If you would like to receive weekly updates like this, sign up here.

Are you wondering where your next pay rise will come from?

Most workers around the world are feeling the burden of ever rising costs on the same pay packet they have held for years now.

Is there any hope on the horizon for this to change?

I may have found it.

I noticed the Australian Bureau of Statistics (ABS) released its latest Business Conditions and Sentiments report for June 2021 recently.

These reports have been released starting July 2020.

Since then, we have seen several states re-enter lockdown protocols due to the Delta variant of COVID breaking out amongst the community.

The thing is, Australia has been no different to all modern economies around the world.

All of them have been in lockdowns, and now for the most part most of them are now all re-opening.

I feel very confident the results of this survey are closely aligned to what businesses around the world are thinking.

So, it’s the time today to look.

So, if you have direct exposure to retail, commercial or office space within any large CBD, or are just interested in the opportunities that the current reopening will bring, the April and June 2021 reports will prove revealing.

Plus, I will discuss exactly how one can take advantage too.

Let’s begin.

What did Australian businesses say?

The background to these reports involved phone calls between the 9th to the 16th of June respectively across a wide selection of small, medium, and large business.

They were asked to provide their best estimates and not rely on records.

Likewise, a week-long campaign was held in April 2021.

Each month a different set of questions were posed to each business.

April’s report focused on their current work from home arrangements with employees.

This ABS survey found that 27% of those businesses that had no teleworking prior to Covid, have introduced working from home in response to Covid-19.

Those same businesses increased the number of their staff working from home over the last 18 months. And they increased the frequency of that same teleworking.

So as of April 2021, some 31% of the Australian workforce now works from home consistently.

That’s almost four million workers, or 3 times the number of normal teleworkers prior to COVID lockdowns in 2020.

This has been mirrored all around the world as economies realised they needed to turn to work-from-home arrangements to keep a lockdown economy moving.

The survey seemed to confirm one fact. Teleworkers love not having to commute to and from work.

They are more productive and can spend more time with their family.

So, what does this mean for the real estate market?

Well, if these changes do become part of the “new normal”, then we are going to see effects across the urbanization of our big cities.

But it also presents opportunity.

It makes good business sense if you are a property investor to focus on the type of homes that these workers may desire should these proposed working arrangements stick.

Well, if you read June’s business sentiment report, you would quickly realize that this work-from -home trend is manifesting the argument quite differently for businesses.

This June report found business sentiment and trading conditions were already improving.

Granted, the then Victorian lockdowns meant sentiment for business revenue based in this state were lower than the national average.

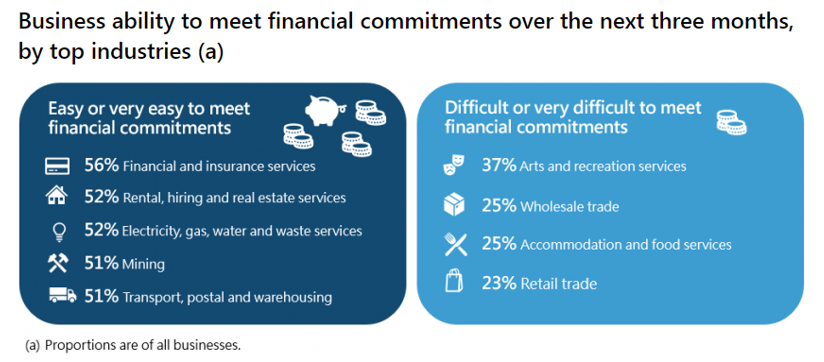

But for the rest, businesses across the top industries were broken down into those who would find their financial commitments easy to meet as opposed to not easy.

See the graphic below. It shows the sectors of the economy who expect to have little to no problem meeting their financial commitments compared to those who forecast difficulties.

However, one impediment to growth was sited as a chronic staff shortage both today and into the future.

In June, 19% of employing businesses reported that they did not have enough employees based on current operations, compared to 12% in March 2021 and 15% in December 2020.

Businesses in construction (29%) and retail trade (27%) were the most likely to report staff shortages.

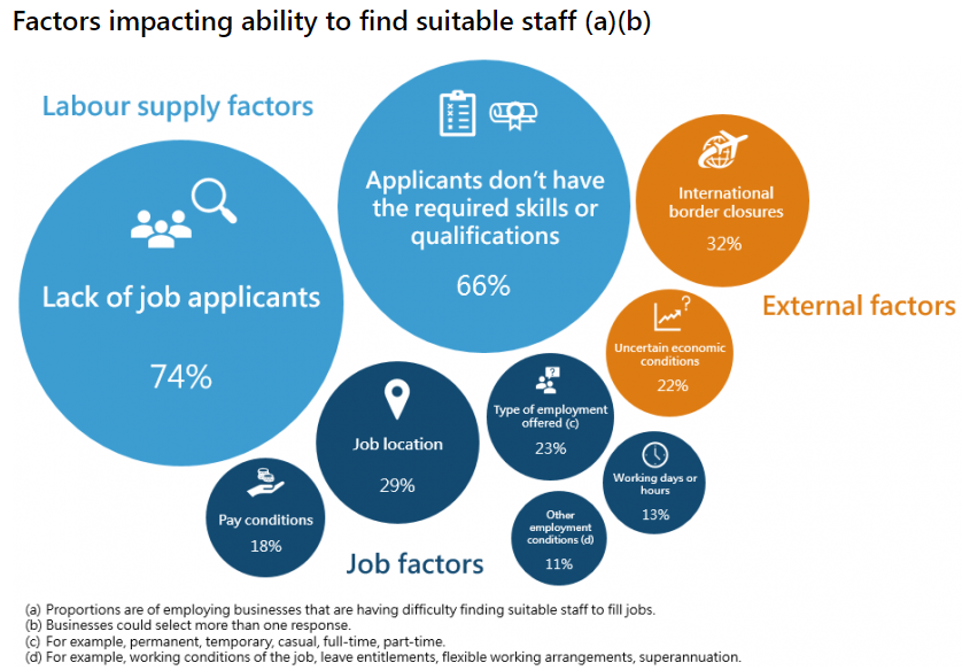

These staff shortages were broken down into three distinct factors: Labor supply, External and Job factors.

