18.6 Strategic Investment Portfolio

The only true managed investment that invests with the phases of the Real Estate and Banking cycle.

As a member of PSE, you have a key advantage in the market:

TIMING

And you know that the timing right now has never been better for making large investment returns.

2023 should be the start of a big run-up in markets.

Preparing your stock market investments to really outperform the market takes skill. And it takes time.

Finding the right stocks to buy that perform better this half of the cycle; when to do it, and also to know when to sell them can be challenging.

Markets don’t make it easy.

The news with all the confusion and, sometimes, false opinion, makes it even harder.

Which is why Phil and Akhil have partnered with Tim Moffatt at Oakleigh Investment Management to build a bespoke stock market portfolio to be positioned throughout the remainder of the Real Estate and Banking Cycle boom.

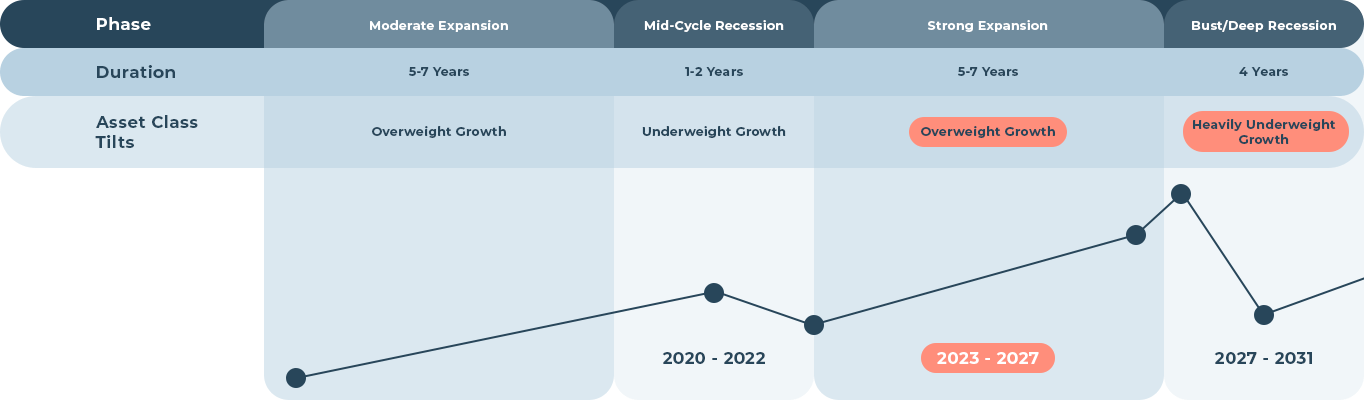

The below graph shows the opportunity this half of the cycle. Tap the graph to enlarge it.

The graph reflects the views [and beliefs] of Oakleigh Investment Management Pty Ltd (‘OIM’) at the time of preparation, which are subject to change without notice. Readers are cautioned to not to place undue reliance on forward-looking estimates. No representations or warranties are made by OIM, its director or consultants, as to the accuracy and reliability of the graph.

Phil, Akhil and the Oakleigh Investment team are dedicated to managing your investment for you. Analysing the charts, picking the stocks and making those difficult decisions amongst the ebbs and flow of the market.

The 18.6 Strategic Investment Portfolio is referred to as a bespoke portfolio.

Because there are certain sectors and stocks that, with only the deep and intimate knowledge of the cycle that Phil and Akhil have, enable the right stocks to be added, at the right time.

It is the only true managed investment that invests with the phases of the Real Estate and Banking cycle.

That also means when the peak of the cycle arrives it’s designed to preserve your capital.

Because holding on to the wealth you’ve gained is almost the most important rule in markets.

It’s comforting to know that the investment portfolio is designed to do this for you later in the decade too.

Your Investment Committee Members

TIM MOFFATT

Investment Manager

20-year experience in stockbroking, financial advisory and wealth management

PHILLIP J ANDERSON

Director of Property Sharemarket Economics

Author of The Secret Life of Real Estate and Banking

AKHIL PATEL

Director of Property Sharemarket Economics

Author of The Secret Wealth Advantage

DAVE PRESCOTT

Managing Director & Portfolio Manager Lanyon Asset Management

20-year funds management experience in Australia & the UK