want.

But how, then, does one reconcile the negative interpretation of the table above with a headline like this?

Source – AFR

Hundreds of people lining up to see just one open property. That tells me that demand for those remaining homes listed (remember that listings are negative) …is increasing!

My mantra when it comes to sending you these weekly newsletters is simple: I want to cut through the noise and the disingenuous and contradictory media reports out there to find the facts as they appear on the ground.

And then apply the timing of the 18.6-year Real Estate Cycle to them. Now, if you are still reading to this point, I assume that you are also seeking this.

I wrote to you last week about a trend that is largely being driven by returning Chinese students to Australia.

Consider today’s piece a continuation of that.

It seems I undersold the trend to you. I’ve uncovered further proof that, despite the headlines, a true turning point in the Australian real estate market has been reached.

And it happened fully three months ago! And what is happening in Australia is happening elsewhere (though perhaps for different reasons).

Take a look.

Why the top end of town is the key to this.

In RT Edgar’s Toorak office, real estate agent Mandy Zhu is ready for a busy week. On Saturday, a client is touching down from mainland China, and bringing with them an eye-watering $100 million budget.

The mystery client, whose identity Ms Zhu will not reveal, is facing just one roadblock to securing her dream six-bedroom trophy home on at least 2000 square metres of level Toorak turf.

“The only problem I have is there are few available properties that actually meet this brief,” said Ms Zhu, who urged any potential vendors with homes in this nosebleed price bracket to “give her a call”.

This is a quote from a recent Australian Financial Review (AFR) article detailing a particular Toorak real estate agent dealing with a new influx of Chinese buyers.

Now, Toorak is regarded as one of Australia’s most expensive residential suburbs.

However, even for Toorak the mooted price tags being mentioned here are eye watering!

It is really this simple. Since China’s decision to open again, there has been a surge of Chinese-based interest in almost all of Australia’s most prestige properties.

I have thought about just how much money there is sitting there in China awaiting a suitable asset to buy.

Seems there’s a lot!

So, when I hear real estate experts deeply involved in dealings with these Chinese buyer’s state that investment into Australia’s high-end properties will increase by 30% compared to last year, it gives me pause.

Take another look at that SQM chart. Sydney, Melbourne, and Brisbane have arguably the majority of the high-end property market (that’s homes worth over A$2 million) – although these days the Gold Coast holds plenty as well.

Consider the facts. Sales of such high-end properties during 2022 fell by approximately 6000 units compared to 2021.

This meant that many high-end properties were withdrawn from the market until the soft sales conditions improved. It’s this withdrawal that SQM research is pointing out, right now.

So, what precisely would cause a turnaround in listings at this price point?

I wrote to you about this last week, the trend of Chinese university students needing to return to Australia to complete their degrees that had been interrupted by the Covid lockdowns.

I made a case that they alone could see a fundamental revaluation of many of the best-located apartments in Australia’s top cities.

Seems that I underestimated the potential fallout.

If it bleeds, then it leads.

A particular passage from the above AFR quoted article made me stop to re-read it.

That’s because it proved my conclusions regarding the impact returning Chinese students would have on Australian real estate was not broad enough.

“The first category is those who are returning permanent residents who have already obtained residency through the Significant Investment Visa,”

“The second category is parents looking to buy their university-aged children’s properties now they are returning to study.” Ms Zhu said this group was urgently seeking properties after China’s recent policy change so close to the start of the new academic year.

“Some are already here for the Chinese New Year. They are calling me every day, saying, ‘I need some property for my kids’.”

So, it is not just students, but families.

And of course, their preferred form of accommodation is a 3–4-bedroom home.

Which, if we are looking at this in relation to where the very best universities and schools are located, means that the most exclusive suburbs in the biggest cities are the target market.

In other words, the best suburbs in tier 1 cities such as Sydney, Melbourne, and Brisbane.

And what’s the most highly sought after properties in those cities? 3–4-bedroom family homes. And they all sit in that $1-2 million dollar range.

And you can even include the Gold Coast.

2022 closed with over 1300 sales of $2 million dollar or higher homes on the Gold Coast.

Research suggests on the Gold Coast there “may” be between 60,000 to 70,000 freehold homes potentially valued at or near that $2 million-dollar mark.

In Sydney, The Plus Agency’s Peter Li said the open border had dramatically increased inspection numbers across all price points.

“We’re looking after 60 to 70 groups of Chinese buyers every week. Inspection numbers are quite literally 10 times what they were during COVID isolation,” Mr Li said.

Let’s sum this up by saying – even I had underestimated the latent demand from Chinese buyers.

Here is the explanation for hundreds of people lined up around the block to attend just a single open home.

I can’t for the life of me understand how the “If it bleeds, then it leads” media have stoked such fear and negativity about property.

When you read the above quotes, and witness what’s happening on the ground.

Here’s the truth: there is overwhelming demand for the best properties in the country, whose supply has vanished over the last 12 months. Under these circumstances you have one option.

This nation needs to start building more residential homes. And in December 2022, according to the latest Australian Bureau of Statistics (ABS) data dump, building approvals rose in December by over 18%.

That’s three months ago. Or, let me put it in real estate cycle terms for you.

The dip in the Australian real estate market is over.

It ended in December! Which news outlet was reporting that at the end of last year.

My advice: don’t stand in the way of these trends as they appear, folks. But you’re not going to read about them before they happen or when they start.

During those times, when you should be buying, you’ll be told that property is on the verge of collapse.

Then when the rising trend is obvious to everyone, the news will reflect that. And you’ll have missed out on some or all of it.

How can you avoid looking the wrong way all the time? It’s quite simple.

Get educated.

Start that right here with a Boom Bust Bulletin (BBB) membership.

This is how you will learn about the over 200-year history of the 18.6-year Real Estate Cycle, why it continues to repeat over and over, and guide you to the best opportunities for your investment capital as it turns.

Most importantly, help you see when it’s the right time to be in or out of the markets.

Our BBB editions cover the most important topics at the correct times according to where we are in the 18.6-year Real Estate Cycle. Our December edition for instance covered the sate of the US housing market and the effects that would have worldwide.

How timely was that!

And all for $4USD a month, less than a takeaway coffee.

I must say this: 2023 is going to be a bumper year for real estate in Australia – and globally.

This newsletter edition has been about Australia. Other markets have their own dynamics. But they all share one thing in coming.

They have shrugged off the difficult news of 2022 and are moving up. You won’t know it from the news. But if you open your eyes and understand the cycle you will see it.

But it’s now a time critical window too.

Be it emotional, financial or some other important reason, the facts are speaking to a surge of home buyers who now believe property brought today will be cheaper than trying to buy in 12 months’ time.

I will leave the final word here for Mr. Peter Li from Sydney based The Plus Agency’s.

“The decision time to buy properties has been shortened. Now, buyers for $20 million properties are making decisions in as little as three weeks down from six months”.

The clocks ticking, a rising tide raises all boats.

Take charge of your financial future – today.

Sign up to Boom Bust Bulletin here.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.