If you would like to receive weekly updates like this, sign up here.

If you happen to be reading this week’s blog from the UK, well have I got a deal for you!

How would you like to own your own island complete with villa in an exclusive 100-person community called Fantasy Islands?

Imagine living far away from the hustle and bustle of crowded city streets? And with prices starting as low as $104,000, it’s a steal —less than half the average cost of a first-time buyer’s house in the UK.

What’s that, you ask, is there a catch?

Ok, you got me. Yes, there is always a catch.

You can’t physically live in it.

The entire community exists online.

It is located in what is called the metaverse. This particular one is called the Sandbox.

But the bit about being half as expensive as a real home in the UK, well that’s totally true.

This is, according to the believers, the future of real estate in the UK, and indeed around the globe.

But is this actually the case?

Should we all simply vanish from the real world, its COVID restrictions and insanely high real estate prices, and start again in a metaverse of our choosing?

What could go wrong? It is, after all, the future of real estate and social gatherings, right?

Find somewhere comfortable to sit for a few minutes’ folks.

You and I need to talk.

Star Registries.

Straight up, I can understand if this is a new and utterly confusing concept to grasp at first viewing.

So let me use an analogy that may resonate more with you.

Did you know, if you walked outside tonight and looked up into the heavens, you may have found a star that has your name on it. Seriously!

It’s a concept that’s really taken off over the last few years.

Source: Star Name

Source: Star Name

Companies like Star Name above will grant you exclusive rights to name a star whatever name you wish, and ‘register’ it on their independent Star Name registry. Your star, forever.

And they will even provide you with a nice certificate as proof.

Now, is it official? Nah.

Does it grant you legal provenance over the naming rights? Nah.

It’s just a bit of fun really.

The concept here, though, is what’s important. There are now dozens of similar businesses who claim to grant exclusive rights to name a star. Who exactly is vetting this process to ensure multiple claims aren’t made on the same star?

Well, nobody actually. There doesn’t exist a single source of truth to govern any of it.

Does it really matter? I don’t believe so, it seems like a bit of harmless fun, albeit quite lucrative….for the company registering the names.

However, what I do want you to do is think of virtual real estate in the metaverse in the same terms.

This way, it will cut through all the hype and rubbish surrounding this space right now and allow you to view it all with a critical eye.

Now, what is this “Sandbox”?

The Sandbox is a metaverse: one of many virtual worlds filled with digital assets ranging from dresses and sneakers to art and cars.

Users buy a digital receipt of the property, a non-fungible token (NFT) that is recorded on a shared digital ledger known as a blockchain, similar to the way in which cryptocurrency transactions are logged.

There are millions of dollars being exchanged to buy the best locations or to own the most lucrative NFTs on offer.

Consider Republic Realm, who spent $4.3 million on virtual land to co-develop with gaming giant Atari.

It was Republic Realm who launched Fantasy Islands last August, a development of 100 islands with villas that buyers can “visit”, remodel, and use to show off their NFT artworks and host friends in.

Ownership also grants access to a members-only channel on chat app Discord.

90 islands sold within the first 24 hours after their listing, with no plans to list the last 10 for sale any time soon.

So far, you can’t say there is much difference between the way we buy and flip property to each other in the real world compared to this.

Same behavior, same results.

But like a real island, it’s not much good owning it if you’ve no way of getting to and from it.

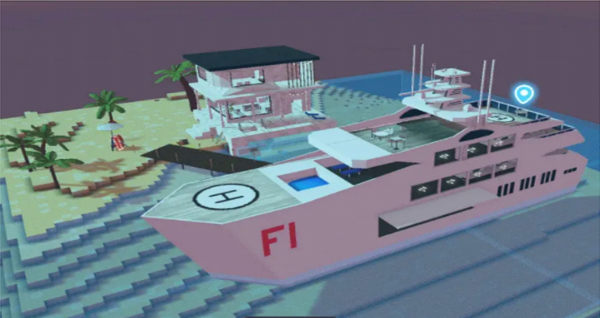

That’s why Republic Realm created the one-off “Metaflower” superyacht. Here it is below.

Source: Financial Times

Source: Financial Times

Described as “fit for after-parties and beach retreats alike”, this one-off digital creation was sold for $650,000 USD.

Republic Realm are now stretching out into virtual property development and property management.

They are also developing store fronts, much the same as those you see in your local shopping mall.

Buyers don’t need to enlist a software maker to build what you want on your parcel of land, as your store front can be brought ready for use straight away.

