If you would like to receive weekly updates like this, sign up here.

Amazing.

I’ve just hung up on the last of three cold phone calls.

Who was calling me you ask?

I had three separate calls from three separate banks!

And not just any banks either. They were banks at which I am or had been a mortgage customer.

And what did they want?

All were very interested in finding out how I’m doing, and how much they enjoyed my previous dealings with them.

But what each then went on to pitch to me made me sit upright.

Each was very excited to tell me that they are about to release special rate offers to new and existing customers and would love to speak to me about them.

It made me sit bolt upright let me tell you. The reason being it was proof of where we are in the 18.6-year Real Estate Cycle.

Let me use today’s newsletter to explain why that sentence above is important. It’s not simply the big banks looking to extend more credit now.

But they called me right in the middle of research I was doing exploring the levels of innovation now occurring in the Australian mortgage market.

Let me share with you what one particular company is looking to introduce to revolutionize home ownership.

Their message is a world-first innovation for owners and investors to fund and invest in property.

But wait until you see the one HUGE caveat with all this.

Use these Brix’s to build your future.

So, let’s review what ‘could’ be the future of mortgages.

But it’s also very likely you will in fact become a customer of this. Or if not specifically this product, something very similar.

The market, it seems, is now ready for new, innovative, and easy-to-use and access products when it comes to housing.

Introducing MyBrix.

Source – MyBrix

This is the latest in the fractionalization fad of most people’s favorite sport, buying or flipping property.

This product is tailored for owner occupiers, investors and for those who qualify as a ‘low-equity owner’.

So…. that’s pretty much everyone.

The website describes itself this way below.

MyBrix is new, just like Uber, Airbnb and Afterpay once were. All market disrupting technology needs to start somewhere, and this is the start of the new way to fund or invest in Real Estate in Australia, the MyBrix way.

MyBrix is a world first offering that provides a win/win situation for both Investors, who are looking to invest in Australian property and Property Owners who don’t want to be tied down in monthly mortgage payments.

MyBrix Investors replace the Bank and fund your property allowing them to access investment opportunities not previously available.

Property Owners sell fractional interests in their property through our simple listing and funding process.

Again, you need to prepare yourself for many more such offerings like this. I am based in Australia – but this offer won’t be unique to this country. It will be happening now, or soon, in the US and UK for example.

And in terms of trying to innovate and improve the drawn-out process of buying and selling, this attempt is quite ingenious.

However, the ‘easy’ part of all this is – well, it’s a stretch.

I like to think I’m quite learned in these types of things given I have my head buried in the financial world every day.

But trying to truly understand this, and then forcing myself to explain it to someone else?

More on that in a moment. Let’s get into the details here.

Because you want to know whether it’s right for you, yes!

The devil always lies within the detail.

On the surface, this is a very attractive form of financing.

In effect, MyBrix becomes the lending middleman between homeowners and its own ‘investors’.

And for you, the fact you can be either, or indeed both, at the same time has some clear appeal.

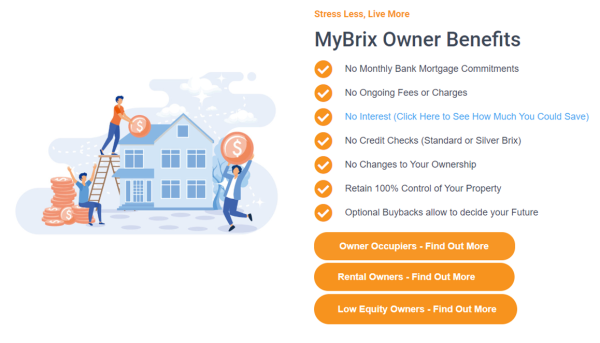

Let me once again use the MyBrix website to break down the benefits.

Source – MyBrix

Source – MyBrix

Let’s quickly break down the benefits for each as explained by MyBrix.

Firstly, current homeowners, regardless of whether it’s their principal place of residence or an investment property, can sign up and use this platform.

These people organize a valuation through MyBrix to determine if their property meets some company specific requirements. Whilst 35% equity is the standard requirement the company offers a different product if you have less than this – as low as 10% (up to 90% mortgaged) in some cases.

