If you would like to receive weekly updates like this, sign up here.

“And that, dear Grandchildren, was how your Grandad was able to borrow $100 million dollars to set him and your Grandmother up for life during the 2012 to 2028 Real Estate Cycle!”

“Wow, said one of the children sitting on the floor, “that’s so much money, you must be the richest person in the world Grandad?”

I smile down at him, being the centre of the universe for small children is such a thrill.

“Grandad, can I ask a question?” I nod knowingly down to another grandchild. “Sure, you can ask.”

“Why are you guys living in a caravan on council land and Grandma no longer talks to you?”

My smile has long disappeared as I shuffle the kids out of the caravan and lock the door.

My mind now goes back to those heady days where the promise of limitless wealth and the sheer ease of getting a loan propelled me right up the social ladder.

No one ever asked me to read any of the fine print on my lending documents.

I didn’t pay any interest each month for that money, in fact I was told no margin calls would ever be called in should my equity fall.

It was just so easy, I had a huge amount of “wealth”, I was so popular with the young and hip and everyone was making money hand over fist.

So where did it go wrong?

How did it come to this, broke, destitute, and now withdrawing my invite for the grand kids to visit for a few years?

Read on as I explain what temptations await you all over the next few years.

You need to understand the incredible lengths that will be taken to part you from your money and your financial future.

What digital loans on steroids looks like.

Semantics aside, I need to be brutally blunt with you here.

For the remainder of the decade, your ability to navigate through the avalanche of “get rich quick” schemes and to resist the unrelenting pressure to succumb to “too good to be true” access to unlimited credit will ultimately shape what kind of life you will lead.

As a valued Property Cycle Investor reader, you are (or soon will be) very aware of the fact that credit during the second more speculative half of the 18.6-year Real Estate Cycle is about to become amazingly easy to secure.

And on the surface, fair game. If you have the means, then take full advantage.

Here’s the deal though.

Just because something becomes easier to secure does not mean that you should secure it.

I know some of you reading this are crypto investors. I know many have a well-thought-out long-term investment plan for your crypto portfolio, and work hard to educate yourself about the markets.

Which to my eyes makes it even more remarkable that those who strive the most for your business make no pretense whatsoever that you should not be treated as such.

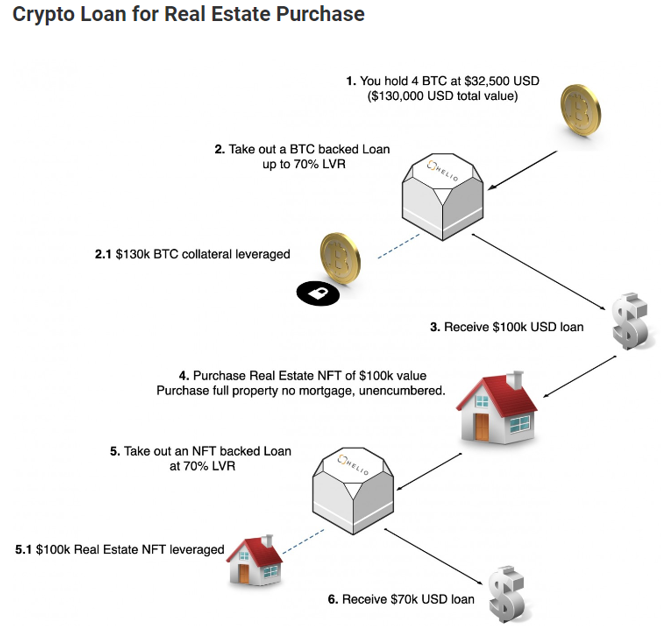

Here’s what I mean. Look at the diagram below that shows one such idea for leveraging your crypto portfolio.

Source: Helios

Behold a method to double leverage yourself using both cryptocurrency and real estate NFTs either owned or brought using borrowed funds.

You can now use your personal crypto or NFT portfolio to not only take out a loan to buy more in the future but can now pledge those same NFTs to get another loan.

The above image is from the Helios website, a digital third party that matches up interested crypto investors with preferred lenders to make this dream of digital nirvana possible.

This is 100% in line with my earlier statement about the jamming open of the credit faucets during the remainder of the decade. The story of each cycle in history is unequivocal on this.

This credit has always ended up mostly in speculative real estate during this time. The big difference this cycle is the introduction of digital real estate to the mainstream.

And yet, the behavior this generates is no different to the real world.

So, what’s the deal here?

Helios functions as a broker between certain crypto based lenders and those who wish to use their own crypto portfolios to borrow via a short-term loan to invest in, in this case, digital real estate assets.

As explained on the website, the benefits to the borrower are zero margin calls should your staked cryptos fall in value during the duration of your loan and the fact your cryptos are cold stored in a digital wallet held offline, insured, and inaccessible to the lender.

Allied with low interest rates compared to traditional banks, no credit checks required to secure the loan, and a large panel of lenders, at least at first sight it seems quite a smart method to fully utilize an otherwise dormant crypto wallet.

