Recently I have sent emails to you about the recent craze that non-fungible tokens (NFT) digital collections are creating across the globe.

NBA top shot is one I detailed to you, but this is the tip of the iceberg.

And it is something we will continue to track and speak to you about as they develop.

But what they do show us is a current trend of speculation which speaks volumes about what drives the 18.6-year Real Estate Cycle.

There is big money looking for every and all opportunities to get themselves something for virtually nothing.

And we now have a digital revolution overtake the real estate industry that is causing significant disruption right across every aspect.

Today we will focus on yet another speculative trend here, one that you can take advantage of too, should you wish?

If you are keen to start your own property portfolio but you are finding property prices simply too high to make financial sense for you, then read on.

I’m about to explain how for tens of dollars a week you too can start your own property portfolio one brick at a time.

Don’t ignore this trend.

Now I don’t know if you have previously researched the NFT space before now? Perhaps you are very familiar with it and enjoyed some success? Or maybe all I have done is to steer you away from it?

You may even scoff and regard the whole idea as a Ponzi scheme, even a joke!

And I can understand that point of view.

I’d also say, you’re wrong.

To dismiss NFT based collector games is one thing, but that risks you missing another opportunity here staring us in the face.

Remember, you no longer need to own physical assets to make enormous profit from them.

Because this trend is mainstream, more than you think, see below.

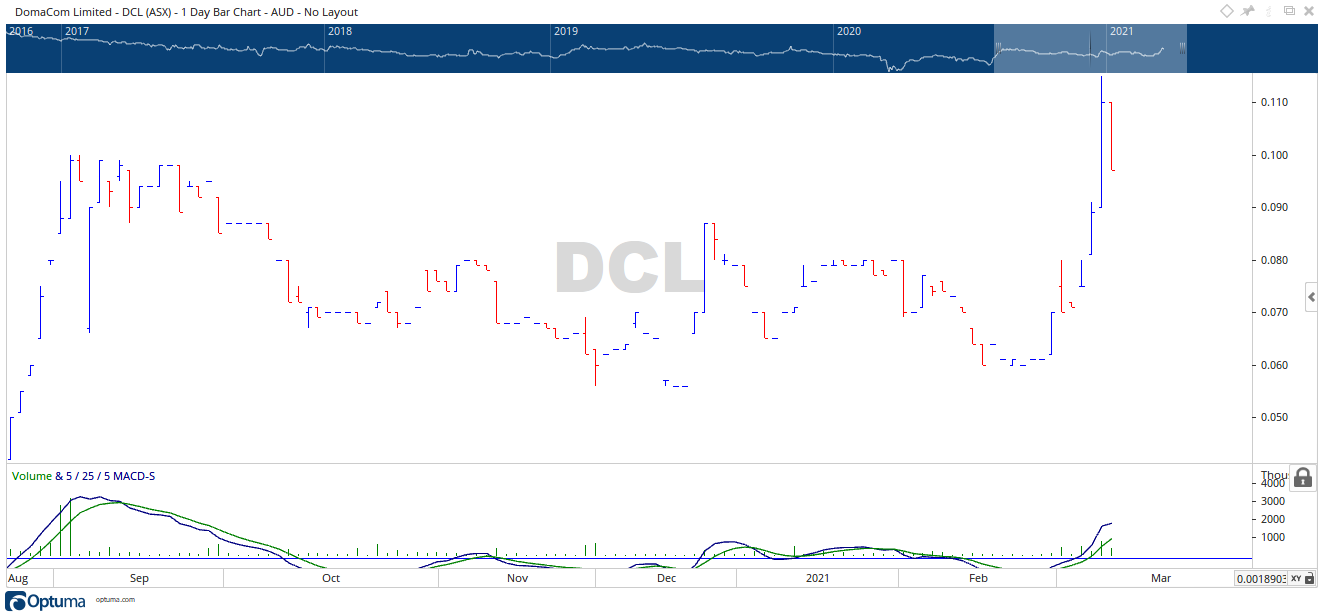

The chart above is for DomaCom Limited (ASX – DCL) which is a listed company on the Australian Stock Exchange.

Their business model is, via an ASIC managed investment scheme, a real estate crowdfunding model that allows fractional investment across various Australian and global property projects.

Their proprietary platform allows easy fractional ownership of selected property which include a cut for the rental income based on % of ownership. You are also free to buy more fractions of these from other owners and sell as well to capture a capital gain.

Alternatively, you can apply to “rent to buy” by allowing DomaCom to use the rent you pay to provide an income stream to fractional investors while allowing part of the same rent to build equity for you to, one day, part own the same property you are renting.

This is a publicly listed company exposed to the real estate cycle with a business model that allows exposure to property both here and around the world for as little as $2500 to approved members.

But do you see and understand the underlying trend here? The digitization of buying and selling property, virtual and real life.

Another example in this space is BrickX.

BrickX has a team of specialists who analyse the property market and purchase investment properties they believe will outperform the market average.

These properties are then divided into shares or “bricks” which individual investors can purchase. This allows interested investors to start investing in property on a smaller scale than the traditional method, which involves purchasing and maintaining an entire property and renting it out.

These properties are rented out, with you receiving a % of the rent minus costs.

The only fees are charged when you buy and sell your ‘bricks’.

Each brick in this regard is a literal fraction of the property.

You are looking at around $77 AUD per brick, on average.

These can be brought and sold between members, so you can build a greater share of the property over time by purchasing the bricks of sellers.

BrickX is one of the true fractional property investment companies in Australia, and arguably one of dozens moving forward.

However, you need to do your research here.

As it is so new, the liquidity may be a problem, as to get your money out, someone else must purchase your bricks from you.

And if most buyers are long term holders there may be a limited market to buy your bricks.

However, as this type of fractional investment takes off, more interest should in time increase liquidity, but it’s something to keep in mind.

These are the type of real-life opportunities we are following here at PSE.

If you want to follow along, to understand how such trends can benefit you and your family, you should consider a membership of the Boom Bust Bulletin.

The Boom Bust Bulletin will teach you the history of the 18.6-year Real Estate Cycle, how to identify the opportunities the cycle presents and how best to maximize these opportunities as they present.

We also cover the stocks that are really beginning to move, all timed with the cycle and show you how best to trade these too. Stocks like DomaCom for instance and other tech related companies.

All for the price of a cup of coffee a week, or half a brick!

So, don’t wait.

Best wishes

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.