If you would like to receive weekly updates like this, sign up here.

How would like to jump onto an absolute mega-trend that almost no-one has heard off nor seen or heard anything about in the financial media?

Before it does become big news, and everyone piles on!

Now, before you say it, I realize this really does sound like one of those standard marketing spin emails that you spend too much time each day deleting from your inbox.

But I can prove to you that, in fact, no-one has heard about what I’ve written today. Much less actually figured out the possibilities for outsized investment returns.

And here is why.

Its because 99% of people, and for that matter every financial marketing business out there, does not see the world through the lens of the 18.6-year Real Estate Cycle.

It really is your own personal market advantage.

Let me show you.

Follow the money.

Today we visit the exclusive holiday destination of the Maldives.

In 2018, Chinese engineers became the first to link the scattered islands of the Maldives by road, inaugurating the 2km Sinamalé Bridge that arched across the waters separating the capital Malé from its airport.

This bridge was a symbol of Beijing’s multibillion-dollar infrastructure lending program in the Indian Ocean. Now, another regional power is preparing to bankroll its own, even longer, structure in the same area.

India is funding, via loans and grants, the $500m “Greater Malé Connectivity Project”, a 7km bridge linking the capital to several other surrounding islands, in a project run by India’s historic Shapoorji Pallonji Group conglomerate.

This battle of the bridges in the picturesque island chain is one of the clearest examples of a tussle for geopolitical influence between Beijing and New Delhi.

It is quite pathetic if you ask me.

Why do nations spend so much national treasure and take on so much debt in the name of geopolitics?

Maybe it’s just me. But here we are.

What’s basically been behind this project is Indian’s long-awaited response to China’s “Belt and Roads Initiative” (or BRI) across Asia. India has decided to fight China’s infrastructure binge with more infrastructure projects of its own.

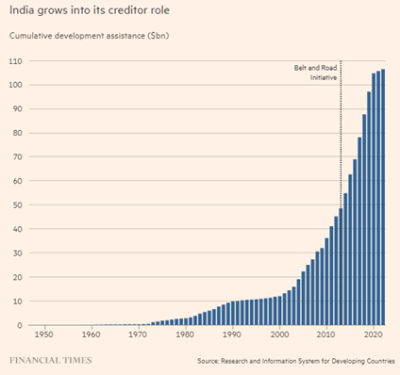

New Delhi has stepped up its efforts in recent years providing tens of billions of dollars in credit to neighbouring countries, including financially distressed BRI-recipients such as Sri Lanka.

Indian companies have also expanded rapidly in the region, providing a counterweight to Chinese commercial activity.

Lending by the Indian government via its Development Partnership Administration has tripled since 2014. This is the money trail you need to start following.

Source: FT

One reason why is this money is building bridges, mosques, cultural centres and even a cement factory in Somalia.

But it’s the ‘who’ rather than the ‘what’ that’s of most interest. Desperate to not feel surrounded by Chinese bankrolled infrastrucutre programs which New Delhi believe could be used by the Chinese military (a correct assumption if recent history is any guide), they have given state-run bank ExIm specific instructions.

And those are to prioritise loans to those nations who have had similar arrangements with China within the last 12 months.

This is according to research by the Aid Data lab at William & Mary College in the United States. They added that this dynamic was even stronger where China had made “public opinion gains relative to India.”

Again, this is schoolyard behavior, isn’t it?

But I digress.

Here’s your takeaway. I’ve outlined above what the Indian government seems committed to do and the amount of credit it’s going to take. Here’s the rub.

It won’t be enough. And that’s why Modi’s cabinet have turned to India’s largest private corporate champions to fulfill this vision.

This combination is already reaping dividends for Modi’s strategy and for many publicly-listed companies.

When Sri Lanka went bankrupt because it ran out of foreign reserves (and after China refused to restructure the terms of the loans it had granted them), India stepped in to help.

It provided bridging loans four times greater than what China was offering – and the price of the loan was two-thirds cheaper as well.

Now India has begun to leverage its influence over Sri Lanka.

