If you would like to receive weekly updates like this, sign up here.

Stop me if you’ve heard me write this to you before?

“There is nothing new under the sun.”

But it’s true!

A lot of very smart people spend an inordinate amount of time contemplating and researching what they think the future may hold for us all.

I do the same. The difference is I research what has happened in history to provide me with clues as to what’s coming.

And today’s blog will show you why.

Today we are going to look at a story from 2008. I believe some of you will start reading and say “Oh yes! I remember this.”

It’s my contention that, by revisiting history, you can make some astute assumptions about what will occur years from now.

It all comes down to two things: timing and human behavior.

It’s a story that can help you see where you are in the 18.6-year Real Estate Cycle even if you aren’t interested in investing in markets or real estate.

And the behavior on display, well, it’s truly only something you see make worldwide headlines at the peak of emotion.

Read on now, and you’ll see what I mean.

Virtual worlds can turn into virtual disaster.

Ever heard of the cryptoverse?

It’s a 3D virtual world underpinned by purpose-built blockchain technology. I’m sure if you ask your kids about this, they will be all over it.

It’s how they envisage most of their future online interactions with their friends to be, as virtual residents.

Players, who are called residents, create virtual representations of themselves, called avatars, and are able to interact with places, objects, and other avatars. They can explore the world (known as the grid), meet other residents, socialize, participate in both individual and group activities, build, create, shop, and trade virtual property and services with one another.

Ok, so I’m being a touch disingenuous with you here.

Why? Well, the above comment isn’t about the cryptoverse. In fact, it’s not even a recent comment either.

It’s from 2003!

It describes a game produced and created by a company called Linden Lab and the game it’s referring to is called “Second Life.”

The platform principally features 3D-based user-generated content. “Second Life” also has its own virtual currency, the Linden Dollar, which is exchangeable with real world currency.

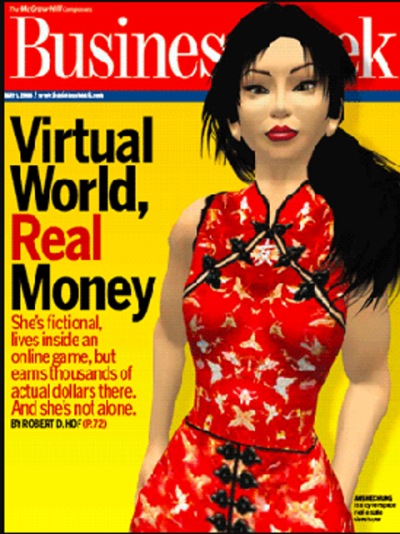

In 2005 to 2006 the worlds media fell head over heels with Anshe Chung, an avatar of online personality Ailin Graef.

Source – Business week

Source – Business week

‘She’ was a significant figure back then, covered by Business Week and Fortune magazine.

In fact, CNN labeled her the “Rockefeller of Second Life.”

This is because she was the face behind a large development, brokerage and arbitrage of virtual currencies, land and items.

By creating and selling custom animations for other users of Second Life and using those proceeds to buy virtual land which ended up being thousands of virtual acres called ‘Dreamland.’

These parcels of land were rezoned using different rules to establish who could build on their parcel and exactly what they were allowed to build.

Geez, has anything changed since then in this regard?

Suffice to say, Anshe Chung had become Second Life’s poster child and symbol for the economic opportunities that the virtual world offered to its residents. At the same time, between 2006 and 2008, the service saw a period of exponential growth of its user base.

Do those years ring a bell?

Anyway, this story provides a segue way to a young couple named Amy Taylor and David Pollard.

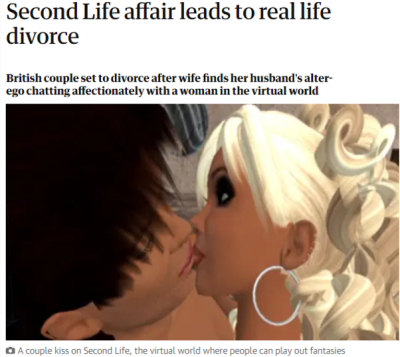

Why are they important? It has been over 12 years since the following headline came out:

Source – The Guardian

Source – The Guardian

This was a headline from November 2008. A glorious collision of the excess and emotion at that time.

“…fact and fiction have collided in heartbreaking fashion for a British couple who are divorcing after the wife discovered her real-life husbands online alter-ego, a goatee-bearded, medallion-wearing hombre called Dave Barmy, with another – virtual – woman.”

“Medallion wearing hombre”! Lol!

It seems inevitable to me in such a role-playing virtual universe that this kind of thing occurs. But this case was the first so heavily covered by mass media which introduced the very concept of a virtual alter-ego.

Where the virtual worlds timing can affect the real world.

Here’s a question for you: do you think something like this will repeat in the future?

For me, I think it’s absolutely on the cards. And this is the point of today’s blog.

I’m going to throw another term at you now: the metaverse. I wrote a blog a few months ago, about a company in this space called The Sandbox, creators of Fantasy Island.

Now, consider my example here. It’s easy to see the emotion surrounding something like Second Life as being totally new, unique, and even a ‘cool’ thing to brag to your mates about back then.

Add in the timing. Think of the increase in worldwide wealth during the heady days between 2003 to 2008.

What a terrific way to ‘invest’ those surplus funds into, say, a winter chalet with a Cobra helicopter gunship parked out the front!

That’s how David Pollard or “Dave Barmy” lived in Second Life.

Better still, why not mimic real life and go buy and then flip virtual land and property to other users?

Everyone’s swimming in money, there are profits to be made, so why not?

I predict a metaverse virtual world one day leading to the world’s first virtual billionaire. Second Life offered so-called ‘Linden dollars’ which were strictly used within that game.

Crypto currencies however can be converted to any other crypto at will. No barriers to entry anymore.

Can you see a scenario where, as the current real estate cycle busts, the emotions involved could see the world’s biggest virtual divorce settlement of all time.

With metaverse family lawyers involved too. Working out how to evenly split the virtual assets of each. All while the speculative money that went into the metaverses quickly disappearing.

“There is nothing new under the sun.”

This is the same behavior, invoking the same emotions and leading to the inevitable result.

Don’t simply think that, because the words “Real Estate” are part of the cycle, its simply only ever about land.

Human behavior and the emotions of greed and fear are also the cycle!

And, just as it happened last cycle, you better believe when stories like this start hitting the media later this decade it’s in fact a key piece of real estate cycle timing.

Virtual land is exhibiting all the same speculative behavior that real land is today.

Which means you can use the same timing to enter, and exit should you decide, your investments in the next Fantasy Island.

And this is where you’ll find that timing, via a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this very day and guide you to the opportunities it presents.

I wrote last week about my two favorite words to describe the rest of this decade, frenetic and emotional.

Whether you realize it or not, both are going to have a significant effect on us all moving forwards. Much like I described here, the very peak will be a time when everything seems perfect, no issues or worries on the horizon and crucially, everyone is neck deep in debt.

The metaverse offers you a brief window to make outsized gains simply because the behavior of those involved are absolutely no different to those who seek to speculate in property in real life.

The same timing applies. And, sadly, the same end results.

Don’t get caught up in the emotion, use the Boom Bust Bulletin as your guide to protect yourself and your investments.

At the end of the day, it’s just a little bit of history repeating.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.