If you would like to receive weekly updates like this, sign up here.

Recently I wrote to you about the mounting evidence that shows the true extent of global credit creation and infrastructure building occurring today.

That newsletter can be re-read at your leisure here.

Today, I would like to continue that story.

Something that was so important that I didn’t have the space to squeeze it into the end of that newsletter.

Something that is important for your long-term investments. It’s arguably even more important than the real estate cycle given the direction the world is taking right now.

You see, alongside the 18.6-year Real Estate Cycle and the enormous amount of credit induced building already happening, there is another cycle you absolutely must be aware of.

And it is the ending of this cycle that will have even more influence over the expected land market peaks later this decade.

It is that important!

And so, your knowledge of this alongside the timing of the current real estate cycle means you truly have a view of the economic world few others possess.

So, I hope you are ready for today’s newsletter.

And whilst I’ve tried to lower the hyperbole – I don’t want you to undervalue what I am about to tell you.

Let us begin; allow me to introduce you to the Kondratieff Wave.

One Long Wave to rule them all?

This is a long-term cycle.

It was named after the person who discovered it, a Russian economist by the name of Nikolai Kondratieff (though he himself referred to it as the “Long Cycle”).

People these days refer to as the “K Wave”.

Kondratieff was the economist charged by back in the 1920s Stalin to reveal when Western economies would collapse. He researched the history of commodities and overlayed those with the cyclical peak and busts of a capitalist economy.

He knew the Great Depression was coming based upon his research – which was published in 1926, well before it happened.

The Kondratieff Wave is seen today as a commodity price wave. It is a rough 50-60-year cycle divided into two distinct phases: 25-30 years of rising commodity prices – the up wave – and 25-30 years declining – the down wave.

He also noted evidence to suggest that it was also a technology wave.

Here is why that’s important: society’s behaviour and investment activity is markedly different on the upside of the wave, compared to the downside.

Which means, like the 18.6-year Real Estate Cycle, its effects can be forecasted.

And that’s the key here. Because this K-wave explains the prodigious rise in commodity prices starting from about 2001 to 2011.

I chose this timeline because it’s likely you may well have lived through it.

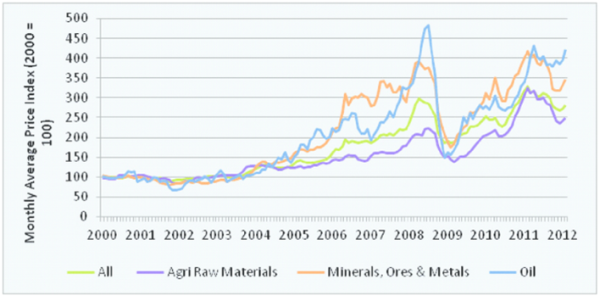

If you need reminding, here is what commodity prices did that decade.

Source – research gate

So strong is a K-wave on the upside that the absolute carnage that was the global financial crisis – more accurately, the bust of the last completed real estate cycle. where the worlds credit system seized up and land prices collapsed – couldn’t halt the insatiable demand for raw materials.

For commodity-producing nations, such as Australia and Canada, these were the heady days where the “Aussie” and the “Loonie” were strong relative to the almighty US dollar. The Aussie was the stronger of the two because much of the demand was coming from China.

This is the type of generational wealth and prosperity these commodity cycles might potentially bring to nations that that are well-placed to take advantage of them.

This was one of the reasons why real estate in Canada and Australia held up – and even increased sharply – at the start of the 2010s – unlike other parts of the world, such as Europe, which took much longer to get going.

The Long Wave is a powerful dynamic.

Today, we find ourselves in the fifth Long Wave in the sequence, beginning in the 1790s, identified by Kondratieff.

Earlier, I mentioned infrastructure via the attached blog here: this is where it comes into the equation.

Because, sad to say, nations that find themselves most benefiting from the rise in commodity prices end up not using the huge wealth generated wisely. In other words, the economic rent – the surplus – reflected in things high gold, silver, iron ore, oil prices.

This surplus is above and beyond the normal cost of mining, extraction, and production.

This surplus is not a “reward” for effort or taking risks; it’s a windfall gain that goes to the owner of natural resources.

If we had a fair tax system, we would not tax effort (wages, business risk taking) but would use this surplus to pay for all the infrastructure that society could ever need or want to make themselves competitive in the global economy.

But instead, governments use that money to pay for extravagant promises to stay in power and allow miners to privatize and collect the rent themselves. So, society ends up with very little.

