If you would like to receive weekly updates like this, sign up here.

Inflation. Is. Boring.

There, I said it. Even though it’s proven to be one of the most newsworthy items, honestly who really wants to deep dive into this?

But we are going to. Became it’s important. And I have a different take on a key aspect of it.

News from across the globe recently has focused on the fact peak inflation is behind us and that the headline figures are falling.

Cue talk of central bankers pausing or even cutting interest rates.

But is the inflation problem really behind us?

Not so fast. I want to tell you about the fact that inflation is here to stay.

But it’s not the inflation you may think.

It’s the kind that, should you be on the right side of this trend, will prove very profitable for you over the coming years.

But if you are on the wrong side, it will really damage your financial future.

So, in an environment of falling inflation and possible interest rate pauses or cuts, today I will explain why neither is really the critical point here.

And with luck help you position yourself correctly for the full force of the speculative second half of the 18.6-year Real Estate Cycle.

Let’s take a look.

What does the chart say?

Now inflation has been all over the news for years now.

Here’s the thing: inflation in its broadest sense has always been prevalent during the second half of every preceding 18.6-year Real Estate Cycle till now.

In what form, how much, and how high is of course determined by the prevailing trends one may find themselves in during these times.

For instance, take the 1955-1973 real estate cycle in the US. By the early 1970’s commodity prices were running wild, particularly oil. But there were rising wages and asset prices.

Everyone alive back then remembers the double-digit inflation and interest rates.

What most don’t recall however is the fact it was the final 2-3 years of that particular 18.6-year Real Estate Cycle, and that US land values falling in early 1970’s was the cause of the 1973/74 collapse.

All it needed was a major bank collapse: at the time it was the US National Bank of San Diego.

This was a particularly difficult time for nations battling inflation, but there were an awful lot of macro-economic issues at this time, including the US being deep into the Vietnam war.

So perhaps an example of the worst case, but still important to keep what’s occurring today in the correct context.

That brings us to today. New data is coming out that’s providing some evidence that the peak of the current supply-side inflation has passed us.

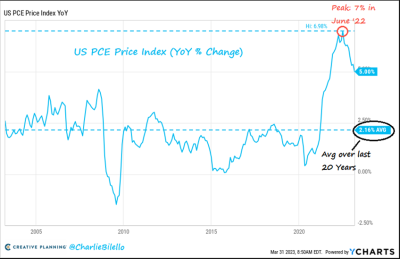

Source – Charlie Bilello/Pete Wargeant

This chart shows the personal consumption expenditure that measures the price for goods and services for people in the US.

Note the high point has been marked in June 2022.

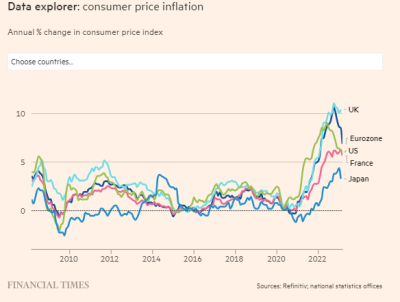

Now from the Financial Times we have a chart showing the change in the consumer price indices for the major economic powerhouses in Europe, US, and Asia.

Source – FT

The main point to note is how closely correlated each colored line is to each other in terms of where they peaked and then the subsequent falls.

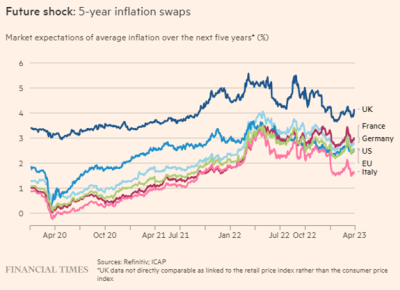

Another chart they provided shows the 5-year expectations of inflation levels for each of the above zones.

Source – FT

It’s quite subjective of course, and the results are hardly binding, but as a rough measure it does indicate that inflation at various levels are here to stay.

Now we can place our real estate cycle lens on. We can say, should history repeat, then higher inflation is expected up to the land market peak at least.

5 years from now and we should be well into the “winners curse” phase of the cycle.

A big narrative was the potential European energy shock as Russia chose to close their energy exports to Europe. Without going into details prompt action by governments to subsidize, find alternative sources of energy and a very mild winter means energy storage across Europe are near historic highs.

One example then of how the supply side inflation inputs have been mediated down.

