If you would like to receive weekly updates like this, sign up here.

I recently wrote to you here about a mega-trend that was building in India.

Its favored companies and conglomerates were on the cusp of an infrastructure building and credit creation frenzy.

My goal was to give you the chance to see that opportunity through the lens of the 18.6-year Real Estate Cycle.

This is something that no-one except you knows about.

Today I am going to use the same method to bring to you an equally important – and HUGE – mega-trend developing.

Let’s look now and what this mega-trend is. It has some roadblocks ahead – quite a few in fact!

But if these are overcome and it realizes the vision its government has put in place, the opportunity is going to be enormous. Even better though is the fact you’ll be able to take advantage.

It’s the perfect blend of investing with the 18.6-year Real Estate Cycle right as the timing of announcements begins to reach a crescendo.

The evidence of what IS coming continues to pile up.

You need to be on top of this.

A boom like no other?

Recent editions of this newsletter covered the massive infrastructure projects that are currently underway in Australia and Indonesia.

Now, you may be asking why I’ve not spent much time examining what’s occurring in the US?

Well, guess what!

A shortage of construction workers is putting at risk the Biden administration’s ambitious plan to fuel a historic building boom in the US, according to industry executives.

“It would be difficult to identify a period during which the construction labour market was more constrained than it is now,” said Anirban Basu, chief economist at the ABC. “Demand for construction workers is sky high . . . This is the era of the mega project.”

Now I need to make this clear from the off.

The total US government investment into its, let’s be frank, horrible infrastructure is estimated to total $1.5 trillion dollars.

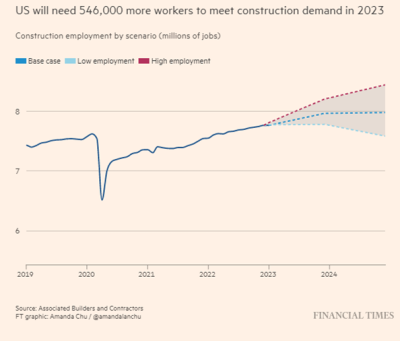

So, the first roadblock, if you will, to roll this initiative out is this: where are the construction workers going to come from? As you can see from the graphic below, the shortfall is MASSIVE: they are short by over half a million workers.

Source – Financial Times

This will prove a tough nut to crack. As global infrastructure programs mature and secure the credit they need, they vacuum up a large cohort of the world’s supply of construction workers. So there’s that.

It look even bleaker though once you break down the entire $1.5trn dollar package down.

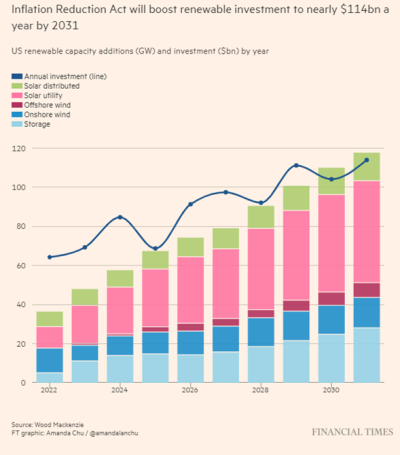

The federal stimulus includes $1.2trn in infrastructure spending, $369bn from the Inflation Reduction Act (IRA) for clean energy projects, and $39bn from the Chips and Science Act to spearhead the country’s production of semiconductors.

Now you need to corner the market on those with the skills to build semiconductors. Not to mention the resources needed for clean energy.

From a recent FT article on the subject.

“The reshoring of manufacturing to the United States is creating a huge demand for construction workers in what was and continues to be an already tight labour market,” said Jim Brownrigg, senior vice-president at Turner Construction, the group working on the Honda-LG venture.

Brownrigg said its demand for clean tech construction projects had more than quadrupled since last year. “[Labor shortages] continue to be a bigger challenge. I think 2023 is going to be challenging. [Next year] could even be bigger,”

Workers are already benefiting from wage rises more than those in the big cities and college graduates.

Because there is simply not enough supply to meet demand. Speaking of which, where exactly are all these people going to live during the construction phase?

Bechtel, a leading construction, engineering, and project management firm, said it will pull some of the 7,000 workers it needs from across the country and is in conversation with hotels to provide temporary housing.

Rising wages and shortage of accommodation. Bookmark that for a minute.

From the rust belt to technological nirvana.

It’s taken a while for many economic commentators to fully unpack President Biden’s IRA given its enormous scale.

It not only encompasses domestic infrastructure but also crosses geo-political boundaries, tackles China’s stranglehold on key resources head on and tries to position the US as the world leader on clean energy technology (at the expense of Europe).