The best way to see this is to look at the lack of new infrastructure in places like Australia and the United States in the early 2000’s.

This time coincided with the prior 30-year downside culmination of the commodity wave.

What happened in 2001 was that this chronic lack of infrastructure was exposed, and this had to be addressed.

This then drove new exploration for the resources necessary to rebuild and caused an almighty spike in prices for what was available.

Right when the 2nd more speculative half of the 1993 to 2012 18.6-year Real Estate Cycle really kicked into gear. More and more scarce capital went instead into speculative assets like real estate and less to critical public works.

And the chance went begging. Today, those still unfinished or yet to start projects are still needed but will cost far more today than back in the early 2000’s.

Which brings us to today; the 25–30-year upside of this fifth Long Wave. And once again the amount of infrastructure needed to support growing economies worldwide are still lacking!

If you count it out from the year 2000, we are but a few years away from the ultimate peak now.

And the US, and the rest of the developed world, are stuck playing catch up with much needed public investments like highways, railroads, hospitals etc.

Interesting – what’s another cycle you’re familiar with that’s also due to peak later this decade?

But it also explains a broad desire to build new infrastructure, perfectly in line with what one expects to see on an upswing of the Long Wave.

Now, let’s bring it back to the here and now.

Could this technology mark the ultimate end of the K-wave?

I’m sure you have been overwhelmed with the hype surrounding general Artificial Intelligence (AI) and the almost limitless applications it can be applied to.

Soon you’ll start seeing ads in your favorite social media threads about how AI can help your business. In ways you can’t even imagine now.

As stated, the fifth Long Wave, should history repeat, will peak in a few years’ time.

This fifth wave clearly burst into life with the internet and grew exponentially with high-speed internet, mobile phones, 4G, and the explosion in computing power.

Everyone on the planet pretty much is connected now. And the new economy is built on the back of that. And it has now come together in prodigious ways, such as AI.

As Kondratieff observed, when technology is rolled out at scale, new applications are found, the cost of producing it continues to fall, leading to widespread adoption, and is disruptive enough to move vast capital out of older industries and into the newer ones.

And a new sphere of human activity is born.

So, there you have it. Two important and seismic cycles – the commodity and the real estate – culminating together at roughly the same time. Brought to your attention via these two recent PCI newsletters.

There are few periods in history when both cycles peak at roughly the same time.

This is a highly unusual time to be investing. PSE director, Akhil Patel, once said at a conference back in 2017 that the next ten years – to 2027 – would be the biggest period of wealth creation in human history, with more wealth created in that decade that any equivalent decade since the birth of humanity.

It was quite a statement then. But one which is proving to be true so far.

You are very fortunate. But are you ready?

Because Kondratieff also noted the presence of war, upheaval – and even revolution – as the K wave peaked.

So, my question is: can you handle the volatility and tsunami of news and hype that awaits us for the remainder of the decade?

Because it is going to be VERY difficult to remain on an even keel with all that is going to happen.

Your millions, however, will be made in the buy, not the sell. Prodigious wealth awaits the world thanks to this K-wave and the culmination of the real estate cycle.

There is, however, a very good reason why such wealth is ultimately squandered by those nations most exposed to it.

But that’s also true with individuals. A few of you reading this will be become millionaires, even multi-millionaires.

But the sad reality is that most of you will not.

Only a select few will have the knowledge and the developed market edge to know when, where and what to buy. At the right time.

That group of individuals stand to win. Everyone else will miss out.

Which group do you want to be in?

It would be good to know you have someone who understands and researches both cycles to guide you through it all to help you be in the former group.

And you can know too if you take up a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the history of both the 18.6-year Real Estate Cycle and the Kondratieff Wave and why even today both continue to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed. You’ll know what do to. When to do it. And how to tune out the hype and the nonsense in the news.

One more thing about the natural rhythm that these K waves demonstrate.

It’s this rhythm of the Long Wave that modulates periods of long-term prosperity and recession – according to Kondratieff. Kondratieff also found that economic conditions are markedly different on the upside of the wave, compared to the downside.

This is something that has continued to this day.

You are going to need to be on your toes and have available the absolute best information at hand to both choose the correct investments for your hard-won capital and nail your timing.

But know this: W.D Gann, one of the world’s greatest ever traders and cycles analysts, actively studied and looked for times when multiple things came together.

And if he saw this on a stock price chart, he would trade it. And trade it big.

This is the future of this current real estate and K-wave cycles. Two things coming together at once.

The time to best prepare for them is now.

Here is how the Boom Bust Bulletin can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.