As we race towards the halfway mark of 2024, change is afoot.

And the driver of this change is pressure.

The pressure being applied by the ever-increasing cost of land. Across every single aspect of our lives.

It is a natural consequence of the 18.6-year Real Estate Cycle. It is supposed to happen this way. Until society decides to tax these unearned gains of the land and give them back to everyone whose productive and intellectual capacity created them.

Instead of allowing these to be privatized and then further leveraged against by our financial system.

For you to answer the question “what is coming next” for yourself, your family, the economy, and the world, it’s never been more important than to have some knowledge of the land markets.

Today I shall provide an example of why.

I will explain why one of the most emotionally charged problems in most countries is anything but.

And why this particular group, by doing absolutely nothing, guarantees the highest debt load of any generation lands squarely on your shoulders.

With a little knowledge, however, you will also discover there is a simple yet effective way to manage it, even avoid it altogether.

Let’s look at this issue in greater detail.

You won’t believe just how easy it can be to see what’s coming.

Obtain yourself a view few will ever have.

Let me take Australia as an example. But what happens in this country is highly applicable elsewhere.

One of Australia’s great pastimes is to find a rather enlarged stick and then beat it metaphorically across its sitting government’s head.

This can usually be for just about anything. The most recent example though will take some ‘beating’ if you know what I mean. Recently the Australian Federal budget was handed down.

Whilst the masses were promised energy rebates and the approval of expanded stage 3 tax cuts for all working Australians, it did seem to me one topic dominated all others, much like it has for over 18 months now.

Where are all these new houses going to come from?

Fair question, given the Labor government’s decision to not only push all the way down on the immigration throttle, but jam it three feet underground instead.

Now, this is a far-ranging subject involving many moving parts.

It would take longer than a weekly newsletter like this to go into detail. But I am prepared to say this to you.

It isn’t all the government’s fault.

And I’ve discovered one of the reasons why that is. More in a moment.

Firstly, let me once again reiterate just why I write these weekly newsletters to you. In five minutes or less a week, I strive to help you see the economy, and therefore the world, in a way that very few do.

I metaphorically call it using the “lens of the 18.6-year Real Estate Cycle.” Via this lens, you can cut through all the noise and BS and uncover the true heart of the economies hidden order.

Quite an apt term; because without such a lens, you will never even realize it is hidden from your view.

The key to developing one yourself is to know your history; your real estate cycle history to be precise. So today, I too turn to this history via my colleague Akhil Patel’s best-selling book “The Secret Wealth Advantage.”

A book you simply must have in your bookcase – grab your own copy here.

Chapters 10 to 12 include some of Akhil’s most astute comments regarding where we are in the cycle today, the increase of credit creation and the behavior on display from land developers.

Thanks to my knowledge of the cycle, I know full well it’s this part of the book I need to read to ascertain the truth. I won’t fall for the media narrative on this subject.; It is just too important.

What did the lens of the cycle help me discover?

Is it more lucrative to build; or do nothing?

The crux of the argument is this. The reason the government is getting pushback and criticism about the abject lack of new build housing is that, despite them announcing to great fanfare the relaxation of zoning and planning laws, construction remains moribund.

Hence the bad press. However, a study of history shows us where this blame may ‘actually’ lie.

From page 158 of Akhil’s book.

“Property prices increase at a faster rate in outer regions than in central ones…the land boom is broad based.

…construction and new lending for real estate go to more marginal developments…areas with smaller and less affluent populations.”

This describes where we are today in our own current cycle. Thus, if this is indeed what’s happening today, then more marginal and, in theory, less expensive sites should be the focus for these new government relaxed rules and laws.

Here’s the thing; they are! Earlier this month an article by the Daily Telegraph exposed the shocking truth.

“…almost one billion dollars’ worth of housing in one of Sydney’s most affordable local government areas is yet to be built despite the DAs being approved up to five years ago.

The dead zones, also known as “zombie DAs,” are located in Liverpool, one of the most affordable local government areas in Sydney.

“Each has been approved for a residential flat development, including one for a 25-story complex worth more than $40 million that was lodged in 2016.”

