If you would like to receive weekly updates like this, sign up here.

“All’s quiet on the digital crypto front.”

Do you agree with that sentence?

For me, the absence of hype and emotion surrounding the performance of virtually all digital assets right now has created a vacuum.

That vacuum is the absence of any recent news about the performance or future in particular of crypto assets like Bitcoin.

Especially to the general public who for the most part isn’t very interested in it otherwise.

You see, it’s the everyday folk out there for whom the hype and emotion are aimed squarely at.

But it doesn’t mean there hasn’t been news or indeed innovative developments going on.

So today, we shall dive back into the world of cryptos.

And for you, a wonderful example of the inevitable links being made between these cryptos and the turning of the real estate cycle.

It’s now obvious that both will end up sharing the same fate here.

So, if you own a crypto portfolio yourself, maybe brought near or at the highs, and feel frustrated as the price meanders about and goes nowhere, then this newsletter might appeal.

A recent development, in all places Australia, sheds light on a new scheme to get your portfolio working hard for you.

And while for most holders, this is an exciting development, don’t discount the financial trap you leave yourself open to either.

Because it’s “you” who are their future customers.

Can the history of the cycle help determine if you “should” be a customer at all?

Let’s find out.

A chip off the old Block?

Is it really about “no news is good news” here?

Sure, the mainstream media may have cooled their interest in cryptos, but it doesn’t mean nothing at all has been happening in this space.

You see, the true believers in Ethereum and Bitcoin have been spending the last 12 months or more accumulating as many coins as possible at the best price they can find.

And there has been a lot of innovation still in this space, percolating behind the scenes and out of sight.

One such piece of innovation recently emerged here in Australia, see below.

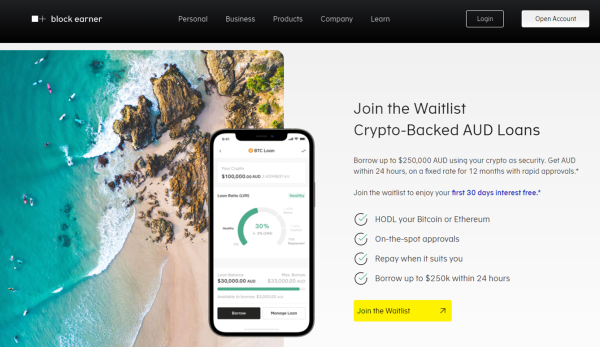

Recent start-up block earner is about to launch a crypto backed loan priced in Australian dollars.

You can pledge your own personal Bitcoin or Ethereum coins to secure a loan up to $250K over a fixed 1 2month term.

Awesome. Have your cake and eat it too!

Keep your cryptos and liquefy them via what’s in effect a personal loan using them as collateral.

Now Block Earner, at its heart, is a private crypto trading service and a DeFi (decentralized finance) depository for fintech and other digital business.

I will speak to the decentralized finance part shortly.

Back to the real estate cycle. The history here shows that right now we should be seeing both innovation across lending and an increased appetite for easier credit access.

The 1970’s saw the widespread adoption of derivatives. However, you can go right back to the first ever recorded 18.6-year Real Estate Cycle in the US and UK and see this occurring.

So, this is the time for us to be seeing these becoming mainstream.

Therefore, this is a critical sign to determine precisely where we are as the cycle turns here.

And thus, a window has opened here.

If you personally own either Bitcoin or Ethereum in your digital wallet, is this something you should consider signing up for?

Don’t ignore the lesson history can teach you about this.

Ok, so now it’s time to get all intimate and in depth with Block Earner.

I posed the question above; so, what’s my answer?

The history of the cycle tells me a window has opened here where judicious use of leverage can potentially provide a decent return on your risk.

The key though is your ability to identify the correct tool that is up to the job.

And then apply the timing of the real estate cycle to reduce your risk.

Are new innovative forms of credit like this one proposed by Block Earner going to become that tool of choice and drive the speculative and over the top behavior we expect will occur over the next few years?

If so, then history suggests a few hard and fast rules that these types of companies need to meet.

The first one is that the latest innovations need to be pushing the rules of what’s allowed and even exploit the many loopholes within the current regulatory environment.

Which means that regulators end up, as always, behind the eight ball and scrambling to keep up as this new space develops.

Fortunately, Block Earner has had previous dealings with regulators and so isn’t an unknown entity.

