If you would like to receive weekly updates like this, sign up here.

In early July 2020, Tesla did something that no company had ever done before.

It saw the volume of bets made by its “haters” — the term co-founder Elon Musk uses to describe investors who bet that the electric-car company’s stock will fall — cross $20 billion.

To this day, those bets are a painful reminder that the “haters” have been consistently wrong.

The company’s shares sped to a new high on August 17 — rising 11 percent from the record set the previous day of trading — to close at about $1,836 each.

Their climb continued to an unprecedented $1,887.

“It’s a picture of the perseverance of the short-sellers that are left…” says Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, “The magnitude of losses short-sellers have endured is just absurd.”

Ihor called it “by far the longest unprofitable short I’ve ever seen.”

Its one of the best examples currently I can show you that even the professionals consistently get their million-dollar bets wrong.

And if they are making enormous losses like these, how do you think everyday traders who short stocks are performing!

And yet, if both the professionals and amateurs were aware of one simple truth that I know thanks to the 18.6-year Real Estate Cycle, they would have made millions instead!

When I see a list of the top 20 most shorted stocks, I say to myself “Most investors involved here don’t know what they are doing”.

And I can prove it.

Let me show you.

The easiest way to throw away your trading capital

Firstly, an explanation of what a ‘shorted stock’ is.

The short seller enters a position where the person sells a share which the short seller does not own and plans to buy the share back in future to close the position.

The short seller can profit from a share price falling by borrowing shares to sell at a high price and buy back those shares in future at a lower price to close the position.

The profit is the gap between the sell price and the future buyback price.

Perhaps a chart example can explain.

So, in the above example, the profit as it were to the short seller is $6 per share borrowed ($18-$12 = $6).

Ok, so sounds like a good strategy.

Here is where real life interrupts the theory.

Everyone, and I mean everyone, who I know have shorted a stock has, at least once, generally more, told me the reason they did so is because “the stock price is too high”.

Huh?

How do they know this then?

Have they created some divine insights into the machinations of a market that involves millions of buyers and sellers that provides them the edge to determine the absolute highest price any listed company may ever reach?

Nope.

They guess.

Thank you for changing the direction of mine and my families lives. You have permanent subscribers from me and mine, and friends from Ontario Canada for life as well!

You are bringing people out of ignorance and danger of the banking/land cycle, what a service to humanity!

Thank you for everything so far, and I am excited to ride with you all into the future!

Josh – March 2021

“I think this stocks price has risen far enough; I’ve got to short it” is the emotionally driven decision one takes when you try and guess the market.

Look, I’m not singling out these investors. Anyone who spends time in the markets knows just how much hard work it is.

But our trading capital is not unlimited, its precious and without capital to trade, you are out of the game full stop.

And by trying to guess when a stock price has moved ‘too high’ is the best way to achieve financial ruin.

Let me show you.

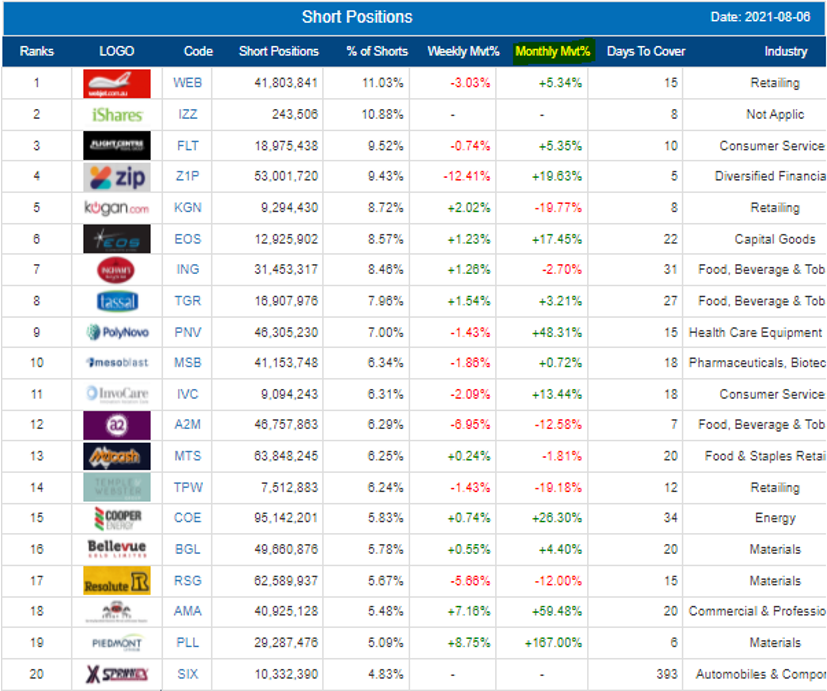

Above is a list for today of the top 20 most shorted stocks in the Australian markets.

Please note, as I did, the yellow highlighted column named “Monthly Mvt%” which refers to how much each stock has either risen or fallen in percentage terms for the last four weeks.

I see a lot of green on the page, which means a lot of these stocks are moving up in price: in fact, of the top 20 shorted stocks in Australia today, 12 out of 20 stocks have risen in price over the last month!

Two of these stocks are even, and only six have fallen, so that the short seller is making money.

And the best short performance over the last month? Just under 20% return…

Not bad, you might think. But the best performing stock to the upside produced a massive 157% return!

And it’s a top 20 shorted stock!

What are we doing here?

This truly is madness. I said it’s the path to financial ruin, but that’s my opinion.

Thanks to the chart above, I present to you the cold hard facts.