Should MyBrix deem your property suitable for their pool of investors, they will then buy out your mortgage. The suitability test is done using AI to determine the “attractiveness score” of your property to the potential pool of investors.

The owner then receives a report detailing all this and then they can choose whether to list their chosen property on the website.

The money comes from the investor pool who of course will seek an above average return for the use of their money.

For the property owner, they are now relieved from their monthly mortgage payments and retain 100% control over the property.

For investors, they provide the finance to buy-out the mortgage via Brix, which is the fractionalized part of the process.

These investors avoid dealing with renters, stamp duty and other purchase costs, and in return receive instant appreciation on their investment, future capital growth and/or rental income and can then on-sell their Brix to other investors via the MyBrix platform.

Phew – was that really a quick breakdown?

I won’t say this often in this newsletter, but should this be of interest to you, I do suggest you visit their website and do some due diligence.

In fact, given the proliferation of these types of innovative new products now hitting the market, this breakdown is quite timely.

So now, it’s time to wheel in that rather large caveat into proceedings.

Is this a solution looking for a problem?

If you are serious about asking me to part with my hard-earned investment capital, expect some rather frank and to-the-point questions from me.

Perhaps you are the same.

For starters, what I expect to find on websites for businesses like these is a FAQ section. Yet there’s none on this website I could locate.

Secondly, I want to know what assumptions underpin the investment story they are telling potential users of this platform. Is it true that both sides of this process can be winners?

For investors, given the stage of the 18.6-year Real Estate Cycle we are in, guaranteeing 15% below market value for well-located real estate is a big win. The thing is this is what any owner who lists their property must accept to attract the funds to replace their mortgage.

Is that a good deal? It’s up to the owner to decide that.

These properties get fractionalized into 10,000 Brix which investors can buy. The stated maximum investment term is 10 years. Why 10 years? The website explained it like this.

The maximum lifespan of Brix is 10 years, so that is the maximum investment term, we expect most properties to be sold in an average 5-to-8-year timeframe.

Really? They expect most properties to be sold within 5-8 years.

Where’s the empirical evidence for such a claim? I can’t find it. What happens to the terms of finance if they sell in 2-3 years? What if they don’t sell at all?

There is a mechanism for owners to arrange buy backs of these Brix, subject to indexation and at an agreed upon rate to rebuild equity. This allows investors to have their investment capital returned to them over time.

The best I can tell is upon completion of the investment term, the owner has two choices. The website says, the maximum funding term for MyBrix is 10 Years, after which you can sell or refinance (potentially on MyBrix for another 10-year term).

What if you don’t want to do either of these? That’s not explained.

Ok, time for the caveat.

As stated by MyBrix, here is the biggest assumption of the lot.

Secured Against Australian Real Estate. All Brix are fully secured by a mortgage against the property in favour of all Brix holders.

The caveat here is simple; this will work only as long as property prices in Australia keep rising!

And that’s what PSE expect them to do for a few years yet.

But what happens when that stops? What provisions are there for both if prices don’t just stop rising, but crash?

Doesn’t…rate…a…mention.

If you are going to take advantage of one of these schemes, then you need to understand the timing of the cycle, so you are not holding something when the crash comes.

Because if you are when it happens it could be catastrophic for your wealth because schemes like this leaves your property open to multiple claims to get their money back at the worst possible time, when land prices are crashing.

You MUST therefore understand the cycle. And the best way to do so is with membership of the Boom Bust Bulletin (BBB).

Give me the opportunity to take you in depth into the cycle.

Learn about the history of both the 18.6-year Real Estate Cycle and the real reasons why interest rate rises, house prices, and stock markets are so indelibly linked.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

This type of innovation purported by MyBrix is simply the start. Whether you believe that their model to be all things to all property owners and investors is overly ambitious or not, their take on credit is worthy of your attention.

But only at the right time.

Recall the cold calls from the banks I got? They are now front running the RBA and offering cheaper finance. They aren’t even waiting for central banks to officially reduce their rates.

The rush to grab market share has begun. And its companies like MyBrix that they are fighting with for it. Who ends up winning?

Time will tell.

The same timing that will be your greatest help to you when things turn bad.

That’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.