If you would like to receive weekly updates like this, sign up here.

A few years ago, Carville, a working mother of two in her late fifties, learned a very old, very costly lesson in buying property.

She had bought in Melbourne’s inner city apartment market at a time when cries of “over-supply” continue to reverberate.

In 2011, she lost her entire $37,000 deposit and racked up more than $14,000 in legal fees after failing to settle on a tiny $375,000 studio apartment. That’s $51,000 dollars.

She had bought the unit off the plan two years earlier, on the advice of her financial adviser, but fell afoul of unforeseen changes to lending rules.

That makes it 2009 by my math.

And the absolute peak of speculation in the land market.

Economists called what followed this the Global Financial Crisis.

It was nothing of the sort.

Believe me when I say this. If Carville had understood the 18.6-year Real Estate Cycle and the chase for the economic rent, such a disaster could easily have been avoided.

Which means, YOU can also avoid similar mistakes as real estate reach their peak over the next few years.

Particularly if your investment strategy involves buying off-the-plan apartments that you think will be worth more once built than what you paid for.

Let me show you how a little knowledge and knowing when to look up can save you from financial ruin.

Practical speculation.

“Buying off the plan is very risky. Your circumstances can shift and change, but when it comes to settle, there is no wiggle room to negotiate,” said Carville during a 2015 interview with the Australian Financial Review.

I really do sympathise with people like Carville.

It’s compounded by the fact that most people who try to get out of a contract when the land market turns down do so after they have signed legal documents.

These contracts are created by high-end lawyers and are by design extremely difficult to get out of.

What occurred to Carville is a microcosm to what happened right across the apartment market at the 2009 peak.

Carville ran into trouble after her mortgage lender, a big four bank, changed its rules on financing apartments under 40 square metres.

The bank wrote to tell her she would need to pay a 20 per cent deposit rather than the 10 per cent she had put down.

Well, that’s fine, if you have the money. But what if you don’t?

Carville could not find the cash and so lost her entire deposit.

You can see what a disaster a simple purchase off the plan has now become in this example.

But nothing I can write can convey the emotional anguish and stress this causes.

The good news though is this is all totally avoidable.

I’m about to show you how.

Simply by walking into the middle of your nearby CBD and looking up!

“Hello property share market. Just wanted to say I think your literature is spot on and I’m excited to absorb everything you have to offer.”

Carl – August 2021

Henry George is one of the greatest economists ever. His name lives on as those who continue to study his work are known as “Georgists”.

In 1879 he wrote his masterwork about the economic cycle, Progress and Poverty. It’s probably the bestselling economic book you’ve never heard of.

This is because almost no work today quotes his above work whatsoever.

One of the few that have however is Victor Niederhoffer and Laurel Kenner’s excellent read, titled Practical Speculation.

I can think of no better explanation of Henry George’s work.

Below, on page 255 of the book (emphasis added):

“…The speculator will find real estate a highly profitable field of study for understanding stock market cycles. According to a widely respected economic theory first put forward by Henry George… business cycles are caused mainly by movements in real estate values.”

“George began with the observation that rent and land prices rise when business conditions are good. Eventually, rent-seeking landlords absorb all the excess profits that business can make. Businesses fall behind on rents and mortgage payments; defaults begin, and bankers call in loans…”

A few sentences which explain very simply why we continue to this day to flip properties to one another.

And the conditions that bring about the bust.

Here is your takeaway: nothing is more critical to your success when building your property portfolio, even more so if buying off-the-plan, than understanding the importance of your timing.

Plan your exit strategy before you buy!

So, what’s the single best way to determine the timing?

The fact is it’s several key indicators overlaid across the 18.6-year Real Estate Cycle.

One of those is called the Skyscraper Index, created by economist Andrew Lawrence, which shows the correlation between the construction of the world’s tallest buildings and the business cycle.

So, what can it tell us?

Niederhoffer, in the work cited above, explains the effect as land prices begin to crash (emphasis added):

“Land prices begin declining because few tenants can be found to lease property at current prices. As these developments reduce lending for other business activities, general business conditions worsen.

Just at this most inauspicious time, an abundance of new development comes on the market. Developers had broken ground on new projects back when business conditions were good, acting on the assumption that property values would keep rising. Now that the projects are complete, there are few takers.

