If you would like to receive weekly updates like this, sign up here.

‘When real-estate agent Don Nugent listed a three-bedroom, two-bath house here on Jo Ann Drive, offers came immediately, including a $208,000 one from a couple with a young child looking for their first home. A competing bid was too attractive to pass up.

American Homes 4 Rent, a public company that had been scooping up homes in the neighbourhood, offered the same amount — but all cash, no inspection required.’

Got to love how history continues to repeat.

Above is a quote from a Wall Street Journal article (with emphasis added) from an American real estate agent about a property he listed…. way back in July 2017!

Land is the absolute center of the 18.6-year Real Estate Cycle.

If you can’t grasp this simple truth, you’ll continue to lose ground financially to those who can.

It’s one of the reasons I keep these old articles around, to better remind me of this fact.

Here’s another fact: the longer the real estate cycle continues, the more innovative the use of land becomes.

This is something I’d like to show you today.

Just a small, nuanced change in the way you look at land and the way it’s used can potentially lead you to some of the more unique opportunities land offers, including finding an outperformer in your own portfolio that you least expected.

That’s always a bonus!

Please read on to find out more.

Just borrow more!

I follow the US when it comes to timing the real estate cycle. It leads the world into and out of every cycle.

The event in the quote above is an example of a “new” way to maximize the gains in real estate.

In other words, an average Mum and Dad trying to buy their first home for their children to grow up in were outbid by a public company that raised cash and listed via an Initial Public Offering (IPO).

And you can’t blame the vendor for not selling to the parents: a cash deal with no inspection required (and no questions asked) is just too tempting to pass.

Can you see how real estate prices continue to be pushed higher by such practices?

(It also shows everything that’s wrong with the current economic system, but I digress).

But that was 2017, surely a window into that time only? It doesn’t apply today, does it?

Source – Nasdaq

Source – Nasdaq

An article from last week.

Whilst it doesn’t specifically call out “who” is paying cash, it’s obvious who they are referring to indirectly.

As I mentioned, it’s simply too lucrative.

This represents the commercialization of the residential real estate market, from average investors to multibillion-dollar hedge funds.

And the cycle turns.

In fact, the article tells you as much, check it out (emphasis added).

‘Another way to give yourself an edge over cash buyers. Offer to pay more. Cash buyers may not have much flexibility to make an offer above a home’s asking price.

On the other hand, if you’re mortgaging the bulk of your home’s cost anyway, you may have the leeway to go higher than the asking price.’

And this simply ensures that land prices continue ever higher.

Which brings us nicely to today. We stand on the first step of the second half of the 18.6-year Real Estate Cycle. The more speculative half.

As land becomes more expensive, new and innovative solutions are required to get value from your purchase.

For developers, this means the ability to squeeze even higher margins from a given plot of land.

You must develop this same mindset now, the ability to see what those innovations may be before they become mainstream and splashed across the news.

I will explain to you how to develop this, as stated a more nuanced way to look at the subject of land and its role in the increased speculation to come.

And so, once again, I ask you to step outside and look up.

And sideways, oh, and diagonally as well!

Source – ThyssenKrupp

Source – ThyssenKrupp

Above is an image of ThyssenKrupp’s new multi-directional elevator lift.

Looks a bit like a Jenga tower, doesn’t it?

It is in fact a serious breakthrough in lift technology.

The prototype of this systems was tested by ThyssenKrupp themselves on a 200 odd meter tall building. This technology does indeed work. Here is how:

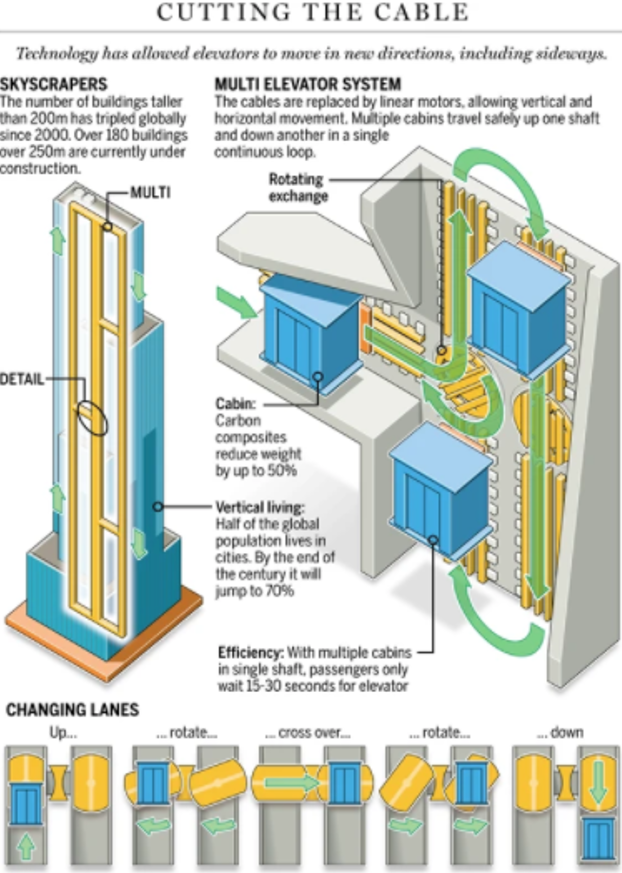

Source – financialpost

Source – financialpost

Please note this from the above image.

‘The number of buildings taller than 200 meters has tripled globally since 2000. Over 180 buildings over 250 meters are currently under construction.’

The world is urbanizing faster today than at any other time in history.

UNICEF estimates 70 per cent of the global population will live in cities by the end of the century.

Which means ever taller buildings are going to be needed. Right at the time of the cycle when land prices are about to go through the metaphorical roof globally!

Look at the world like this.

Put on your real estate lenses folks.

By doing so, the opportunities here, both for the future of urbanized living, and potentially your own portfolio, are starting to shape up.

This system is more like a metro loop, like the one public bus networks use. Each elevator shaft currently can only run one elevator at a time.

ThyssenKrupp’s system can run dozens within the same shaft, all travelling in one huge loop around and within a tall building.

This tells me: more elevator sales per building at a time when more companies are building taller buildings, globally.

That’s one way to look at this.

You may decide to look at a long-term investment in the company itself, if you believe the need for this technology is only going to become greater.

Above is the chart and stock code for ThyssenKrupp. You will need to have a broker with access to the Stuttgart stock exchange or the DAX in general should you wish to invest.

But how does this technology increase the value of the land the building is sitting upon?

Because this is really the key, the true opportunity to unlock the potential of these elevators.

Multi-elevators have up to 50-per-cent higher transport capacity and reduce peak power by as much as 60 per cent, according to ThyssenKrupp.

And since multi-elevators require smaller and fewer shafts, a building’s usable space can be increased by up to 25 per cent, which means more leasable square footage and, therefore, more revenue for the owner.

These then are the gains. Developers can now plan for extra leasing space, which brings in more rent.

More people being moved around a building means more productive workers.

Less power means margins can improve.

You should be aware by now, if you have read many of these blogs before, that once these gains manifest, they go eventually into the land.

This is the real opportunity.

Look closely at listed developers and commercial REIT’s who release news of new buildings designed specifically around this multi elevator system.

Or indeed, go and check your own portfolio for similar companies; are they or have they recently announced plans for deploying this type of technology?

With your real estate cycle knowledge, you can position yourself early and watch as the gains end up driving the value of the land such buildings reside on higher.

Most people see a new lift technology and think ‘cool’.

You don’t want to be like everyone else.

From now on, look at this type of development and ask, “How does this manifest into the price of land?” and then plan accordingly.

A simple yet effective change in mindset is all you need to view the world from the lens of the 18.6-year Real Estate Cycle.

It’s something we can teach you with a membership to the Boom Bust Bulletin.

Here you will learn the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day and help guide you to the opportunities it presents as the cycle turns.

Granted, it can take time to view the world around you in such a manner.

I’ve provided a quick and simple example here but know that there are new innovations coming out every day which can and most likely will lead to much higher land prices.

Start looking at these innovations through the lens of the real estate cycle now.

By the time they become household names the opportunity will have passed.

The Boom Bust Bulletin can give you that advantage.

Allow you to see the world for what it is, and best prepare you for what’s to come.

You will not find such information anywhere else.

And all for $4USD a month.

Simply amazing value.

Don’t wait any longer. Develop and fine-tune your own personalised real estate lens today.

Best regards,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Find us on Twitter under the username @PropertySharem1

P.P.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.