This is an early mover in a financial sector that’s only going to grow ever more present as the cycle continues to turn. It’s a specific example of how each cycle is always different from the one which preceded it.

So, let’s say this is of interest to you. And after a brief read on the Helios website you realize it only takes a few minutes to fill in your online application.

You decide, much like true real estate, its digital cousins will closely match the performance of the land price as it streaks ever higher towards its peak later this decade.

C’mon, this is the digital age, why not stick it to the big banks and embrace the new financial order to benefit myself?

Yeh…about that.

It’s what isn’t said that speaks volumes.

My experience researching these crypto lending platforms lead me to a stark conclusion: be careful.

The PSE team have spoken at length about what to expect for the remaining years of this current cycle. One of those is an increase in both available credit and easing of conditions required to get it.

So, if Helios and others like it are the forerunners in this space of crypto back mortgages, you better know full well what you’re getting into now.

Consider then the following breakdown as your first warning.

Say I’m interested in applying for a loan so decide to undertake some due diligence. First thing I notice on the Helios homepage is the fact information about the process is quite opaque.

For instance, their claim of a “large panel of lenders” isn’t, they have a total of six. Oh well, could be worse, I suppose.

However, when I tried to find out who exactly these six lenders are, there is no information at all on who they are. And you won’t know until Helios matches your application with a potential lender.

Oh well, that’s par for the course for brokers like this, what are the terms of these mortgages? If I’m pledging some of my real estate NFTs for instance, I can get up to 70% of the value of the NFT.

Or I can put up say Bitcoin to get a similar amount to then purchase a real estate NFT, then pledge that same NFT for another loan.

Ok then, well this is starting to get a touch out of hand, wonder what the tax implications are here. After all, one of the major investors controls a real estate landlord needs to be across is making your investment tax effective.

This is from the Helios website (emphasis in bold is my own):

The benefits of this loan include no margin calls, interest as low as 4% p.a, no rehypothication, no credit checks, non-recourse and no tax event is triggered by the transaction.

For starters, rehypothecation is spelt wrong on their website. But what about no credit checks and no tax event triggered by this loan?

A credit check goes against your permanent record. And that same record is available to every tax authority I’m aware of. Are Helios trying to tell me indirectly that I can keep this transaction away from the tax authority?

Well, taking out a loan is not a tax event, so on the surface that’s correct, but further study uncovered this info about how these short-term loans are settled.

If at the end of the loan you cannot pay off your loan, then: the funds provider may sell your crypto to repay your loan.

Selling crypto to settle a debt is a capital tax gains event!

No wonder it took me 20 minutes scrolling through their FAQ page to find that. But hey, what’s a harmless bit of tax evasion between borrower and lender heh?

So now we are prepared to flout tax laws, how much could I borrow? From the same FAQ page.

The minimum amount you can borrow is US$50,000. There isn’t a hard, upper limit ― for example, a loan for US$10 million would be OK.

Phew, I was worried I would have to seek professional financial advice first, but everything’s ok so…

And what’s this about no margin call? That’s sound awfully generous. But wait, there’s more than meets the eye (I know, hard to believe right?)

Helios is correct that they will not place a margin call on your collateral if the value of your pledged NFT or crypto suffers a mammoth fall in 1 hour. Because as we know, such falls never occur in this space.

The reason why they are right is they are a broker. You aren’t borrowing from them. Of course, they won’t margin call you.

It’s the lenders and their policies you need to know. So, I should just check what their lenders policies are in this regard, only I CANT. Because their lenders aren’t listed on their website.

Folks, you just need to be so careful in this space. You may not be involved whatsoever in digital assets or cryptos, but your children?

The only way such double leveraging of multiple digital asset can work is when both are constantly rising at the same time. However, we know full well just how volatile these digital assets are even on an hourly basis.

What kind of carnage occurs at the end of the present real estate cycle when everything comes down during the end of cycle bust?

As outlined above, it’s the small print involved with this type of lending that’s absolutely key. My worry is if Helios represents the future of this type of brokerage, then opaque and frankly misleading information and blatantly blocking you from seeing precisely who’s lending you money in the first place becomes the norm.

We face being bombarded by social media platforms and news media with advertisements clamoring to get our money. And the trick is it will all seem so easy to get it to.

Your fiduciary ability to know the right questions to ask and the potential pitfalls you may encounter are crucial.

But so is your timing. Did you know that there are on average two years out of every 18.6-year Real Estate Cycle where being overleveraged is guaranteed to lead you to financial ruin?

Here is the best way to secure both for yourself; a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this very day and the unique opportunities it presents as it turns.

It’s critical now to understand the dynamics at play in this space, which involve credit, real estate and rising then falling asset prices.

The prime determinate of all of this is the 18.6-year Real Estate Cycle. For now, you can take advantage of the easy credit from providers like Helios, but you need to understand how things could go wrong and crucially when they will do so, you can exit in time.

Don’t get caught out with too good to be true schemes. Navigate the coming years successfully and learn when the right time to be leveraged is and the right time to unwind it.

Sign up now.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.