The net result is that rents and land values are driven down still further.”

So, it’s clear then that buying off-the-plan with an expected completion date right when “…an abundance of new development comes on the market…” is bad timing.

And remember you’d be buying when it ‘feels’ right, when everyone is congratulating you on your purchase and the media keeps reporting that business is booming.

Here is how I interpret this.

Thanks to my knowledge of the 18.6-year Real Estate Cycle I can rely upon more than 200 years of repeatable and predictable history to guide my investment decisions.

I know the peak of the US land market is due near the end of this decade (sometime after 2026), then across the rest of the world.

So, if I would like advanced warning of the tallest buildings due to be completed around 2026 and beyond, then a website like skyscraper centre is where I look (google it yourself and add it as a browser favourite if you’d like to follow it too).

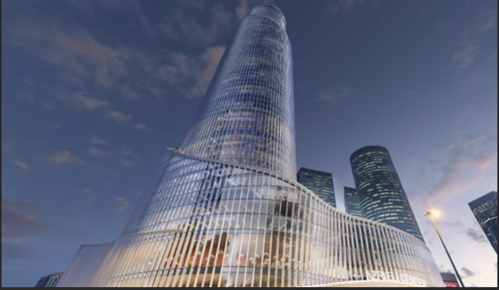

Here’s a brief example of what’s due for completion at the end of the decade.

Source – Skyscrapercentre

Source – Skyscrapercentre

The Suzhou Zhongnan centre in China. A residential, office and hotel skyscraper with 103 floors standing at 500 metres tall due to be completed in 2026.

Source – Skyscrapercentre

Source – Skyscrapercentre

The Azreli spiral tower in Tel Aviv in Israel. A 91-storey office block standing 330 metres tall, due for completion in 2025.

Source – Skyscrapercentre

Source – Skyscrapercentre

One Bangkok tower precinct in Bangkok Thailand. A 5-tower precinct with its tallest tower 92 floors high and standing 440 metres tall. Designed to incorporate retail, hospitality, corporate and cultural experiences, due for completion in 2025.

If I visited any of those capitals in 2025 or 2026 and looked up, I’d see a totally different CBD skyline than I would today.

And there are literally dozens more like them planned today across the world.

Not forgetting there will be even more on the drawing board next year that haven’t yet seen the light of day.

I encourage you to take the time and look for yourself.

Recall the fact it’s the saturation of these developments coming to market at the same time which pushes the land market over into bust.

If you can plan an exit strategy first before you buy, you can avoid that fate by having the timing confirmed to you as the biggest, largest, tallest, most expensive towers come to market.

If that’s not enough to convince you, I will leave the final word on this to Niederhoffer (emphasis added):

“…In the real estate cycle, prices eventually fall to a level low enough to permit entrepreneurs to start profitable businesses on these properties once again. Expansion of the new businesses spurs real estate prices higher, and the cycle is ready to repeat.

This simplified model is so obvious and so elementary that it almost seems naïve to present it, except that throughout history and across countries the cycle George and Ricardo described seems to repeat over and over”

I say to you, if you are planning on investing via off-the-plan apartments, or even detached housing, your strategy must begin with knowing your timing.

Get this wrong, and potentially years of heartache, legal challenges and wasted capital await.

The best way to start is to grab yourself a membership to the Boom Bust Bulletin.

It will teach you the history of the real estate cycle, why, like Niederhoffer says, it continues to repeat and guide you to the best opportunities as the 2nd more speculative half of the cycle begins.

Having the timing built into your investment plan and knowing where and what to look for to confirm it ahead of time is a simply incredible advantage.

One the majority of those who will buy off-the-plan apartments this year onwards will have no idea about.

But you can.

All for $4USD a month!

That’s incredible value. So don’t wait.

Though I must say, there’s a lot to be said for perseverance.

Remember Carville? It turns out she did eventually bounce back from her off-the-plan nightmare.

In 2013, she bought an apartment in a small art deco block in Bellevue Hill, Sydney, where she has benefited from the surge in values in the Sydney market.

Her apartment, which she bought for $550,000 and rents out at $550 a week, is now worth more than $700,000. A $150,000 capital gain in over 10 years.

Timing is everything!

Best regards,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Find us on Twitter under the username @PropertySharem1

P.P.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.