If you would like to receive weekly updates like this, sign up here.

When it comes to the world of finance and investing, things never stand still for long. If you are paying attention, you’ll see there’s an awful lot going on.

There are several weird and wacky things happening right now that I could draw your attention to.

But for me, it’s the ‘timing’ of their announcements that catches my eye.

All thanks to my knowledge of history…. the history of the 18.6-year Real Estate Cycle to be precise.

This year my aim has been to help my valued PCI newsletters readers to become more aware of how the cycle is playing out.

And I want you to use this awareness so that I can help you prepare for what’s coming next.

So, as you’ll soon see, when I start to find the type of developments I am about to reveal taking place, right when the history of the cycle suggests I should be seeing it, I take careful note.

Let me detail now what I found, and why you need to be very much across it.

Because this news will either turbo charge your investment returns for the next few years.

Or they could also severely damage you financially should you approach it in the wrong way.

But make no mistake. The tools to significantly change your investment potential are beginning to arrive.

What you need to know is how to use them. And that’s where I am going to help you.

So please read on.

You’ve been lied to – again!

It seems every month the sheer amount of negative news flowing into my newsfeed increases.

It’s such a disservice to us all. Because under the surface a lot of things are in train to drive the coming boom.

And when you apply the real estate cycle to all of this, you soon see the connections at work.

You can take it for fact that the US will lead the world into the peak and then subsequent bust of this current cycle.

Long-term readers here should be well aware of this fact.

Which means regardless of which funky named Chinese property developer is about to collapse next, the inherent timing of it all will remain driven by the US.

So, if you want to beat the average investor’s returns, you need to identify the leader of a trend and follow what’s happening there.

This is the first step to placing yourself above most other market participants.

Ok. So, we know that the US leads the global economy. And what’s happening today in that particular market?

Take a look at the following headline.

Source – CNN Business.

House prices to June have risen for five months in a row. Should you be surprised by this news?

I wasn’t. I had in fact been waiting for something like it.

I already expected other forms of real estate to be performing strongly this year in the US. Think industrial and some commercial sectors (though not offices for obvious reasons, i.e. the working at home revolution).

Granted certain commercial real estate companies have suffered due to falling vacancy rates and rolling over debt at a higher interest rate.

But as we explained to our valued PSE members earlier this year, there was excess capacity in bond and money markets to facilitate the refinancing of these debts.

But as the inflation numbers continued to fall and employment numbers remained strong over the last 12 months, the US economy was on a strong footing.

Then we have the trillions of US government money earmarked for hundreds of domestic infrastructure projects.

This all acts as an accelerant for the entire economy. The US is one of the world’s biggest exporters too. And who’s buying? Countries like the UK and Australia. Because their own economies are beginning to improve.

These represent the gains. A quick look at US listed companies in the commercial and industrial real estate sector on US stock markets will demonstrate that.

Hence the land all these data centers and industrial warehouses sit on becomes more valuable.

It was inevitable that the residential sector would begin to improve. And it appears this is the case.

If you look at this logically then there is an obvious next step here. And again, the real estate cycle will tell you what that is, and when it’s likely to happen.

In fact, folks, it has already happened!

New and exciting ways to go all-in have arrived!

The above section should explain why the US was never going to experience a recession this year, much less any kind of market crash.

It is not time in the cycle for this to happen.

The biggest single reason? Land prices are still rising.

But there’s another reason why, too.

We as a society need to be completely and overwhelmingly soaked in debt before we can have a crisis. Everyone needs to be maxed out, with every penny available or borrowed placed into the markets.

That hasn’t occurred yet.

And the main reason isn’t complicated and it’s something you can relate to: it’s quite hard to secure loans right now.

Allied with that, there is investor sentiment that’s still quite cautious. There’s a distinct lack of the ‘risk-on’ mentality that signifies that tipping point in investor behavior.

So, we have not had the exuberant investor sentiment that precedes the peak of the cycle.

In other words, you’d more than likely be happy to go into more debt if it’s no-fuss, can be done digitally within minutes and isn’t too expensive.

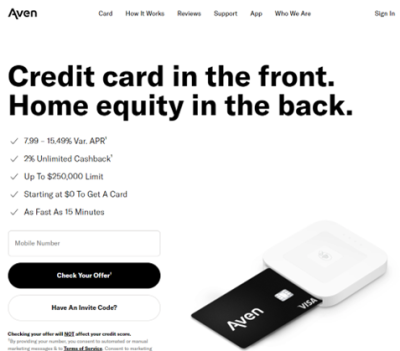

Perhaps this is the credit card you’ve been waiting for.

Source – Aven.com

OH YEAH, BABY!

Now we are talking. A credit card that’s linked to your home equity.

In the US, the main way to overcome 30 year fixed mortgage rates to access home equity is via a HELOC (Home Equity Line Of Credit). This Aven credit card combines the low interest rates of your traditional home equity line of credit with the flexibility of a credit card. It can be used anywhere a Visa card is accepted.

Plus you can cash out, personalise your payment plan and get cashbacks every time you use this card to purchase everyday items.

Best of all, 15 minutes on your smart phone is all you need to see if you qualify.

This is how the process of “all-in” will begin in this real estate cycle.

The credit card company – Aven – even states it has full deposit insurance via the underwriting of loans by Coastal Community Bank.

With the wealth effect of rising residential home prices, homeowners will now be made to feel they “deserve” to access all that equity just sitting there.

Remember in the US the average fixed mortgage rate is 20-25 years in length. The majority of these are probably 3-5% cheaper than if they applied for a fixed mortgage today.

You’d be mad to refinance if that’s you, unless…you can get a home equity linked credit card!

The next phase of the current real estate cycle is now on.

Expect similar products soon in countries like the UK and Australia. This is what the history of the cycle suggests.

The urge to unleash all that money locked away in your home will prove too overwhelming for most.

But…should they? Is this the right time to do it?

Is there a way you can cover your downside by following the clues in the economy that can tell you it’s time to deleverage instead of borrowing more?

Believe me, this simple decision will make or break the rest of your financial life.

You “cannot” afford to get this wrong if you accept offers like this. It is knowledge that will best serve you here.

And that’s what the Boom Bust Bulletin (BBB) is designed to help you with.

You are going to give me the opportunity to take you in depth into the cycle.

You are going to learn about the history of both the 18.6-year Real Estate Cycle and the real reasons why interest rate rises, house prices, and stock markets are so indelibly linked.

Once you know this you will be able to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed in to take advantage of the rise in asset prices and avoid a crash.

The trap is set now for the unwary. Look again at that advert. Can you see the limit? $250,000.

Why that number? Well, the average amount of equity of homeowners in the US? $270,000.

Yep, and consider most who take up this offer are still paying a mortgage!

So, you will be inundated with similar schemes. It will be too easy to apply and get this credit too.

Predicated, of course, on one immutable fact. All this easy credit will work – providing land prices continue to rise.

You should know what PSE’s view on land prices for the next few years is right?

How would you feel when land prices don’t just stop growing, but crash? How will you fend off not one bank but two? All wanting their money back whilst the collateral for that debt is dropping like a stone.

You must be ever so careful now in the next few years into the peak. Your ability to successfully navigate it all will ultimately prove whether you end up a winner or loser from this real estate cycle.

That’s how my Boom Bust Bulletin can help.

As a Boom Bust Bulletin member you will receive a long-form newsletter every month detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

This derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US$4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.