Folks, welcome to the game of land banking. One that that property developers are now past masters of. The government have done what they promised, it’s the developers who would rather not build them.

It is far more lucrative to drip-feed these sites onto the market to ensure the highest market value possible.

The fact that Liverpool, as a western suburb surrounding the greater Sydney area, makes it an attractive place for you to try and buy there, doesn’t mean it suits the builders of those same homes to supply you with enough to meet demand.

Again, history is instructive here. From page 189 of Akhil’s book:

“Developers have focused more attention on outer areas where land is cheaper. Outer areas have less real demand and so profit margins are lower (and dependant on land prices increasing).”

It’s clear to me then what’s happening in Liverpool. Developers have their development approvals for their land, but they realise it’s much more profitable to sit and wait for further land price increases than it is to build and invoke lower margins.

Meanwhile, you must pay even more via borrowing a larger mortgage for the privilege.

Is that fair? Is it fair on your children trying to buy their first home? Well, this is the society we have created today. And unfortunately, the news on this front gets worse. It’s not just an outer Sydney council area.

Let’s look at a concrete example.

A.V Jennings released their first half of financial year 2024 investor presentation back in February.

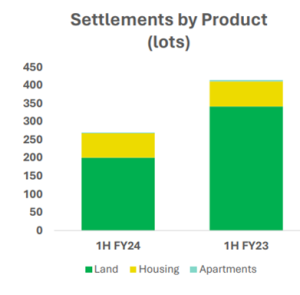

In it, they proudly gloated to investors that settlements compared to the same time in 2023 had fallen 35%.

Settlements in this context means house and land packages brought by would-be homebuyers off the plan and then delivered during H1 2024.

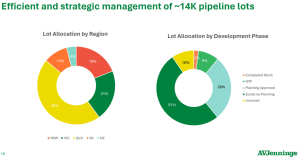

They’re saying: “but don’t worry, investors, because we have your back”. Because then they announced 14,000 lots of land sitting idle including nearly 4,000 (28%) have planning approval and over 7,000 (51%) are zoned with no planning approval.

In other words, they are happy that they are not incurring costs in developing the land they own in areas where people want to buy housing.

Take a look at the following graphic, which covers where their lots are located and shows what type (if any) of planning and development approvals they have for these same lots.

“Efficient and strategic management”, heh! I have another less complimentary abverb to describe it.

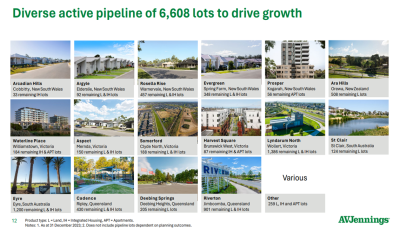

Again though, note below the length and breadth of this deliberate policy, across mulitple states and even New Zealand. Their investment presentaiton showed just how broad the vacant and undeveloped blocks are located across their portfolio.

So, if you are in the market to buy or are thinking of entering the market this year, how does it feel about going even further into debt because of a greedy landbanker?

But, you may say, even if that’s true, if I don’t buy today, it just means even more expense this time next year? What option do you have?

I have one, get educated about the land markets, via a membership of the Boom Bust Bulletin (BBB).

Let me teach you the history of the real etate cycle. And how you can turn the timing of it to best benefit you and your family. Knowledge that gives you the confidence to ignore the noise and lift above the emotion of the final few years of the cycle to make those critical financial decisions.

And history is unequivocal here about what comes next.

There isn’t a lot of supply being added to inventories now, but there is a whole lot of developments ready to go in the near future.

Soon, that one billion dollars worth of development in Liverpool will hit the market, including the aformentioned 25-story complex worth more than $40 million that was lodged in 2016.” And given immigration levels coming to Sydney, these will be feircely fought over.

I’ll let Akhil have the final say here via his book.

“Be wary about buying apartments, especially in new areas where there is a lot of…developments planned or going in.

These are likley to be the most over-supplied during a land boom…this limits price growth for newer buildings…and owners of [existing] stock will find themselves competing with newer stock if they wish to sell.”

These are the final frenetic and emotional years of the current cycle.

Don’t be daunted by the challenge. Get educated – and win.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.