I imagine these would be similar across the world right now. Your ability to meet the demands for skilled and experienced staff in your chosen field is key to experiencing the wage grow you seek.

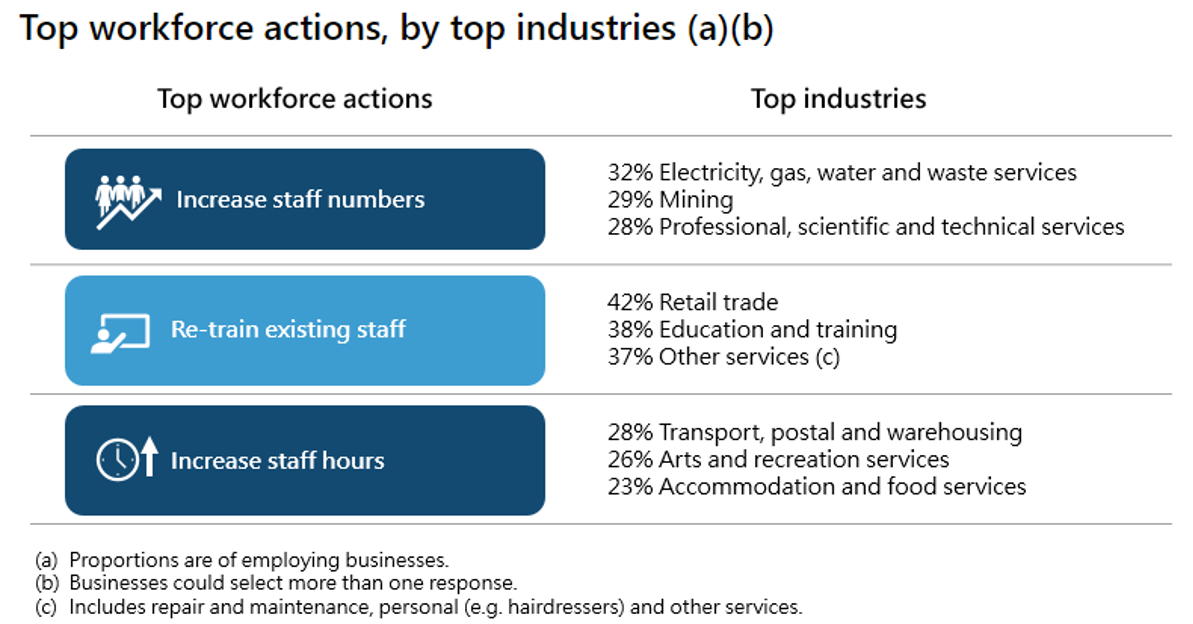

Finally, all small, medium, and large business were asked what their priority workforce actions would be over the next two months?

How to square this round hole?

So you need to find a way now to bring the results of these two reports together now.

Right now, it does appear we are forcing a square peg into a round hole.

I would suggest the best way to identify what the trend will be moving forward is to put on your real estate cycle lenses.

It’s the best possible way to view the economy, by taking advantage of the 18.6-year Real Estate Cycle history to study the land market.

Look again at those industries who are the best positioned to meet their future financial commitments.

You will notice they are also the same ones who identified their top workforce actions as increasing staff numbers and staff work hours.

This will create competition in an already strong employment market.

These types of jobs are largely incompatible with the work-from-home trends we have seen reported in April 2020.

So, wage growth is likely to come in these areas to attract the right type of employees and not those who represent workers who are employed from home.

Will cost of living pressures mean more of this cohort return to traditional office work?

Say we all decide to go back to our central offices. Does that mean that all those homes with purpose-built home offices decrease in price as they are no longer as desirable?

Does this trend change your buying decision as an investor?

What if businesses no longer believe their teleworkers are as productive anymore and thus insist they return to their normal place of work?

And commercial real estate now becomes the standout asset to own moving forwards?

How do we square this round hole? Which way is this likely to tilt?

Where are the opportunities for your own future wage growth, personal investment strategy and property portfolio?

This is how you’ll know, by becoming a member of the Boom Bust Bulletin (BBB).

The Boom Bust Bulletin can teach you the history of the 18.6-year Real Estate Cycle, why it repeats the way it does and identify and guide you to the best opportunities it presents.

Just this week our recently released BBB edition was about identifying the best Real Estate Investment Trusts (REITs) for you to invest in around the globe.

Remember, most of all infrastructure built in this country and across the globe are surrounding the one place we all tend to migrate to for work and play. And that’s our CBDs.

You can’t tell me there aren’t powerful vested interest expecting a return on all this infrastructure investment.

And these ABS surveys provide powerful hints as to what most businesses see in the short term.

The REIT charts are already showing who is winning here, and which sectors of the economy are now outperforming.

It’s time for you to gain a similar edge with your investments.

And know with certainty where the economy is going, and most crucially when.

I don’t know what happens tomorrow.

I do know though that I can rely upon more than 200 years of repeatable history to guide me regardless.

And nothing can replace the inherent timing the 18.6-year Real Estate Cycle can provide you.

All for $4USD a month, incredible value!

Best regards,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.