Let’s go back, way back. Ninety years ago, to 1930.

It was then that renowned and famous economist, John Maynard Keynes, wrote…

‘…within a hundred years, we’d all be working a 15-hour week.’

It was a big call.

And as you’d know, the year 2030 is not so far away now.

But as for our 15 hour week? It seems further away than ever?

So what happened?

Ask the economists, you’ll get a dozen different answers…

Some say despite the grumbling, we actually enjoy the work. There’s something about the human psyche that we need to be useful and productive. Some economists point to competition from around the globe. That’s why we have to work longer hours.

Some economists blame rampant consumerism. That progress has produced a greater array of goods. That we’re all working longer hours just to buy them.

Or, that we’re all working longer, to keep up with the ‘Joneses’. It’s the social climber in us, that has us all borrowing more, and working longer hours.

Now, there may be something to each and every one of these explanations. But…

All the economists fail to see one thing. Now stick with me here. The reason we’re all working longer, could be as plain as the ground you’re standing on.

Get this nailed down, and you’ll discover why Keynes got it so wrong.

And why the era of leisure he predicted, never came to pass.

If you get what follows, you’ll inhabit the 4th dimension. A parallel universe that few, if any, ever see.

Now, I should confess, I’m on the wrong side of fifty. That means I’m old enough to remember the days of black and white TV.

Shows like My Three Sons, Gilligan’s Island, Lost in Space, McHale’s Navy, F Troop,… I could go on and on.

Simpler days. The days when dad went off to work, and mum stayed home to look after the kids.

But how hard did the dad of yesteryear have to work to put a roof over the family’s head?

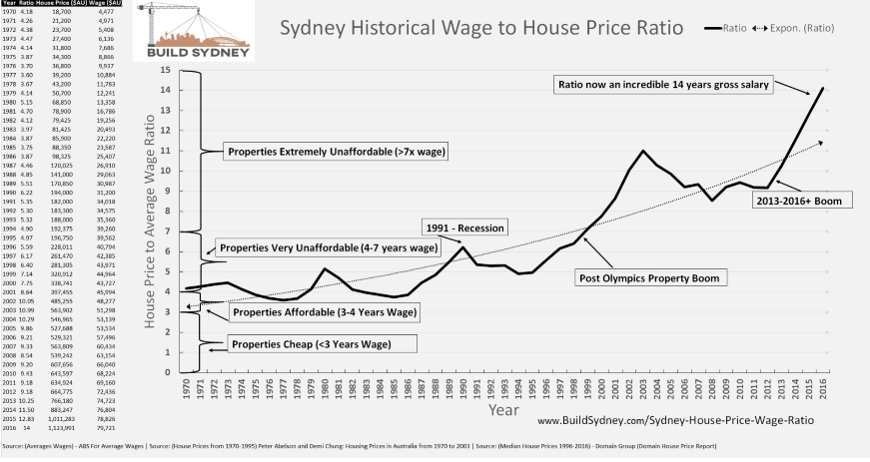

Have a look at the graph below…

Source: Reddit

This particular study is done for Sydney, but is just as applicable to elsewhere. It compares the average wage to house prices, expressed as a ratio.

It suggests the dad of yesteryear actually had it easy. That the modern-day dad has to work harder than ever, just to keep a roof over the family’s head. It suggests homes were a whole lot cheaper, way back when in the seventies.

Back then it ‘only’ took up to 3-4 years of the average wage to buy. Then fast forward to the modern day, it goes to an incredible 14 times the ‘average dad’s’ wage!

It’s great data and good research. It really is. Only there’s one problem…

It’s a totally irrelevant comparison for today’s housing market.

These kinds of graphs get trotted out every now and then. They’re meant to convince you why house prices must and will fall.

But should they?

