If you would like to receive weekly updates like this, sign up here.

My oh my. It’s really starting to feel like it’s happening now!

Can you tell what I am referring to?

The second, more speculative, half of the 18.6-year Real Estate Cycle.

And all the incredible hysteria, hedonistic behavior and of course the bucketload of cash and credit being spent on everything, everywhere, that it entails.

Honestly, you’ve got no idea just how over the top everything is going to become in a few short years from now.

Which is why I wasn’t surprised by the following headline.

Source – Bloomberg

The grand old lady of golf that is the US Professional Golfers Association of America (PGA) finally caved in and decided to join forces with its much younger, far wealthier, upstart; the Saudi backed and funded LIV Golf tour.

LIV in this instance isn’t an acronym, rather the Roman numerals for 54. That’s because the Saudi golf courses used by this LIV tour are 54 holes, rather than the traditional 72 holes of its rival PGA tour.

However, it’s all semantics when you start to unravel and look for the bigger picture, the true driver for this Saudi push into golf.

Today I will address what else the House of Saudi has been up to in regards investment in sports.

And using the lens of the real estate cycle start to show you there’s more to this than who scores a bogey or birdie on a golf course.

In fact, it’s got everything to do with the coming peak of the current real estate cycle.

And depending just how far they are prepared to go to get what they want, this Saudi obsession with owning sports as we know it can give us a true insight into just how bad the bust might become.

Let’s take a look.

Compete or spend to win.

Are you into sports? Do you enjoy the display of athletic prowess and competitiveness to determine who is either the single best athlete or team?

If so, then I’m certain you’ve got nothing to do with these Saudi bids.

What do I mean? Well, this merger between the two biggest golf competitions on earth is simply the latest in a long list of acquisition targets by the Saudi government.

It started in 2016, and the release of the ‘Saudi Vision 2030’. Back then, the country’s reliance on oil sales meant that 70% of all government revenue came from this one source. Diversification was needed. This urgent need was underscored by the 2016 oil price crash.

I wrote more extensively about this initiative recently here.

In that Vision 2030 statement was an aspirational line that read “we aspire to excel in sports”.

So, if you thought that logically this meant a large state-backed investment in the Saudi Olympics team or promoting more Saudi players in team sports like football, I think the reality will show you how wrong you were.

Here are a few examples of what I mean.

Source – Bloomberg

Source – Bloomberg

Source – Bloomberg

Mmm, can’t see any mention of Saudi athletes or sporting teams being promoted using this money. Local sports starts weren’t intended to benefit, judging by the headlines above.

Something else was going on here. It is more accurate to say that they are making a series of attempts to effectively buy and own outright certain sports assets and have some of the finest athletes in the world on their payroll.

But why?

No power quite like soft power.

This is the point where politics and sports become intertwined. And you really need to know how to read between the lines of what we are told are the motives.

Take golf again. When the merger was announced, it was sold to everyone as being ‘a merger to unify the game of golf’.

But did golf need merging? Did it require unifying?

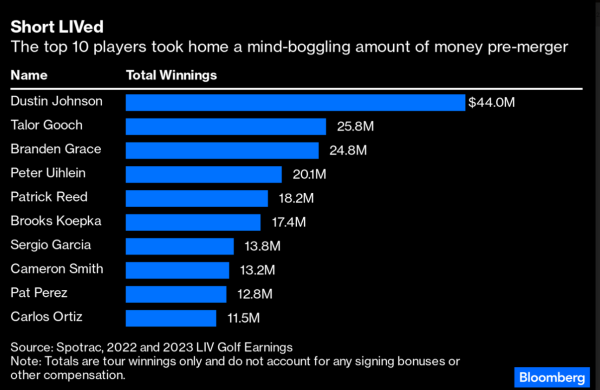

Take this table below.

Source – Bloomberg

It shows the the top 10 earnings in the LIV tournament prior to the merger. All these players were on the PGA tour before coming over to LIV.

That’s fine, those players have the right to change where they play their golf. But this LIV/PGA merger was announced because the PGA wanted higher revenues. And the Saudi government gave them the biggest punchbowl in sports history to merge.

So LIV was actually a tool to allow the most pretigious and biggest golf competiton become owned by the House of Saud.

Why?

A recent Bloomberg article articulated it well. I’d like to use parts of it to explain the true motive here.