Earlier this year, New Delhi won a trio of energy projects in northern Sri Lanka previously held by a Chinese developer, after lobbying the Sri Lanka government against the deal over “security” concerns sparked by its proximity to India’s coast.

And when India’s largest company Adani won important contracts to build road infrastructure the Sri Lankan government was quick to publicly call out its bureaucracy to tell them not to hold Indian-backed projects up.

These Indian companies have been involved in many different projects like cross-country transportation networks across Bangladesh. Why would they do this?

Because this is what they need to trade with these nations. And that trade is revenue, and for those companies listed on the Indian stock exchange, increased earnings.

This partnership is what Modi wants to fully counter China.

India’s ExIm Bank credit generally carries more concessional terms than Chinese loans. India also selects contractors through a competitive bidding process, provided the proceeds purchase Indian goods and services.

The government says these schemes create “jobs, demand for material and machinery in India and also a lot of goodwill”.

But what really matters is the government has the back of India companies like Tata, Larsen & Toubro and the GMR Group, who have all built up significant business abroad.

When credit and infrastructure combine like this, you have a mega-trend

So, once again, we can now use the lens of the 18.6-year Real Estate Cycle to overlay two important trends that symbolize the second more speculative half of the cycle.

Which is precisely where we find ourselves today.

Firstly, the proprietary Property Sharemarket Economics (PSE) property clock is sitting at 1pm (1300). You can access it from the home page of our website here.

This is perfectly in line with a significant global increase in construction projects, particularly infrastructure.

This requires availability and access to ever increasing lines of credit to build all of it. Credit goes hand in hand with infrastructure building.

Without it, nothing would get built.

You can see via our example of India that the whole prospect of success as a creditor of choice sits squarely on the shoulders of those lenders ready to dig deep for the loans and grants the Indian government needs.

I ask you: where at the end of the day will all the gains which manifest from all this credit and building eventually end up?

The answer of course is back into the land itself.

The sad part here is that, whilst the residents of these many Asian countries who depend on this infrastructure to help them live a healthy and productive life, will see very little from these gains.

Those closely connected to governments who find themselves in the envious position of being able to play China and India against each other will have long positioned themselves and their families to benefit.

By privately capturing those same gains at the expense of everyone else.

In recent years, conglomerates such as the Adani Group, run by the world’s third-richest man, Gautam Adani, a vocal advocate for Modi’s government, have expanded into power and infrastructure projects everywhere from Myanmar to Sri Lanka.

Modi’s government “wants to do big stuff and it doesn’t think that the Indian public sector is up to it”, says Kanti Bajpai, a political scientist at the Lee Kuan Yew School of Public Policy in Singapore. “Most Indian businesses are too conservative. It needs an Adani.”

Translation: Those with access to the very top will position themselves front and centre to benefit from lavish government largess while also ensuring that same government removes any and all competition.

This is the world we have created by allowing the banks to own the earth we live on and provide the means for private ownership of what is a natural resource for all.

Be that as it may, it doesn’t mean a little knowledge of how things really work can’t help you with your long-term investment goals.

I’ve shown you today how my knowledge of the real estate cycle has led me to identify long term opportunities that align with my goal of investing with the cycle rather than against it.

Here is where I learnt it: via a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day and the unique opportunities that present themselves as it turns.

I mentioned two important trends this article articulates. The first one was infrastructure and credit creation. I’ve covered that with you.

The second trend is this. It is the emerging markets that outperform most, if not all, first world nations during the second half of every real estate cycle in history.

And you’ve just spent four minutes reading precisely why that is.

Researching publicly listed Indian based (or overseas) companies and banks linked to this Development Partnership Administration, particularly those in the favor of Prime Minister Modis government, stand to increase earnings substantially thanks to this initiative.

It will be the stock charts of selected Indian and overseas listed companies that will be the first to show you these increases in earnings, via a rising stock price.

This will be a mega-trend to follow for the remainder of the decade.

Now is the time to act. Start developing your own market edge to find the best opportunities before they become public knowledge.

And invest with confidence inherent with the timing of the real estate cycle.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.