That’s no mean feat for a piece of legislation! It is going to end up being one of the most important laws passed this cycle.

“It is truly massive,” says Melissa Lott, director of research at Columbia University’s Center on Global Energy Policy. “It’s industrial policy. It’s the kitchen sink. It’s a strong, direct, and clear signal about what the US is prioritising.”

Source – Financial Times

Some folks have announced that an arms race is now underway. They are right – but not the way they think….It’s a global arms race for clean energy dominance.

And the battle lines were well and truly drawn back in April 2022 when Biden said “There is simply no reason why the blades for wind turbines cannot be made in Pittsburgh rather than Beijing,”

Looks like China’s the one in the cross hairs yet again.

Now Pittsburgh is interesting. It’s part of the fabled US “rust belt” of former manufacturing hubs.

Biden’s plan here is straightforward: create advanced manufacturing jobs in rustbelt regions like western Pennsylvania, once the heart of the country’s steelmaking industry.

From Ohio to Georgia, investment is also pouring into lithium-ion energy storage, the technology that will underpin the electrification of the US auto fleet.

Source – Brendan H Jennings

This, however, is where our good old trusty real estate cycle lens comes in very handy.

When you have decided to go to war you need to husband as many resources as possible before entering battle.

And a classic ploy used by all governments is how they’ll do it.

Emphasis in bold is my own.

All told, the IRA offers $369bn of tax credits, grants, loans and subsidies, many of them guaranteed past 2030. The credits can be sold, too, allowing deep-pocketed investors with enough tax liability to buy the credit — a way to get more capital to developers, quickly.

The tax breaks have made marginal projects suddenly economical, say developers. A battery plant can generate tax credits of up to 50 per cent of headline costs…This can translate into an effective reduction of 60 to 65 per cent of a project’s fair market value, according to law firm Vinson & Elkins.

We are currently at 1300 hours (or 1pm) on PSE’s proprietary property clock. This means a land boom and expansion of credit.

Well….there you go!

This is how you incentivise both workers and private capital to come and get involved. It is this exact point that has riled the EU, due to the fact that it gives American companies a competitve advantage.

European complaints about America tackling climate change are a bit ironic considering the fuss that was made when Trump refused to resign the Paris climate agreement when he was President.

Now the US is back in the climate change fight: only its on its terms and no-one else’s.

Recall in the first paragraph, I left a link there to a earlier newsletter I wrote about India’s grand ambitions of turning itself into the go-to source of infrastructure funding in West Asia.

How did I frame it at the time?

The chase for a exclusive government granted licence. And here we are, precisely the same thing is now occuring in the US thanks to IRA.

This is how the few ends up owning everything.

So, just like India, what’s occurring in the US is indeed the start of a new mega-tend, one that we as investors need to come to grips with.

The sad part though is while there will be winners there will be many more losers here too.

Just the same as in India.

Thanks to these tax credits and subsidies, borrowers can expect full US government co-operation to ensure their business ventures are a success. They will discourage competition (which is the EU’s true point) via forming a small minority of monopoly capitalists.

They will expect, and get, most of the government’s largesse via loans, tax credits and the like.

Which means they end up with scant regard for the rest of us. The rush is on to secure the best sites and secure the largest amount of funding possible. Places like Ohio are earmarked for various lithium ion and high-tech manufacturing.

Which requires all sort of exotic and potentially dangerous chemicals to produce. See the headline below.

Source – ET

There is a deep and persistent media blackout on the eco-disaster unfolding in West Virginia.

So, I can’t seem to find the answer to my over-riding question.

What the hell was a train full of vinyl chlorine doing passing through a suburban area like this!

I told you there would be losers. Is this linked with the mad rush to secure the best sites and access to credit it brings by being first to market to produce lithium-ion batteries or wind turbines?

You be the judge.

But even more importantly, can you see this is yet another huge piece of evidence to show you where we are in the 18.6-year Real Estate Cycle?

The gap between the haves and have-nots is about to widen significantly. It is a natural, though deeply troubling, outcome as the current cycle reaches its peak later this decade.

Your choice is to decide which side you are on. We will all have to do this.

Thankfully, help is at hand, via a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why even today it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

High earning construction workers, lack of available housing, huge infrastructure programs with abundant credit: all of this eventually ends up into the price of land.

The true mega-trend here is the global land market.

The cycle has proven that this is where we are – right now!

So, your hard work begins now.

Develop your own market edge and position yourself well ahead of the crowd.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just $4USD a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.