If you would like to receive weekly updates like this, sign up here.

In the last few weeks, I have written about some truly mammoth projects which are either already underway or about to commence.

Following such megaprojects can make for heavy reading at times, but I do it because it’s critical to you in terms of following the 18.6-year real Estate Cycle and identifying the unique opportunities it presents.

Today though I’d like to change tack. I am not going to talk about any world changing mega-projects or about tech behemoths moving into the real estate markets.

I want to be more practical today and come back to some investment basics.

Today I bring to you a simple yet effective investment that, frankly, almost anyone can do.

Done right, and given enough time, it can be very lucrative.

Are you interested in making up to ten times your money on an investment that carries some of the lowest amount of risk imaginable?

If so, please read on.

I will explain this very simple method of wealth creation. Particularly if you are in the market now to buy your next home.

It’s a very well-proven path to financial success too. Why it’s not receiving wall-to-wall media interest I have no idea.

Recession and housing collapse gets all the clicks I suppose.

No problem: it means we can keep this to ourselves!

Back to school time.

We all want to own a property that you can call ‘home’.

It will be the biggest single investment for most of us. And our most important too.

One of the biggest drivers of this is when we decide it’s time to settle down and have a family.

It’s one of the best ways to lay down some roots, give your children a chance to grow up with happy memories of early childhood in the family home.

Also, in time, those children will need to go to school to get an education.

As parents, this decision is a crucial one. We want the very best for them, and clearly a good education will set them up for whatever future career they may seek for themselves.

Again, there is nothing here that’s a surprise.

However, there are some who have put two and two together.

Not only have they found the best possible solution to educate their children, but they ensured their biggest investment outperforms others by up to a factor of ten!

How is this? Consider this extract from a report I read recently. It was published in Australia, but the principle applies elsewhere, including the US, UK, and Canada.

Houses within public school catchment areas have vastly outperformed their respective suburbs in the past year, with values rising 10 times faster in some cases, and largely defying the broader downturn, Domain’s School Zone report shows.

Nicola Powell, Domain’s chief of research and economics said school catchments can drive up prices in areas with high-demand public schools, making them more resilient in a downturn.

And here’s the proof. Let’s take an example from Sydney in Australia. Again, the dynamic applies to all the world’s major cities.

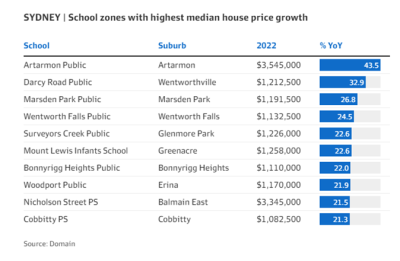

The table below sets out median house price growth in several Sydney school catchment areas or “school zones”.

Firstly, an explanation. What’s a school catchment?

A school catchment is defined as the geographical location where a state school’s core intake of students must live. It can cross multiple suburbs but may not include a suburb in its entirety. It can also slice the suburb or street into half and can vary in size.

Above are the top ten Sydney suburbs located within some of the state’s best school catchment areas.

On the right-hand side of that chart is the year-on-year change in the median price of a house expressed as a percentage.

Now, it’s important to place context here.

Some of the nations most affluent suburbs, like Balmain East, are included. Hardly the most accessible market.

However, there are a few middle-class suburbs in that chart also. Greenacre and Wentworthville are considered outer suburbs that are, relatively speaking, more affordable Sydney suburbs.

But the difference within the suburbs themselves are stark.

And it’s this fact that inspired me to write to you today. Just a little due diligence (or homework as they call it at school) on your part before you buy will make huge differences over time.

In Balmain East, house values inside the Nicholson Street Public School zone jumped by 21.5 per cent, more than ten times faster than the suburb’s 2 per cent annual price gain.

Regardless of where you reside and put the money aside for a moment. Where do you think your precious money will work harder for you?

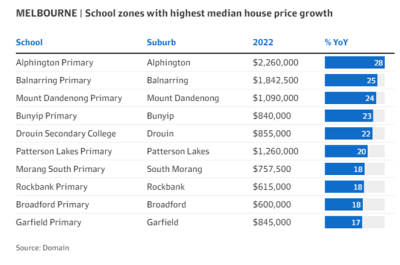

This simple truth has been repeated across each Australian capital city. For example, here is a similar chart for Melbourne, Australia’s second largest city.

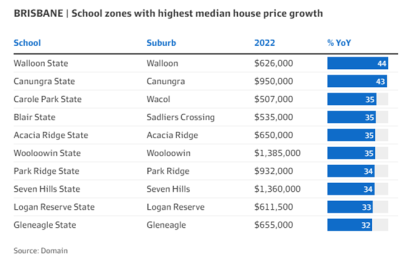

Finally, here’s Brisbane’s performance.

Location, location, location.

The dynamic operates in other countries too if you care to look.

It is a global trend, one that regardless of where you reside you can replicate with only a little investment in time and effort.

I went through and found hundreds of similar suburbs that Domain had charted. During 2022 the “worst’ performing school catchment suburb that they listed recorded a 7% gain for 2022.

This must not sound like much. But consider this.

The market in those places during 2022 was slow: Sydney house prices on average fell by 6.5 per cent, Melbourne was down by 5.8 per cent, while Brisbane and Adelaide ended the year 2.9 per cent and 13.9 per cent higher.

At least in Australia, this does give buyers some negotiating room to manoeuvre here before a more widespread bounce in prices in the future occurs.

This speaks to another angle I haven’t covered with you.

These catchment suburbs are remarkably resilient to soft economic conditions, even in recession.

And this makes sense. Do you think if we suffer a recession this year, no matter how unlikely or how bad it could be, would you then take your children out of school and keep them home?

No. This places a hard floor on home prices. It’s a key and important motivator to stay put and not panic sell into weakness.

So, it’s my contention that if you are the profile of home buyer that this newsletter is aimed at it’s an option that you should seriously consider.

Or perhaps you’re trying to find a different type of investment property to add to your portfolio?

Just research the best or highest rated public schools in your area (they are available online) and then focus your house searches to those same catchments.

Yes, you will need to dig deeper into your wallet to get in, no question.

But your patience and investment will, if these charts are any guide, be well rewarded in time.

The only thing now is – when?

When should you buy? After all the news is so negative and contradictory. You might feel that you don’t know where to turn, who to listen to and are afraid of making a huge mistake.

I can help there, via a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why even today it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

As property experts always say: it’s all about location, location, location.

Today I’ve provided you with one practical and useable explanation of what precisely that means.

There is however so much more involved in the land market that you would do well to know about as we move ever closer to the eventual peak in land values later this decade.

And that’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.