If you would like to receive weekly updates like this, sign up here.

There has been a lot of reporting over the last 2 years across the world about the Covid related shift from living in the CBD’s to more regional areas.

We know that the key drivers of this shift was the ability to leverage technology to transform someones home into an office.

So one could literally work their normal job from anywhere.

There was even talk that this shift was permanent, and that the great cities of the world would no longer be the business hubs they once were.

How has this trend actually held up though? I think I have a great example from Australia to show you.

There was big news recently from the Australian governments federal budget announcements.

All the mass media are reporting that regional Australia is a ‘big winner’ from it and it is receiving a ‘massive sugar hit’ from it.

For mine, it never fails to surprise me how the 18.6-year Real Estate Cycle continues to turn relentlessly, regardless of world events.

It should be self-evident by now how major infrastructure projects not only address critical nation building needs but how they also enrich those ‘fortunate’ enough to own land near them.

But how do such regional infrastructure projects relate to the unending rise of land prices across the globe right now?

It can’t be solely responsible?

No, it isn’t.

But if you have asked yourself this question or tried to explain to family or friends who are striving to take their first step on the property ladder, id imagine this sentence has been a part of the debate.

“How can property prices continue to go so high?”

Find a comfortable seat for 5 minutes.

The answer to that question is quite straightforward.

You just need to know where to start.

It must be alchemy!

This is the exact reason why I always wear my real estate cycle lenses when I read or watch the news.

They are yet to fail me.

What are your first thoughts when you read a headline like this?

Source: AFR

This comes from a recent opinion piece in the Australian Financial Review.

It relates to an extension to the governments home guarantee scheme.

Here is how it was explained on the ABC News website the night of the budget release.

Bold highlights are mine.

The government is expanding its first home buyers’ scheme, where people only need to have a 5 per cent deposit to buy a house with no lenders mortgage insurance (LMI).

It’s expanding the scheme from 10,000 places up to 35,000 places a year, but it comes with rules on who is eligible and how expensive the houses can be.

Along with this, there were new initiatives related to it announced too.

On top of that, it’s creating a new regional housing scheme with 10,000 annual places from October 1 for first home buyers or people who haven’t owned property in the last five years (including permanent residents).

This new scheme is aimed at encouraging construction in regional areas. To access it, people have to either build or buy a newly built home in a designated regional area.

Ok, so some of you reading this might think these are good initiatives. Here’s a fun fact.

Without exception, by stepping into the real estate market and announcing policies designed to help, governments make those same policies utterly unworkable and counterproductive.

More than 200 years of history is unequivocal here.

And now i will prove it to you.

It’s the equivalent of alchemy in the land market.

Trust the insiders to know.

Now I’m not saying that those privy to insider knowledge of future government spending take full advantage of this knowledge.

But that’s what I’m saying.

The game plan is simple: find out areas which will receive a financial boost via the federal budget and buy ahead of the news becoming public.

And then pocket the capital gain.

Let me show you an example.

The following is from the media release of deputy Prime Minister Barnaby Joyce.

Source: infrastructure.gov

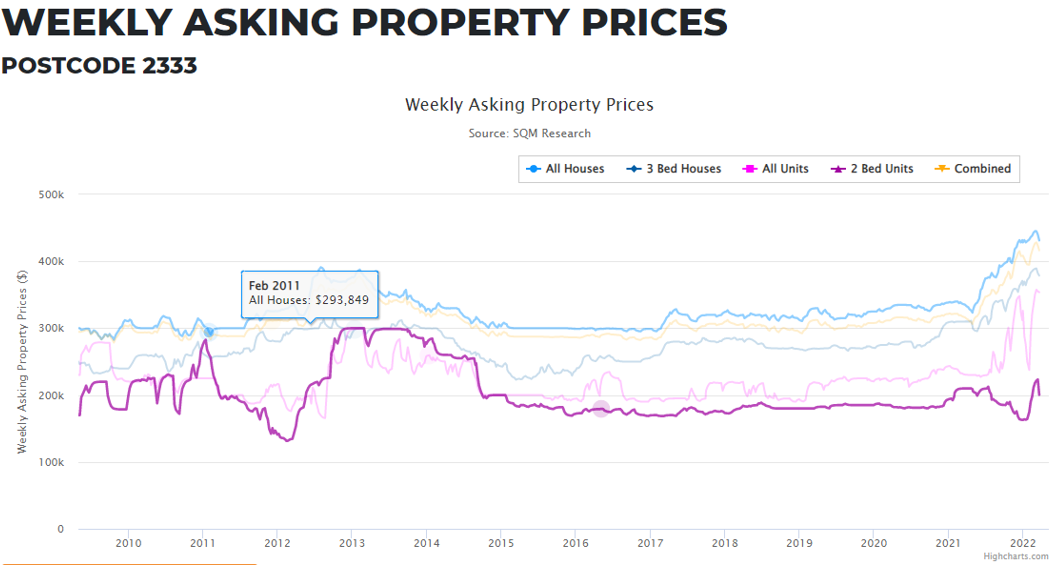

One of the regional areas to receive a boost was the Hunter in Northern New South Wales.

Which leads us to the obscure little postcode called Musswellbrook. I’m sure it’s a nice area and all.

Should be nicer now as it will benefit from the $270 million investment into the New England highway bypass that will connect this area to the Newcastle ports.

This will really help get their produce to market via this brand-new extension.

It will also promote new jobs, new businesses and hopefully some first home buyers to take advantage of the new government schemes to move to an area on the move up.

Yeh, about that.

With prices for all tiers of property going nowhere for almost 7 years, in the last 12 months they have all risen in unison by between 28% to 54%!

It’s almost as if someone knew.

Here is another example of how government policy distorts and artificially alters the land market.

From the above AFR report.

Nicola Powell, chief of research and economics at Domain, said the scheme came with a price cap, which would limit the areas where buyers could purchase their first home.

In greater Sydney and major regional centres in NSW, buyers can only buy a property valued up to $800,000 and up to $600,000 in the regions. In Melbourne, the scheme is capped at $700,000, in Queensland $600,000 and $500,000 for the rest of the capitals.

Another fun fact. There are virtually no remaining detached houses in any of those areas under those price limits.

For instance, 1% of Canberra suburbs would qualify.

So, you must go way out into the regions to find a home that qualifies you.

The first version of this scheme was 1st January 2020. Demand tapered quickly off, however.

Why? Because the price of land overtook the governments artificial caps on what first home buyers could afford!

Any ideas what happens next for the extended version of this.

Folks, here is one simple reason why land prices WILL continue to rise.

It won’t be any cheaper to do so next year. Not when official interest rates start to rise and bring forward demand to get in and lock in a cheaper home loan rate.

In fact, there’s only 2 times every 20 years where it’s a very bad time to be leveraging up and buying.

You can find that out via a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat and show you the opportunities that it presents.

The government ‘knows’ what’s it’s doing by pegging its electoral future to the land market.

But the Boom Bust Bulletin will unveil the true hidden costs to this agenda.

Once you see the world with your own real estate lenses, nothing is the same ever again.

“How can property prices continue to go so high?”

Come on board and find out.

Sign up now,

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.