Fun things about facts: they don’t necessarily care what you or I think.

Still want to take a guess with your own money.

The juice isn’t worth the squeeze.

I do have good news to share though.

I can provide you with an almost foolproof method of avoiding such mistakes.

And ensure you can always be on the right side of the trend to maximise the returns on your limited capital.

In my experience the best time to short stocks are quite predictable and even relatively safe given proper tools and technical knowledge.

But you don’t even need that.

All you need is knowledge of the 18.6-year Real Estate Cycle.

Having knowledge of the land market provides you with a clear and most importantly repeatable structure to overlay across the economy and the market.

For instance, one thing I know is that at this stage of the cycle you simply do not short a bank stock.

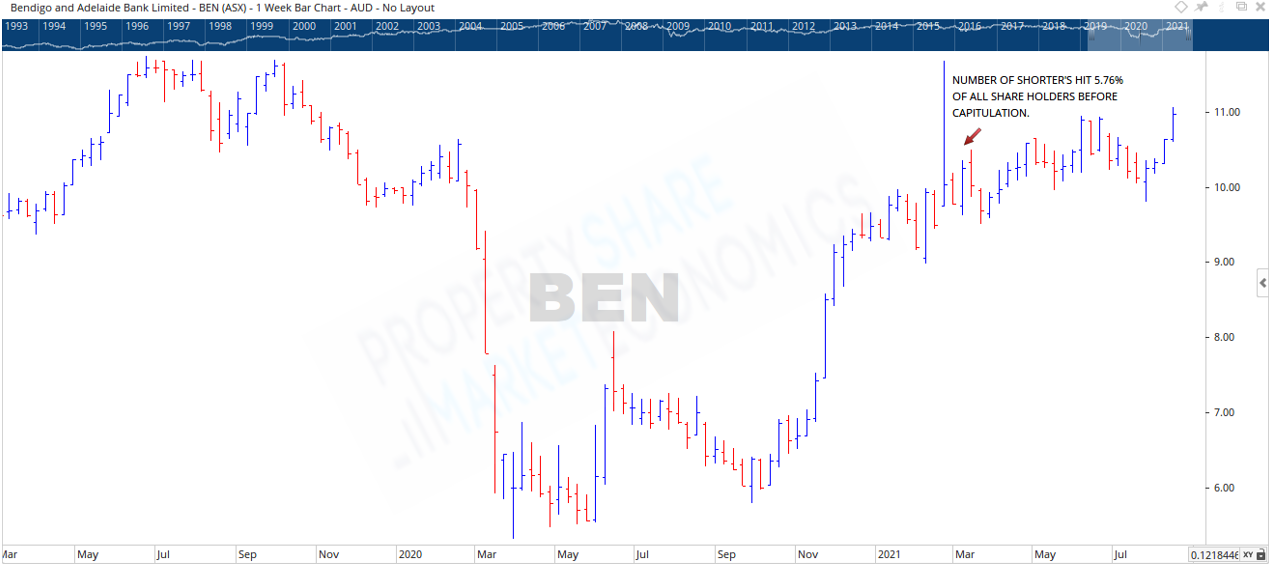

Here’s a weekly chart of Bendigo & Adelaide Bank (ASX Code – BEN).

Now, to be clear, if you could get into and out of the market quickly, the March 2020 drop presented a unique opportunity to short sell. But really, you had a two-week window to maximise your return.

And it happens from time to time. So, to be fair I’ll include that time on the above chart.

The problem though comes from the stock performance since those March 2020 lows.

Because there have been short sellers trying to make money from the stock price falling as the price continued to rise before overtaking its February 2020 highs.

Amazingly, the number of shareholders who shorted account for almost 6% of all holders by March 2021.

Take a look.

Let me explain the above chart. Click on it to open in another browser tab.

The grey line is, like the chart before it, the share price of BEN. The yellow line shows the percentage of shareholders who hold a short position.

Look in the centre of the chart. See the spike firstly in the grey line, then followed by the yellow line?

I have added commentary on the above chart to show you the relationship between the yellow line above and the price action on the Optuma chart.

This is where short sellers are guessing. The price is too high! We simply must short this!

How did that turn out for you?

As the price continued to rise (see Optuma chart) the short sellers were literally squeezed to death. They had to buy back the stock at a higher price to close their position.

Which resulted in the yellow line going vertically down.

Or that’s traders’ capital slowly being destroyed as they are forced to buy their way out of their error.

Do not guess folks, instead get educated.

And make the better financial decisions that will benefit your long-term wealth building.

You won’t make a better start than getting yourself a membership to the Boom Bust Bulletin. Whether or not you are going to short the market or buy or hold for the long-haul, this is relevant information for you.

It will teach you the history of the real estate cycle, why it repeats and guide you to the true-life changing opportunities that it can present.

As I said before, there are times when being short the market is quite lucrative. I know this through my knowledge of the real estate cycle that provides me with a strong understanding of the economy’s structure.

Or, if you like, I don’t need to guess.

I have the confidence of the real estate cycle providing me the trend to follow to maximise results.

Its time you got this yourself.

For just $4USD a month.

Incredible value.

Don’t wait, sign up now.

As for those Tesla shorters? Yep, they still refuse to let go.

“Most big Tesla shorts aren’t losing sleep or missing meals because of their positions,” says Ihor Dusaniwsky. “They still think this will eventually go their way.”

Sure they do, right up to the point when the money runs out!

Best Wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Find us on Twitter under the username @PropertySharem1

P.P.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.