And if you are interested but have no idea where to start your search, then you can reach out to Parcel, which is the self-proclaimed “Zillow of the metaverse world”.

“Parcel is currently mainly selling undeveloped virtual land”, says Noah Gaynor, chief executive and co-founder, reflecting the early state of the metaverse. But he sees a bright future in more complex transactions.

“We also want to facilitate rentals, like you want to Airbnb out your virtual condo, and financial services like mortgages, and then also bring together service providers and landowners”.

Gaynor says there has been interest from family offices, hedge funds and wealthy individuals looking to buy up land in metaverses alongside institutional investors.

Sounds serious huh? Well, there’s more, as world renowned brands are entering this space.

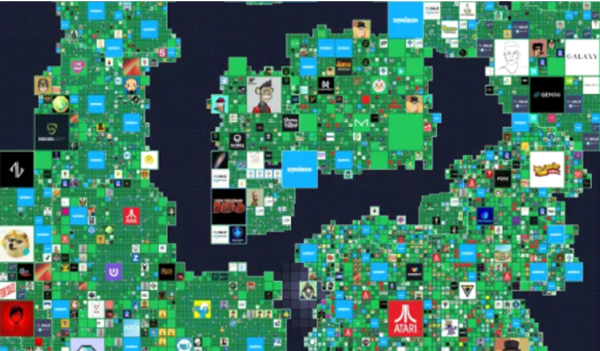

The German sports company Adidas bought land in The Sandbox last year, describing its “acquisition of a plot of land on the platform [as] a way of expressing our excitement around the possibilities it holds”.

Sure.

If you really have the time or inclination, you can always search where Adidas brought, along with others. Just check out the Sandbox map.

Source: Financial Times

Source: Financial Times

So, folks, that’s the metaverse.

Up next, the good old real estate cycle lenses lay on the smackdown.

How’s your attention span these days?

I have little doubt that much of the behavior on display in the metaverse will not surprise. Particularly if you have read previous blogs from me.

The chase for the economic rent, be it in the real or virtual world, is hard wired into our soul as human beings.

We all want something for nothing, regardless of the cost this eventually takes.

Recall I mentioned at the start the so-called believers said this is the ideal way to invest in land now.

Our knowledge of the 18.6-year Real Estate Cycle gives us the history and the fundamentals to understand how this all starts and more importantly ends.

But do you know of the specific pitfalls that exists for those speculating in the metaverse?

For starters there is the almost overwhelming young age of participants. People who are keen to diversify their crypto profits. And there is nothing wrong with that.

They should be doing it.

On the other hand, I’ve tried without success to get such people’s attention when speaking to them for longer than 30 seconds before they need to pull out their phone to check whether a new series has dropped on Netflix.

What drives their investment behavior is the latest and greatest. What if Sandbox 2.0 is created that allows you to share an exclusive digital neighborhood with Elon Musk?

Just how long do you expect such people to hang around and engage with previous versions? No volume means no sales, no sales means the entire project falls apart.

There are no barriers to entry here. Unlike in real life where land cannot be reproduced, nothing of the sort exists in the metaverse. If developers choose, they can release as much virtual land as they see fit.

Scarcity becomes abundance overnight, destroying your investment.

Then you have many examples of game developers unable to service the cost of the servers used to host these projects.

If the electricity becomes too expensive to maintain a profitable business, goodbye electricity.

What happens then? How does one ‘save’ their $600 grand mega yacht when the servers offline? Who do you complain too? Can you take the company to court? On what grounds, what precisely did you ‘own’ to begin with?

Do you possess a government granted license (land title) as proof of your exclusive ownership rights to that property? Think again.

You are making an almighty bet that you have brought in the one true outstanding metaverse that can withstand all the above pressure to provide you with an adequate return on your money.

Because should it fail, you lose everything, instantly.

However, I have stated before, and will here again, that there does indeed exist a window in which outsized gains can be made in this area.

What you will need is the right guidance and knowledge to do so safely and to nail the timing when it comes to getting out again.

I can help you there.

With a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day and guide you to the best opportunities for you and your family to take advantage off as they appear.

The behavior in the metaverse is exactly the same as it is in real life.

It is the chase of the unearned gains, known as the economic rent.

Which makes the timing of when to get into virtual land and when to sell based precisely on the same drivers as in real life.

Take fullest advantage; get educated and most important learn the timing of the cycle for yourself.

All for $4USD a month. That’s a cup of takeaway coffee a day.

Incredible value.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.