Now, you may have just reminded yourself of seeing, hearing, or reading similar things lately. Not necessarily in financial magazines, but say your favourite social media feed.

I certainly am. And it’s mostly crypto related. Not that this was a consideration in 2005.

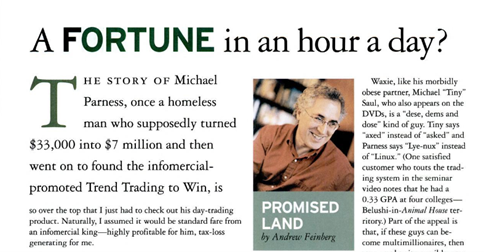

Back to this article. The writer Andrew Feinberg discusses his experience in enrolling in the “trend trading to win” program back in 2005. Atypical of the time really, one had to attend a free live seminar (no Zoom invented yet) where the host gets a chance to really sell you on the emotional need to become part of it all.

If that’s not enough to secure the deal, each seminar attendee received free DVD’s (remember them!) where, in the words of Andrew Feinberg;

“Everything about the DVD reinforces the idea that making a lot of money is good. But only if not a lot of work is required to do it.

Message two; you can be nearly brain dead and still profit from the trend trading system.

Message three; Long-term investing is for losers…all stocks suck, all brokers suck, all analysts suck. The only thing, apparently, that doesn’t suck is trend trading according to the Parness system”

So, much like today, the trap is set.

Recall when I wrote earlier that society today creates haves and have-nots? This type of message is squarely aimed at the latter.

Those who feel it is “their” time now. Who are sick and tired of hearing about the net-wealth of those fortunate enough to hold massive super accounts or multiple properties.

Not only that, but they now believe they ‘know’ something others don’t. That they can posses the cheat code that only requires a hour a day to profit from.

Trend trading stocks back then, trading cryptos now perhaps.

Tell me the exact same behaviour for both isn’t on full display?

It’s classic behaviour too. Make the things available to the lowest common denominator. ETF’s for exposure to bitcoin today, an insistence that no prior education is required to experience outsized profits back in 2005.

Here is why these schemes are so seductive. It is time in the mania phase of the cycle where almost anyone can win.

All you need is patience.

Lets touch upon what this trend trading system actually involves. Participants receive emailed alerts each day telling them which stocks they should buy or sell short. It’s based on ‘gap-trading’, which is a technical trading method.

Sometimes, the price of a stock ‘gaps’ up or down, often on emotional news. The idea then is to place the opposite order in the market once the market digests the news and normalcy takes over.

It’s actually a legitimate and often quite successful method to quickly dive in and grab profits.

The problem however? In this 2005 case, the length of time Andrew went live himself with this system was 4 weeks.

He announced that during this time the system seemed to work quite well.

But, could you argue that it was pure luck? That he just happened to be live during which the markets had, you know, four good weeks worth of trades?

Of course! But it’s this little gem of a comment that really had me chuckling inside.

“As I embarked on my trial, I received a call from Trend Trading, offering me the opportunity to sign up for it’s mentoring program (costed between $5000-$8500).

I asked the recruiter to supply performance information. He replied almost no-one asks for it.

He then said I can expect 30%-40% returns. A year – I asked? No, he replied, a month.

A second recruiter told me I can expect to pay for the cost of mentorship with my first six trades.

The article concludes with the author saying that the system actually works. And frankly, this is where I bring things to the here and now. Umpteen number of forex, crypto and stock trading ads I see personally today are saying the exact same things to this 2005 article.

And the thing is; they are right!

Because from now on, as we enter the true mania phase of the current cycle, you will find that all assets classes will attract speculative monies that will drive them to unseen levels.

It’s designed to make you feel emotionally that you can do this, you can dramatically change your life and turn your financial fortunes around. And maybe you can.

And the facts won’t lie. Soon everyone you know will be making money from some new and exciting form of investing. Here’s the truth for you.

If one word encapsulates what it actually takes to stay safe and excel in the cauldren that is the markets, it is this one.

Patience.

Patience with yourself, remaining patient during the hard times everyone who is new at this will have. And patience with your education. And understanding it takes time to fully learn and embrace new ideas and concepts.

But a little leg-up never hurts. And that’s what the Boom Bust Bulletin (BBB) can give you.

It is your inside edge to fast tracking your knowledge of the worlds most important market – the land markets.

The BBB will teach you the inherent timing of the 18.6-year Real Estate Cycle, and in return give you a market edge 99% of participants simply lack.

All for just US$47 a year! Incredible value.

You may be wondering whatever happened to Michael Parness? Well his website is still online, though it hasn’t changed since the early 2000’s. And his profile is on LinkedIn, not that he’s every posted from it.

I suppose, in the end, he may have never learned about the real estate cycle.

Anyone can end up making a fortune in stock markets, but when peak turns to bust, can you still stay safe. Can you hold on to what you made?

The secret is all in the timing, and that’s what the BBB can teach you.

Sign up now.

|