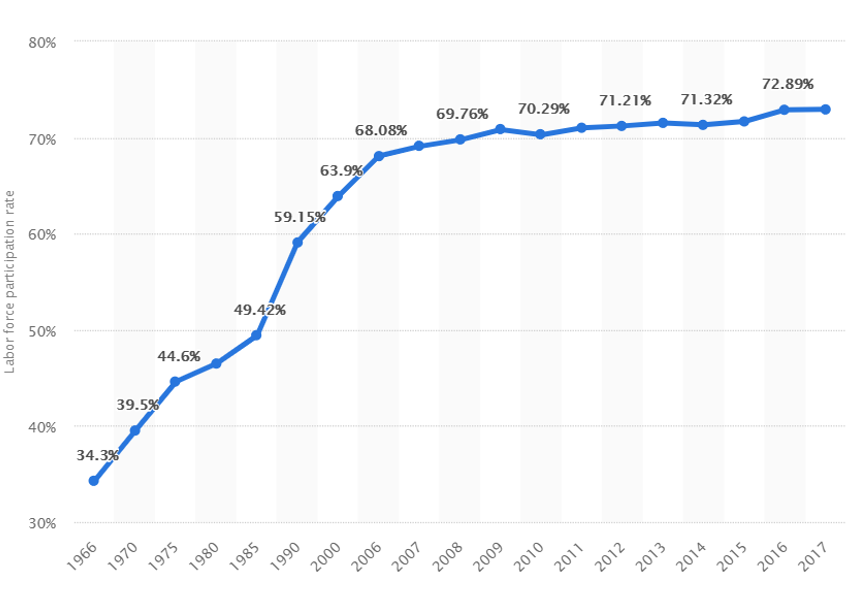

Check out this next chart.

It’s the labour force participation rate for women aged 25 to 64, for Australia, from 1966 to 2017. Most other western nations have seen similar.

What does it all mean?

Just as the days of black and white TV are long gone, so are the days of mum staying home to look after the kids.

These days it’s two combined wages bidding on real estate, mostly. And land, fixed in supply around the amenities, services and infrastructure we all enjoy, simply soaks up that gain.

Our era of leisure, so tantalisingly put before us by Keynes, can never come to pass. House prices (land) will simply take the gains of better ways to work, cheaper ways to build housing, higher pay even.

In fact, life hasn’t got easier. It’s got harder as the modern family often has to contend with childcare and the associated costs as well.

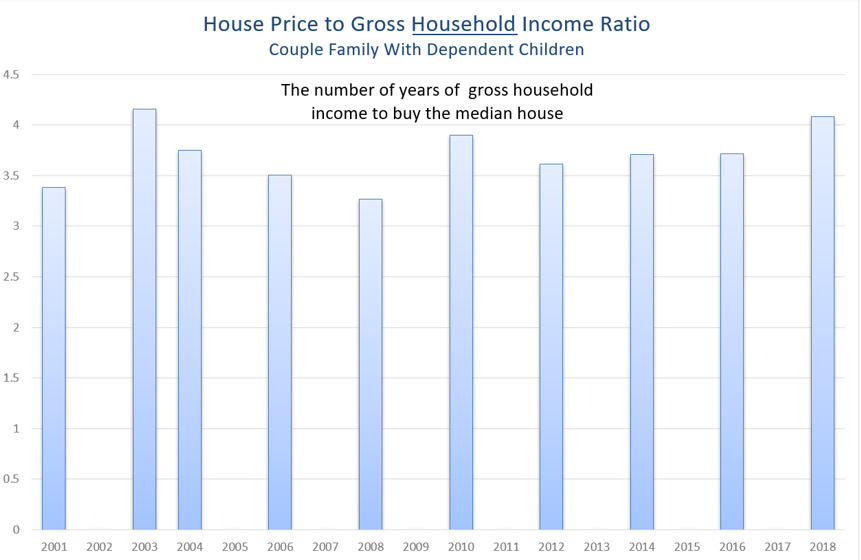

Here’s a better graph for you. One that reflects today’s modern circumstances.

This is research, simply using the historical data I have at hand. It plots Melbourne house prices with the combined household income of a husband / wife with children…

The number of year’s combined household income to buy a house has oscillated around a ratio of 3.5 or so for the last twenty years.

House prices may seem to be unaffordable now. (When has housing ever been affordable?).

The point is this…

House prices are likely no more unaffordable now, compared with times past.

Houses (really land) will always sell at the red line of what the economy and locational advantages can afford. It can’t do anything else.

Start to see what the great economists can’t see.

Land price simply soaks up all of society’s gains.

And to share in societies progress you have to own a little land.

Which is why owning some, could be part of your overall wealth strategy.

If you want to know more, when not to buy and how to time it all to your advantage, then go HERE.

Best wishes

![]()

Phil Anderson

and your Property Sharemarket Economics team.