Well, maybe not the type of attention one wants then.

The corporate regulator has launched legal action alleging crypto platform Block Earner has been providing financial products without the proper licence, exposing customers to risk, and leaving them without appropriate protections.

Block Earner, the trading name of Web3 Ventures Pty Ltd, is a digital currency exchange pitched as a way for less crypto-savvy investors to put money into decentralised finance (DeFi) products that provide annual yields.

One of hundreds of examples where global regulators and governments have both been found out way behind the ball and the subsequent actions they feel necessary to control this market.

I find the term “less crypto-savvy investors” interesting. That’s because even those deeply involved with this have failed to realize.

So, I shall spell it out for you here; there is no such thing as decentralized finance. That dream is dead.

Makes me wonder why companies like Block Earner continue to use it frankly. Well, I do know why.

Comes back to those “less crypto-savvy investors”.

Every aspect of this business, both here in Australia and across the globe, is going to become drenched in government enforced regulations and licensing requirements. This will also allow global tax authorities to have never before granted auditing powers over crypto trading.

Folks, that isn’t decentralization. But you know the inevitable fallout is going to be that, once again, such regulators and government authorities are going to scramble to keep up.

They won’t be able to properly step in and protect users and customers until it’s far too late. This lack of knowledge about who truly owns what, and who owes who, will ultimately lead to complete chaos once schemes like this unwind during the upcoming peak then bust.

The ability to be right across all the terms and conditions therefore ultimately falls upon you.

So, how are Block Earner trying to ‘innovate’ around these constraints?

Well, currently information is limited, as the website calls for crypto holders to join their watchlist prior to the release of this new credit product. The FAQ page isn’t really one, typical of new companies like this, as their customer base is limited.

So, it’s been written up by the company themselves hoping to cover most of the basics. Well, if you ask me, I reckon this is a basic question to ask.

“What happens to my loan should the collateral underwriting my loan (Ethereum or Bitcoin) fall by a certain percentage?”

No mention anywhere. Maybe one day…maybe.

Perhaps the credit underwriter can give us some idea of how these loans will be structured. According to the small print, the loans are made by Web3 loans Pty Ltd. Oh, do they sound familiar?

Block Earner, the trading name of Web3 Ventures Pty Ltd….

I’m not the sharpest tool in the shed, but I reckon there’s a good chance this is all done internally. Which is quite a happy coincidence as it ‘could’ prevent too much oversight occurring here.

So, buyer beware! As stated in previous PCI newsletters to you, you will never find it easier in your life to get access to cheap credit, and lots of it, than what’s coming in the next few years. In fact, I’d say it’s already here today.

At the same time, you will never in your life be so exposed to the inevitable unwinding of it all when the greatest boom ever turns to bust. So, you must choose your tools wisely in this space.

I mentioned judicious use of leverage; today you have a window to allow leverage (or debt) to help you meet your financial goals providing you have a clear and actionable exit plan in place on how to quickly deleverage before you apply!

Once a loan scheme like Block Earners is officially rolled out, and you choose to partake, then become intimately familiar with the terms and condition (T&C’s) of the loans you take on and apply the timing inherent to the real estate cycle to correctly time your exit plans.

That’s what the Boom Bust Bulletin (BBB) is designed to help you with, the timing of the economy.

You are going to give me the opportunity to take you in depth into the cycle.

You are going to learn about the history of both the 18.6-year Real Estate Cycle and the real reasons why interest rate rises, house prices, and stock markets are so indelibly linked.

Once you know this you will be able to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

Let’s see just what kind of uptake this new offer gamers, it could provide vital clues as to the current appetite for this form of lending. Hopefully the full T&C’s will be available soon that can help you make that decision yourself.

But can I be honest: do you “truly” think this is just a fad and will disappear in a week? These types of businesses are now an indelible part of what remains of the current cycle, right in the heart of its most speculative phase.

As stated, there is a window here to leverage this, sure, but for those of you who own large amounts of cryptos personally, know this.

I detailed in a recent BBB edition the link between money printing and the price of Bitcoin. Controversial at the time? You bet!

Proven to be accurate now? Only current BBB members know. What kind of price do you attribute to knowing ‘that’ kind of information?

That’s another way of how my Boom Bust Bulletin can help.

As a Boom Bust Bulletin member you will receive a long-form newsletter every month detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

This derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US$4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.