So we continue with part 2 of what I discovered the city of Brisbane was telling me about the cycle during my Xmas trip there.

To catch up, you can find part 1 here.

When we last talked it was about the fact that Brisbane property developers couldn’t build any taller due to the city councils restrictions.

It was (or rather is) deemed unsafe to build any higher due to the flight paths aircraft must take when landing at Brisbane airport.

I do recall I’d tell you what I found out about this issue.

And why it is important for you personally if you wish to view the economy and the world around you via the lense of the real estate cycle.

The Property Sharemarket Economics (PSE) team study the 18.6-year Real Estate Cycle, 14 years up and 4 down with a mid-cycle recession (MCR) interrupting the 14 years’ expansion.

We have shown our members that we are right in the middle of the mid-cycle recession of the current real estate cycle.

We have gone to great lengths to explain that whilst economies and stock markets around the world will remain volatile, the worst is over for the land market.

Brisbane for mine simply provided further proof of this.

And here’s why; this is what I discovered.

In September 2020 the first flights began to land on Brisbane airport’s brand new second parallel runway. This opening also coincided with changed flight paths.

This has seen (and will again) more air traffic routed away from the city and suburban areas towards the ocean.

In my research I found that the 2007 (note the date) environmental impact study prior to building this runway did not take into account the dramatic urbanisation of Brisbane in the following decade.

The flight paths were a direct result of this study.

Today however, this continuing urbanisation of the greater Brisbane area means noise complaints have skyrocketed.

There is talk now of the flight paths being changed again. This time potentially permanently.

Is this the opening developers need to pressure governments to lift these height restrictions? Or at the very least allow rezoning of areas once thought not viable for tall residential towers?

Changing these flight paths can suddenly open the air space above previously restricted urban areas.

My own experience and knowledge of the cycle suggest they will. But let’s see.

A surge in buying any and all vacant lots or suitably zoned areas ahead of any release of such changes are our clue.

Regardless, another very interesting and potentially lucrative trend to be following, not just in Brisbane but around the world.

I did do a lot of walking around the CBD.

On the corner block opposite to where we are staying is a large vacant lot.

Absolute prime real estate location. Empty.

You can guess what I did.

There is always a story worth investigating when you find something like this.

And it appears a future 91 story development is currently behind schedule on this very location.

Why?

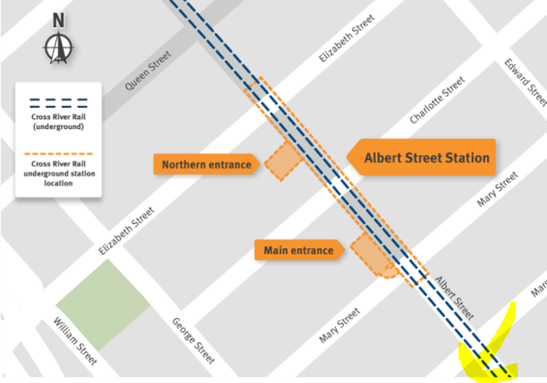

Well, not only is this block on a prime piece of CBD real estate, but it will be tens of metres away from the first new railway station to be built in Brisbane in over 120 years.

Source – crossriverrail

That’s right, government funded infrastructure. Developers are now past masters in ensuring they maximise any such projects to their benefit.

Source – crossriverrail

Note the above yellow arrow point towards the location of the vacant lot (bottom right corner).

History shows us just how much benefit flows to the landholders near infrastructure projects like railway stations.

So, what’s the hold up then?

It appears a new application has been lodge with council to expand downwards the levels of basement parking.

You need to remember this type of development don’t just build up anymore.

The problem?

They will be digging right into the new underground railway line, the one that will run directly to the new Albert Street railway station.

Hence the holdup.

I’ve no doubt this will be resolved, there is much at stake here for it not to.

But again, note the drivers.

Lavish government infrastructure, vacant lots that are anything but.

The 18.6 year Real Estate Cycle is turning. Very soon it will speed up exponentially.

Here’s your takeaway then from what Brisbane told me. I hope its telling you something similar?

- If possible, take a closer look at your own plot of land and determine what its development potential is? Obviously homeowners with detached homes are best placed to do this. What zoning permissions has your local council granted in your area?

- Start researching development potential on vacant blocks around where you live. Also study government paid infrastructure plans. Like in Brisbane, are there any future plans to build new railway lines and stations in the near future? The worlds biggest real estate developers take advantage of this all over the world. You can too.

- Per the above, should your own research show pending infrastructure plans like a new railway that’s due to commence in a year or two, look at buying either properties or vacant land ahead of the build. Do your due diligence and look to buy the most favourable locations near any proposed railway station. This way we try to ensure the gains have not already manifested into an increased price of land. Instead, let the majority of this land price increase go to the astute landowner; you!

Make no mistake, if you wish to benefit yourself and your family’s future by learning about what the real estate cycles, here is a simple 3 step plan to help you begin.

Revealed to you, the true drivers of the economy, hiding in plain sight.

So, we have uncovered trends which can now be followed. You don’t have to be a resident of Brisbane either. This is carrying on everywhere, simply take a closer look.

If our simple 3 step plan above has triggered a need to know more, to really understand what drives the cycle and the potential for great wealth generation it can provide, you need to subscribe to the Boom Bust Bulletin.

As a member of the Boom Bust Bulletin. You will receive the history of the 18.6-year Real Estate Cycle, why it repeats, and how you can take full advantage for yourself and your family.

You will find the information this bulletin provides you nowhere else.

It is 100% exclusive to Property Sharemarket Economics.

And it will cost you less than a single coffee per month. Incredible value.

Join us on this journey.

Sign up now.

Best wishes

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.