In 2021, Saudi Arabia’s Public Investment Fund acquired the Premier League football club Newcastle United. Its soccer league now includes Cristiano Ronaldo, lured by a contract worth $200 million a year; Lionel Messi has been reported to join for as much as $400 million a year. The goal is not simply to improve Saudi Arabia’s image; the Saudi regime views sports as a crucial investment and means of growing the kingdom’s economy beyond its reliance upon oil.

However, accomplishing that requires a foothold in the US, the world’s largest and most lucrative sports market. LIV Golf was the perfect vehicle…the PGA must have wondered how it could withstand years of Saudi money in a sport — and an industry — that demands big purses. Under the circumstances, a merger was most likely seen as the best option.

Are you surprised now?

You really should not be. Ownership of a professional sports franchise is a key means for wealth to project status and soft power in the 21st century. It was just a matter of time before Saudi Arabia and other authoritarian governments decided to join the market.

This is why all this matters now.

So here’s the problem with all this. The US PGA tour was very critical about its rival LIV tour and by extension was less than complimentary about the Saudi government. Well, do you really believe you’ll be hearing anything negative from the PGA now?

Or how about the Saudi takeover of English Premier League (EPL) club Newcastle United? There were a lot of criticisms about the role of the Saudi government in running a domestic sports club. And of course concern that said government didn’t exactly respect human rights at home. But did the football league stop it?

Not at all.

Their away shirt was changed without forwarning, consulation or notice to resemble the Saudi flag. The colours used have “never’ been associated with the club before. Ever.

And don’t think the failed attempt to buy F1 will dissuade them from trying again in the near future.

Here’s why. All of the above have very lucrative and extensive access to TV and paid-for-view televison rights.

Also known as… a government granted licence. So, from now on, you’ll never hear a bad word mentioned about Saudi Arabia again during any live PGA, EPL, and possibly F1 event.

The House of Saud can do this due to the influence those who hold or control these government granted licences can bring. And don’t expect politicians to step in here either. Take the UK for example.

As you’re aware, Western governments don’t really like Russia much these days. And with a ongoing cold war with China, they aren’t much welcomed nowadays either.

But until last year, London was awash with Russian money. Who will replace that? Oh look, here’s some nice friendly Gulf nation state looking to invest sizable amounts into our country.

Don’t say or do anything that might place that investment in jeapordy.

You might think you won’t fall for all the propaganda you are about to be smothered in from these nation states, but think again. Maybe not after the tenth time you’ve heard it, but maybe the twentieth, thirtieth time perhaps?

Eventually, you’ll no longer care too much and will accept it. Job done.

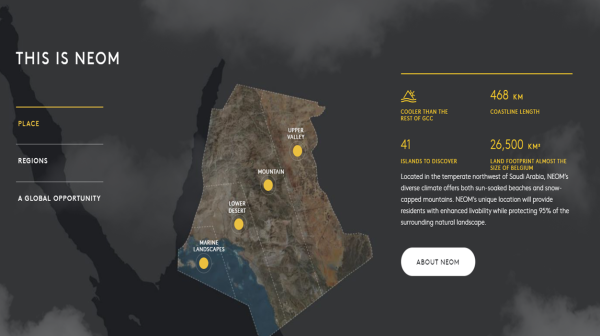

But there’s a lot of money at stake here. Then add in the incredible and outlandish land developments that Saudi Arabia are currently building; need I remind you of this.

Source – neom.com

The current 18.6-year Real Estate Cycle is now well into its second, more speculative stage. Before the decade is over, we shall experience the biggest boom in history, followed by a epic bust the world has never before seen.

At that time, these massive nation state projects will be at extreme risk of failure. Do you “really” think though that nations like Saudi Arabia have any interest in explaining the truth to you?

They will use their sports washing assets to give them the media coverage they need to tell the world that things have never been better! 99% of people will believe them.

Which means they too will see their investments and life irrevocably changed forever. And not in a good way. Only education can set you free of this misinformation.

Start right here via a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in-depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why, even today, it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the real estate cycle – the law of economic rent – and the timing inherent in it.

This is all you need to succeed – to take advantage of the boom, and to stay safe during the inevitable bust.

Soft power and influence are now hallmarks of this particular real estate cycle. Moving forward, clear news on the true state of the world is going to get pushed even further into the margins.

The worse things get, the harder the media companies these states now influence will work to ensure you’ll never know.

But you’ll know better. Because you will possess the timing and the knowledge to outwit them.

That’s how we will help you. We will ensure that no one can pull the wool over your eyes with their propaganda.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.