If you would like to receive weekly updates like this, sign up here.

Did you hear!?

About the NEW world record broken by a piece of digital art during a recent auction by Christie’s.

Sold for $69 million dollars.

Yes, that’s not a typo. Something which you can never ever hold in your own hands was sold for that amount.

That’s almost three times more expensive than a 1955 Pablo Picasso canvas the same auction house sold back in 2020.

Welcome to the world of non-fungible tokens (NFT). Are we at the peak of the current craze yet?

Or is this simply the very beginning of an unstoppable trend that truly marks the time that blockchains and their token becoming mainstream?

Right now, it could really go either way.

But there is a remarkably familiar undercurrent slowly being exposed here, one which you would do very well to understand.

Because the similarity with the standard behavior we study and research as the 18.6-year Real Estate Cycle turns is now driving the NFT craze almost the same way.

The way we chase the economic rent, the speculative drive to gain something for little to no effort and leveraging to the eyeballs to achieve this.

Read on now, as I dive into this high tech crypto based world and explain how this NFT trend is simply becoming a digital twin of the real estate cycle.

And for those reading who are in this NFT space, some ideas on how you can capitalize on this opportunity.

Let us look now.

Now that’s some serious money!

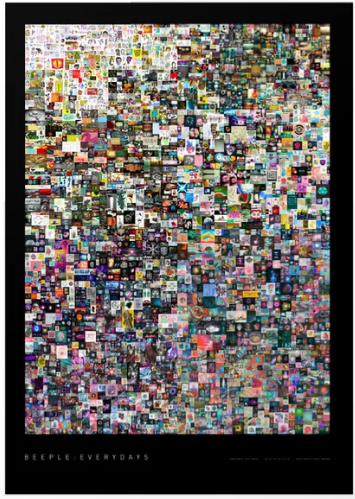

You may or may not have heard of Beeple. Beeple makes digital art linked to its own one of a kind NFT token to prove ownership.

His pseudonym though is neither here nor there.

Its more about the world record he recently set.

And here it is.

Source – Christies

Source – Christies

You’re looking at “Everydays – the first 5000 days”, the most expensive digital artwork ever.

At the conclusion of the $69 million auction, Beeple tweeted a one-word remark to the sale, unprintable here! But I’m sure you can imagine which one…

Do you think that’s insane?

Then I’d love to know what you think of this.

Because recently that very tweet (consisting of a single word + exclamation marks) sold for $6 million.

For a good cause mind, the money going towards tackling climate change.

But as I have said for many weeks now, we aren’t talking chump change here.

This is a serious, very lucrative movement now and is attracting the most well versed in this industry. Mostly young entrepreneurs who have created their own crypto coin-based businesses.

But serious business minds, nonetheless.

It’s quite incredible to realize just how quickly this new type of digital collectable has taken off. Perhaps the speed with which it became mainstream and highly desirable is part of the reason most folk cant fathom the attraction to them.

And I can certainly understand that.

I mean, my own kids can probably produce something like this in an hour online.

Source – Bloomberg

Source – Bloomberg

You’re looking at Cryptopunks, a NFT collectible that looks like they took 30 minutes to make using Microsoft paint. And you wouldn’t be far wrong.

When released, you could grab one for yourself for around $50.

Recently, one was brought for over $7 million.

Again, it’s the limited batches, with unique ownership guaranteed thanks to the NFT tokens, that are driving these prices.

When you buy one, its unique to you only, for life.

Can you share it with others? Sure, but at your discretion. You can share a link or present it using your unique digital wallet.

You certainly don’t have to worry like the owner of a $29 million-dollar 1955 Pablo Picasso canvas of someone coming to visit your home to look and then running off with it!

Should we niftex or NFTfi these tokens?

So, I suppose this was only a matter of time.

And the reason why I’m writing this to you today.

This is the way the behavior in this space becomes no different to those who speculate on property and hope to flip for huge gains in a few years for little to no work.

Cause thanks to protocols like niftex and new marketplaces like NFTfi you now allow collectors of NFT tokens or collectibles to apply leverage to their holdings.

You can use niftex to fractionalize a particularly expensive or highly sought after NFT collectible or token which allows a large group of people to get a slice of ownership which they may not have been able to afford themselves.

It also allows you to buy up other peoples ‘shards’ (someone else’s share of the collectible) and obtain full ownership too.

Whereas NFTfi is a marketplace for NFT-collateralized loans. Users can lend NFTs or borrow them. Once a user repays the loan, the asset will be transferred back.

If a user doesn’t pay back the total repayment amount before the due date, the asset will be transferred to the lender.

While the above is a basic breakdown surely the behaviour being exhibited here should be awfully familiar to anyone who follows the 18.6-year Real Estate Cycle.

The door to rampant speculation in this space has now opened, frankly it will not be shut either.

So, for those of you reading who either have dipped a toe into the NFT craze, or you’re a grizzled veteran of crypto trading and looking for new ways to diversify those gains, here are two further examples of the “financialization” occurring here.

Can you benefit from these? Sure.

However, a reminder from history. The 18.6-year Real Estate Cycle shows us across multiple centuries the many different get rich quick schemes people come up with during the second half of the cycle.

Pure speculation funded by ever easier to acquire credit.

This led to the mad rush for railroad stocks during the 19th century, tech, and internet-based companies in the late 20th century, just for starters.

But always remember that leveraging cuts both ways, it can boost your returns or smash you to pieces, and for more than you initially invested.

Can you make money right now in this space? Absolutely, but never forget the lay of the land. This is a mania; we have seen it all before. Your best bet is to accept that and learn to read the signs of when to get out.

And this decade will be manic; the greatest boom to bust real estate cycle of all time. And all the trillions of easy credit pushing it to the same unheard-of levels.

You simply must understand the nature of speculative markets to allow you to make your money AND keep it.

This is where the Boom Bust Bulletin can really help.

Designed to give you the full history of the real estate cycle, why it repeats and how to best take the plethora of opportunities it will present.

And more importantly, teach you how to be on the other side of the inevitable bust that’s due to occur later this decade.

All for a few cups of coffee a week, talk about easy money!

You will find the information this bulletin provides you nowhere else.

It is 100% exclusive to Property Sharemarket Economics.

Incredible value.

Join us on this journey.

Best wishes

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Find us on Twitter under the username @PropertySharem1

P.S.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.