But to sum up, and I’ve have mentioned this before to you, the fact remains that investors need to understand that above-average inflation is here to stay.

Thus, your investment goals and how you interact with it to boost your portfolio performance needs to take this into consideration.

Cause and effect.

It shouldn’t surprise that the financial media gaze now casts towards central banks and whether they will begin to either pause or even drop their official cash rates.

It has already occurred here in Australia. Generally speaking, global central bank authorities tend to follow the crowd on these things.

It will of course take the US Fed to come out and pause their rate rising campaign to really lay a marker down for global markets.

But there is cause, and then there is effect.

Using interest rates is the bluntest of instruments. As previous real estate cycles show, the primary driver for asset inflation in the second half is always the same.

Easy credit.

Say we have a period of rate rise pauses, and then towards the end of the year maybe a cut or two.

The media will tell you, trumpet it in fact, that this offers proof of the quick and responsible actions of central banks and governments everywhere to break the back of supply side inflation.

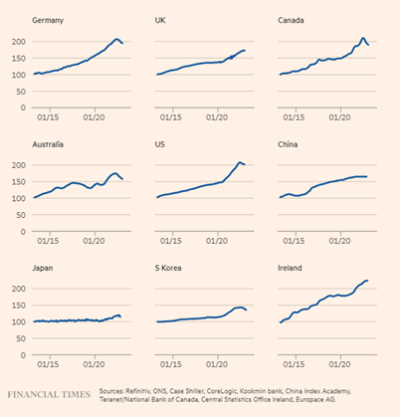

Source – FT

Above is a list of average house prices from 2015 to today. The FT article stated the following.

Another point of concern is asset prices, especially for houses. These soared in many countries during the pandemic, boosted by ultra-loose monetary policy, homeworkers’ desire for more space and government income support schemes.

However, higher mortgage rates are already leading to a significant slowdown in house price growth in many countries.

Again, you can’t ‘really’ argue with that view. Until you overlay the 18.6-year Real Estate Cycle.

Put aside for a moment the fact this slowdown the article refers to is almost nonexistent in some of the charts here. I mean can you even see it on some of them?

The combination of easy credit and paused or declining interest rates does “what” to house prices?

Do I need to spell it out?

Rising land prices are a prime example of asset price inflation. But also, one of the few proven ways to handle the effect inflation has on your investment returns.

Investment property owners will have the rental markets moving ever higher in line with inflation. And don’t expect landlords to drop their rents should interest rates drop.

This rising yield contributes to increasing inflation.

Right when the second more speculative half of the cycle has commenced. And if you take the view that the world is tapped out when it comes to debt, think again.

Here’s yet another fact about inflation you need to consider. From another FT article about high inflation and public finances.

Higher inflation has bolstered advanced economies’ public finances, the IMF said on Monday, as it called on governments to use the windfall to cut deficits.

Research published by the fund showed that the surprise surge in prices over the past couple of years helped lower debt burdens substantially.

According to the IMF’s data, high inflation led the US’s net debt burden to fall from 99 per cent of gross domestic product in 2020 to 95 per cent in 2022, despite the country’s large pandemic-era budget deficits. Italy’s net debt burden fell from 142 per cent of GDP to 135 per cent.

Simply put – the debts don’t matter right now. They will, one day. But that’s in the future.

Let’s put it together. Yes, inflation is a dry topic, very broad in its interpretation and one that can put many people to sleep.

My contention to you is this: inflation, in a different form to what we’ve just lived through, is here to stay. It will affect the investments you need to make.

One of the best performing assets during these times is property.

Can you see now how various drivers are underpinning this trend?

Are you perhaps ready to make the jump into a home of your own, or maybe an investment property or two?

Are you holding back because you are unsure of timing, or the constant barrage of negative news causes confusion right when clear and decisive action can be rewarded in the medium turn?

Start here with a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why even today it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

The expected peak in US land values is only a few years away now.

The window to ‘get-in’ so to speak is still open. And, with the right guidance and knowledge of the inherent timing present in the economy, you can do very well for yourself with an astute buy in a good location.

Allied to the fact you’ll possess one of the great hedges against inflation.

The history of the cycle tells us which trend you need to be on. It is time for credit creation on steroids, in ways and means beyond what’s available now. And I want you on the right side of this trend.

And that’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.