If you would like to receive weekly updates like this, sign up here.

Looks like the “I” word is now all the rage.

That of course would be ‘immigration’.

I have now seen it mentioned in many articles about the state of the Australian and UK economies.

In fact, it reminded me of my school days when I did an assignment investigating the history of Australian immigration policy throughout its history.

Below is an example of the type of posters that frequented the UK back in the late 19th – early 20th century.

Source – National Archives Australia

Thankfully, society has moved on from only trying to attract one single nation populous to migrate to Australia.

And yet, this is a regular and, dare I say, cyclical event for Australia. No-one who is a resident here should be at all surprised. What is surprising though are the sheer numbers of immigrants and short stay visa holders coming here are historic.

However, all this is occurring within the backdrop of, if you believe the media, impending recession.

So, the question for you is, is record immigration and recession linked?

Should you be preparing for further economic weakness and plan accordingly?

Today is as good as any to take a closer look.

I’d like to bring to your attention a few charts.

I want to show you what they are.

What they are trying to show you, and then apply the lens of the 18.6-year Real Estate Cycle to come to a definite conclusion about whether the news media are right.

Whether you believe the media on this subject or not, I leave to your own discretion.

I trust however you’ll appreciate another view on this matter.

So, let’s begin.

Will record immigration cause recession?

So, that’s why you’re here reading this now right?

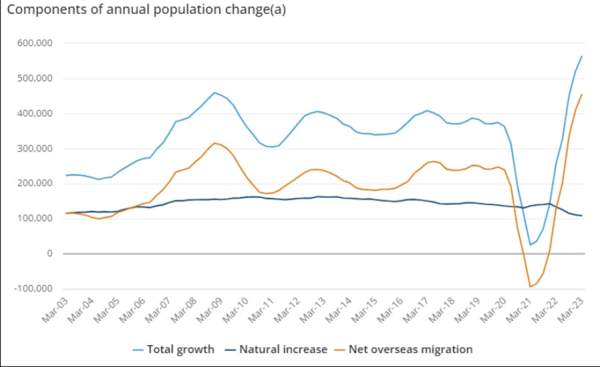

Let’s start with the below chart from the Australian Bureau of Statistics (ABS).

Heres the latest figures for immigration into Australia.

Year to date the population growth of +563,000 is a record high, with this figure set to soar to around +650,000 or more as the year progresses. The trend on the above chart clearly shows you how close we are to seeing this become reality.

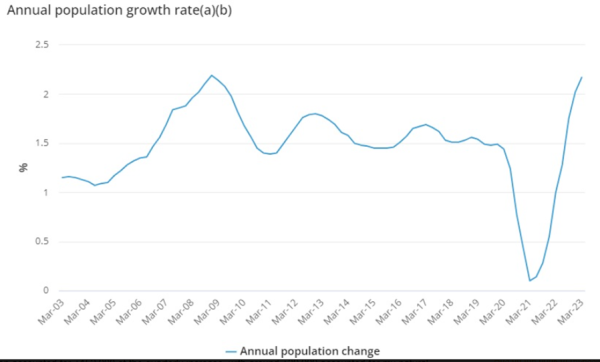

Here another chart showing the growth in more detail.

Over 180,000 immigrants were welcomed to Australia in the March 2023 quarter – a record.

Now, this is the stick that the media are using to beat the drums about recession. According to them, this historic level of immigrants will cause high unemployment as the economy simply doesn’t have the amount of work available for them all.

According to the latest research, something between 35-40,000 new jobs would have to be created each month to absorb the inflows.

ABS data shows the unemployment rate steady at 3.7% albeit the trend is rising, whilst underemployment numbers have risen since July to August; from 6.4% to 6.6%.

To summarise, you are meant to believe that the combination of ever rising immigration numbers allied with a up trending % of unemployed and underemployed is the recipe for recession.

Let’s place our real estate cycle lens on now and use them to show you what’s really going to happen next.

Let the real estate cycle cast the final judgement.

The historical evidence for this is compelling. In fact, it has always been the same for over 200 years of American real estate cycle history. And therefore, no different for places like the UK or Australia.

And it’s this.

High levels of immigration place a rocket under land prices.

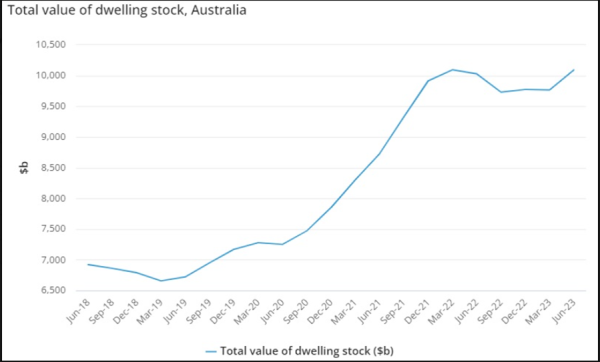

The ABS reported that the value of Australia’s dwelling stock increased by $325 billion in the June quarter to be back above $10 trillion, recovering the decline during the pandemic.

Yes, that’s right. $325 billion increase in property values at a time when unemployment is rising!

In fact, one of the true greats of land cycle economics proved this beyond doubt almost 100 years before.

His name? Homer Hoyt, author of the seminal work One Hundred Years of Land Values in Chicago.

He charted and examined in minute detail the rises and falls of Chicago land prices for 100 years. Later works by PSE’s own Phillip J Anderson and economist Fred Harrison no less expanded upon his work to show the existence of a regularly repeating 18.6-year Real Estate Cycle in both the US and the UK.

Without boring you to tears with even more charts, let me summarize.

Hoyt’s work clearly showed the effect of immigration through the years on the Chicago property market, in particular the link between high immigration into the city and the 2nd more speculative half of the cycle.

So, we are again witnessing history repeating. And I ask once again; Will record immigration cause recession?

The answer is simple. Land prices are rising, so a land price-led recession is impossible.

Suddenly, can you see how the emotion and negativity in this debate begins to ebb away?

I personally am not worried about a cycle ending recession occurring, either here or in the UK.

I do acknowledge the difficulties though. But history is very much on our side here. And it’s this history that’s opened a great opportunity for you.

Because only those fluent in the real estate cycle can truly see the signs for what they are. Boom times have arrived.

Cats aside the worry and negativity the media are trying to stoke within you on this subject. Instead get yourself prepared.

You can’t trust the media, the government, or the central bankers anymore.

The way the news is reported to you; not trustworthy.

So, who can you trust!

I can vouch for this – a membership of the Boom Bust Bulletin (BBB).

Give me the opportunity to take you in depth into the cycle.

Learn about the history of both the 18.6-year Real Estate Cycle and the real reasons why interest rate rises, house prices, and stock markets are so indelibly linked.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

The real estate cycle continues to track on time. While the media focus on recession talk, what I’ve outlined to you is a classic set-up. This set-up has throughout history ensured ever-rising land prices.

Is that not what’s occurring today? Which means the next stage for this set-up is the banks going all-in to grab market share and lend.

Which as we know simply leads to even higher land prices. And so, it builds upon itself into a frenzied peak, which is still years away.

The media is misleading you. Act now and take advantage of other people’s ignorance of the cycle to benefit yourself and your family’s future.

This is the trend, crystal clear. Do not find yourself on the wrong side of this trend. Both when it’s rising, and particularly when the peak becomes bust.

Your one true path to financial freedom today lies in your understanding of the land markets and the inherent timing they can give you.

That’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.