If you would like to receive weekly updates like this, sign up here.

By the time you read this I will have just left Jakarta, the capital of Indonesia on the island of Java.

It’s a fascinating city and one I strongly recommend you visit one day. It truly left its mark on me. But not in the way you may think.

And that’s because, once again, the future was staring me directly in the face.

It’s just so important you understand it too.

I keep looking, watching, and listening for news on this on the TV, radio, and social media. Of course, it’s not mentioned there.

In its place, you simply have more negativity and emotion that is not in your best interest and will lead your investing astray.

Once again, your Property Cycle Investor newsletter will tune out the noise and cut through the mass of negative news to show you what’s truly important to your financial future.

Do you really want to learn how to invest with the real estate cycle?

Are you ready for what I confidently predict will be the greatest boom in our lifetimes.

If so, here’s what you do.

Hidden in plain sight!

Now I’m going to keep shouting this out until I’m blue in the face.

And I will stomp my feet too for good measure.

There exists a hidden order to the economy.

It is all around you and yet, so few see this.

And because they can’t see it, they can’t understand its significance.

I’m really no longer interested in debating this point any longer. Jakarta has proved to my satisfaction what my research has uncovered.

We are in a global construction boom.

And what’s driving it here is government infrastructure projects.

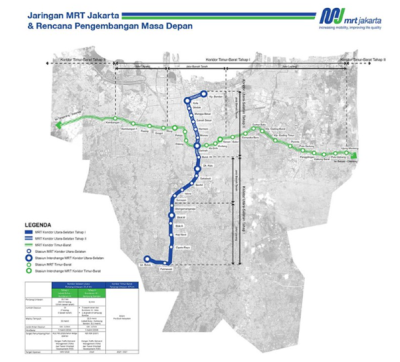

These projects are enormously ambitious in scale. Let me give you a quick breakdown of one of the largest ones around as I got to know it a little bit on my travels: Jakarta’s Mass Rail Transit (MRT) project.

This urban metro will allow commuters to quickly travel from north to south and east to west through Jakarta and surrounding suburbs and bypass the city’s notorious road traffic.

Source – futuresoutheastasia

This system will require 42 railway stations to be constructed.

The MRT is estimated to cost at least US $1.7 billion (including electrical and mechanical systems and the cost of rolling stock) and should be fully completed by 2027. The main owner of the project is the local Jakarta government.

Look at the completion date to finish both stages. Look at the cost, or more correctly, the bank funding required. Any ideas on what’s happened to the value of the land close to each MRT station?

Interestingly, the land acquisition aspect of this project has held things up. This is quite common with rail projects across the globe.

But here’s my point: when your land is set to be acquired to finish a major government project, don’t you think the landowner will hold on for the most attractive price possible?

And do remember that Jakarta is sinking…by about 2 inches a year! This is not a great selling point – normally – unless it’s the government doing the buying.

Take one guess who is winning this argument?

Speaking of sinking, there’s another major project designed to help delay or even stop this inevitability.

Meet the giant sea wall of Jakarta.

Source – kuipercompagnons

The Giant Sea Wall Jakarta is a barrier that is planned to protect the city from the double whammy of rising sea levels from climate change and sinking land due to groundwater depletion.

The proposed seawall will be shaped in the form of a Garuda, the national symbol of Indonesia.

To offset some of the estimated US $40 billion cost, the project will reclaim land and create a new urban area on the wall and on artificial islands. The new city could hold up to 2 million people.

Again, what are the key overlaps with the MRT here?

Massive amounts of credit, land reclamation and a phenomenal increase in land values for those few lucky enough to own the land created.

How would you like your own personal guide that not only unveils the economies “hidden cycles” but also gives you your own “wealth advantage” to make those lifechanging profits? Then keep an eye out in the near future for an exclusive blog written by PSE co-founder & Director Akhil Patel who will explain all!

I’ve spoken about the economy’s “hidden order” in this newsletter. This is a core concept for us at Property Sharemarket Economics.

So how would you like your own personal guide to it?

I am pleased to say that PSE co-Director Akhil Patel has been working behind the scenes on developing just this.

It’s going to be complete guide to the cycle – the economy’s hidden order -with details on how it works and what to do about it.

I have asked Akhil to write a future edition of this newsletter with further details about what he has been working on. Do look out for this. It’s an exciting project he has been working on for over two years!

In a delicious (not really!) irony, the seawall will, in attempting to fix one problem, create another: by keeping the sea water out it means the toxic run-off from canals and rivers which run into the bay will be trapped.

Can you imagine sinking vast sums into reclaimed land to grab an incredible view of the sea and Jakarta skyline but then must contend with that smell in a tropical environment?

This means there is, yet again, battleline’s being drawn between landowners and the government.

But even so, all this pales into insignificance when it comes to this.

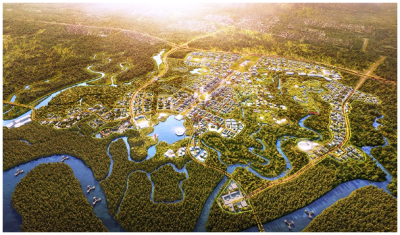

Source – futureofsoutheastasia

Indonesia is planning to move its capital from Jakarta in Java to a new city named Nusantara in East Kalimantan on the island of Borneo. The move is in part to relieve pressure on traffic-clogged Jakarta, which is sinking, polluted and crowded. A new capital city would also be a way of symbolically centralising the government, which is seen as being too Java-centric.

Now, they are not moving all 30 million odd residents to this new city, rather it becomes the self-centered hub of all government departments.

All the projects slated for the residents who live in Jakarta will continue.

My one bit of advice to those charged with designing and building Nusantara: take a lot of bottled water.

Don’t use the underground aquifers again!

This simple truth governs everything.

So, this hidden order for the economy, what precisely do I mean by that?

The past few editions of this newsletter have focused on infrastructure.

I ask you now: do you think blogs about infrastructure spending and the hidden order of the economy are related at all?

Absolutely.

The reasons they are being built, the timing of their start and completion, the money required, all related.

This is the 18.6-year Real Estate Cycle in action, across the world.

And so, this means the various opinions of economists, financial experts, social media spruikers about the endless problems we face currently are simply bull s*#t.

Do not be scared into inaction by their negative reporting on world events. Be confident and assured that the cycle continues to turn globally and know it can help your investment decisions.

I have known personally for years that this rush to build would happen.

When you realize the economy is basically the land market you can forecast what comes next.

Incredible I know, but it’s true.

Everything to do with modern economies must have land at it’s center.

And yet, it’s not taught anymore by mainstream economics. That’s why it is “hidden”.

This obscurity is deliberate, I might add.

Fortunately, you can gain your market edge here, with a membership to the Boom Bust Bulletin (BBB).

It will show you the history of the 18.6-year Real Estate Cycle, help explain to you why it continues to repeat and how you can take this knowledge to better yourself financially.

I am already casting my eyes towards the future to better position myself for what is coming.

No doubt we are right in the middle of a global building frenzy, but do you know what the real estate cycle says we should be expecting next?

I do because I know the natural “order” of the economy.

What an incredible advantage to possess.

Make it yours today.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.