If you would like to receive weekly updates like this, sign up here.

One thing you can always count on when it comes to governments. They all want their cake and eat it too.

Particularly when they are heavily in debt and want more revenue so they can pay it back.

Recent news out of Australian state of Queensland (QLD) highlights this.

As with every other state in the country, it overspent during the Covid lockdowns. Now it needs to boost its revenue to service all this debt, which is one of the reasons that it passed legislation that fundamentally changes the rules governing land taxes in Queensland.

Cue the inevitable emotion led headlines like this one from the Australian Financial Review.

Source: AFR

Source: AFR

If you own commercial and investment properties in QLD and in other Australian states, then you may find today’s blog most instructive. (But even if you don’t, you need to understand the pattern that arises at this point in the 18.6-year real estate cycle).

Are you really going to see the valuation of your properties drop substantially, and must accept extremely high tax bills as a result?

As ever, the truth is far more nuanced.

There’s the right way to do this, and then there is this…

What we are looking at today is the Queensland government’s decision to amend and alter the current legislation underpinning the state’s land tax regime. The Labor government is raising property tax on investors who also own land interstate, in addition to a multi-billion dollar increase in coal royalties and a “mental health levy” on the payrolls of big employers.

All this takes place in an environment of rising costs of living and interest rates.

In effect, Queensland is a classic example of the fact it went too far in one direction in respect of overspending during lockdown only to change tack and go too far the other way with a multitude of tax increases to get it all back.

With respect to this new land tax, here’s the crux of the change: it allows the government to use the total value of the investor’s land holdings, including interstate, to calculate the land tax.

The new law will have no impact on investors who own land in Queensland only. But those who own investment properties elsewhere in Australia will pay more tax in the state.

These changes are due to come into effect in June 2023.

As you can imagine, those vested interest who find themselves in the cross hairs of this have come out firing.

By now you’re probably wondering what the Property Sharemarket Economics (PSE) team may think about this development. After all, if you have been reading these blogs for a while, you’ll know the PSE team are strong advocates of a broad-based land tax.

So, do we support the desire of the Queensland government in rolling out this land tax initiative?

Let’s say, there’s a right way to do this, and then there’s the way this government is doing it!

What PSE supports is a broad-based land tax across all types of real estate and at the same time the abolition of all other taxes levied on production or capital.

And this is not it.

There is no semblance or indication the government here will drop or reduce any other taxes, in fact they are increasing as well.

University of NSW economics professor Richard Holden said the changes looked like a “money grab” and amounted to double taxation.

This pretty much sums it up.

The thinking is to close an apparent loophole that exists which allows savvy investors to exploit the tax-free threshold across multiple states but added up means millions worth of property under one portfolio paying minimal land tax.

Today, any individual investors who own investment properties in Queensland will be exempt from paying land tax if the value of their land holdings is under the land tax threshold of $600,000 even if they own another investment property elsewhere in the country.

By aggregating the total holdings of a property investor who owns an investment property in Queensland and any other state, this will see the above loophole closed and increase the revenue the government can capture.

Would you like to take a guess how this has been received?

It was “time” for this to happen.

Let’s look at some recent comments related to the media.

“The fact that this increase in land tax bill has become permanent is quite alarming,” Mr. Greco said. “This is fundamentally wrong and goes against the concept of a land tax which is a tax imposed on land located in a specific jurisdiction.”

“I think it’s not really a loophole, because a loophole is when you try and correct a mistake, that’s not what this is,” he said.

“This is just a completely new idea to make more money for the government. It’s really a tax grab.”

“It doesn’t feel like the most efficient or the most effective way to raise revenue, and it doesn’t feel like it’s going to hit the people that can afford to pay it.”

Geez, that’s just a small sample of relevant industry experts passing judgement.

I am not seeing much agreement that this is a good idea on any level.

So, if you believe you may be affected by this ruling the one piece of advice I give is to reach out to the best financial and legal advice you can and ensure your own portfolio is correctly structured and you are made aware of your legal rights.

However, this blog doesn’t have the scope to drill down into the details of this decision.

My motive is to provide context to this instead. Because for the entirety of 2022 I have witnessed many similar changes to property tax across the globe.

Source: BDO Canada Website

Source: BDO Canada Website

Source: Barrons

Source: Barrons

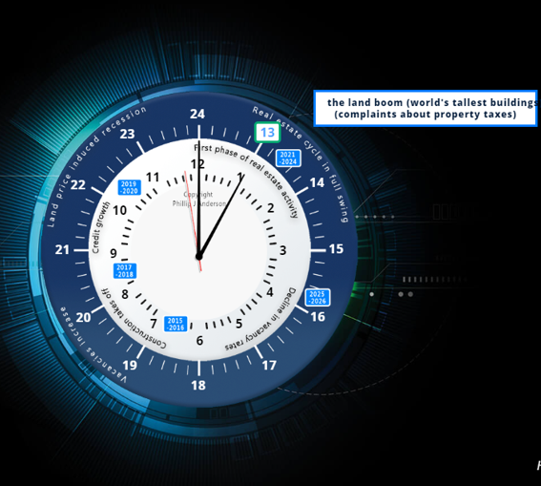

Even more important than this, this trend is no accident. It is, in fact, time for these to become a major issue. And yet another advantage of prior knowledge of the 18.6-year Real Estate Cycle.

Because by researching the previous real estate cycles you would have noticed this exact issue becoming front page news at the same time as today.

It’s a practical advantage to have, as one can’t stop the machinations of governments, but at the same time one can plan and prepare in advance.

Which is precisely the advantage our PSE members have enjoyed, as you can see from the property clock on our website.

Source: PSE

Source: PSE

Early in 2022 we noticed our indicators showed the clock had moved to 1300 (or 1pm). By hovering your mouse over each time slot you’ll notice a brief breakdown of each hour appears.

Above is what 1300 represents. Once again, we have been at this time for most of 2022.

I have also mentioned in previous blogs two things you need to be aware of for the remainder of this decade. That is, things are about to get volatile and emotional.

Read again the comments above, read the emotion in their arguments on why this is a bad idea.

There is no government anywhere in the developed world who will stand idly by and watch the incredible gains made by investors in property over the last three years and not want a cut of it.

An investor’s ability to maximize and anticipate legislative and regulatory changes that can affect their portfolio is an important part of your strategy.

Here is another important part; a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat and the unique opportunities that arise as it turns.

Or, as in this case, provide forewarning of what to expect and the likely outcomes. Suffice to say there’s plenty of time between now and June 2023 for vested interest groups to lobby to get these regulations watered down or changed.

This is what history tells us.

Take one more look at the first image posted from the Australian Financial Review.

If you are familiar with the drivers that underpin the 18.6-year Real Estate Cycle, then the above headline should have raised an eyebrow.

If you missed it though; I will give you a clue. Can increased rent really result in decreased house prices?

Join us and discover the truth of the above statement.

Sign up now.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.