If you would like to receive weekly updates like this, sign up here.

One area of the world not normally covered by these weekly blogs is the focus of today’s email.

That country is India.

It’s difficult to understate the importance of India in shaping the world for the rest of this century.

And yet, it does appear to share many of the best and worst features of the 18.6-year Real Estate Cycle that those of us who reside in the West have become accustomed to.

So, when I read a recent article about the roll out of 5G across the subcontinent and the benefits for the Indian people and economy in general, I couldn’t help but dig deeper.

And what do you know?

I discovered clues to the question “Will India one day experience its very own 18.6-year Real Estate Cycle?”

It’s a critical question. So, if you reside in India or have intentions to one day diversify your portfolio into emerging markets in the years ahead, the clues I’ve uncovered will go a long way to shaping how you invest there in the future.

Let me show you how one form of behavior, ever present in societies that allow private ownership of public assets, uncovers the future of the Indian economy.

And some ideas on how you could turn such knowledge to your advantage.

Let’s take a look.

Does India’s 5G boom “really” help the people of India?

In retrospect, it’s taken a while to get here.

In September 2017, India’s government formed a task force called 5G India 2020 to push for the “early deployment” of the technology in the country.

The timeline was a shade optimistic. Pandemic-struck 2020 came and went: Prime Minister Narendra Modi launched 5G in India only last month.

With companies targeting last week’s Diwali holiday for their initial rollouts, 5G is the latest battleground where India’s network operators compete to dominate the fast-growing mobile market.

In one way you may think this is overblown. 5G was first introduced to the world years ago.

It’s hardly new today, right?

Besides, I don’t believe I have seen too big a difference on my own mobile phone between using it and the previous generation 4G.

If there is one thing that humans aren’t genetically programmed to notice naturally, it is exponential growth.

Yes, this tech has been around for a while now, but have you ever asked just how prevalent is it?

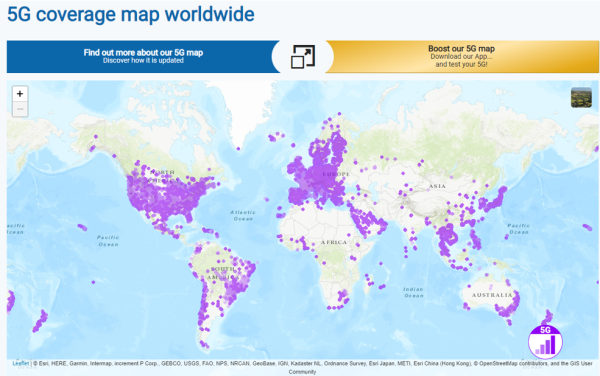

For starters I can see the usual regions highlighted on the above map in purple.

But I also note some glaring holes in that same 5G coverage globally also.

Africa, India, and most of China for one. That’s almost a quarter of the world’s population!

So, I would suggest that this tech trend has hardly begun.

However, there are things afoot in India right now which could indeed signal that the exponential growth curve to really start heading higher.

The real fight for 5G supremacy in India began back in 2016 when billionaire Mukesh Ambani’s phone network company Jio jumped in to capture much of India’s data.

By targeting the networks via huge investment in their infrastructure, much of India’s prior fragmented mobile data providers were ruthlessly cast aside or forced to consolidate.

It is safe to say it’s a two-horse race now. Jio owns 36 percent of the market while rival Bharti Airtel owns 32 percent.

The key to this though is what’s rarely mentioned.

It is something I always look for though when I read or hear about things like this.

It is a hallmark of the 18.6-year Real Estate Cycle. Part symptomatic of and part responsible for the actual real estate cycle itself.

India is hungry for data. According to Reliance, Jio has more than 420m mobile broadband subscribers who each gobble up 20GB of broadband data every month.

That’s well above the global monthly average consumption of 12GB, according to communications equipment maker Ericsson, which says India has the second highest data traffic per smartphone in the world.

If I ran Jio and I’ve just spent the best part of $48 billion over the last 5 years to own critical infrastructure nodes, I’d be keen on seeing a return on that investment.

Believe it or not, to make billions, you need to spend billions.

Source: FT

Source: FT

That’s right, it’s that old government granted license chestnut again.

By bidding for what in essence is natural resource (radio spectrum), companies like Jio can now turn such a resource into a virtual monopoly.

And because it was the government who decided who won the bidding, they will be expected to stand up and protect said licenses against any outside competition.

This is precisely what Jio has paid for after all.

I don’t ever recall the Indian government, or any government for that matter, ever asking its citizens if it could do this.

And yet here we are.

By allowing the banks and governments to effectively own the earth in this manner, we are all the poorer for it.

Because we now must pay for what nature provided us all for nothing.

But for Jio and its investors, it equates to over 400 million subscribers. This is a huge number.

But what’s in this for the government?

Narendra Modi’s government has credited itself with fostering competition in the telecoms sector as part of a broader agenda of bringing down India’s business costs and making services more affordable for poorer residents.

And with only 40mn of the countries estimated 700mn handsets 5G enabled, it is hoped widespread adoption of this tech will drive prices down and make access to 5G more assessable.

And with it drive the economy to new heights thanks to the promise of more efficient and innovative business practices.

And it’s here the real estate cycle really does kick into proceedings.

At the end of the day, it all comes back to the land.

The true key to unlocking the full spectrum of 5G is not what you may think.

It’s actually land.

And access to the right locations to provide full and proper coverage without encountering one of the main stumbling blocks for this service.

Proximity to service networks and the effect this has on spectrum and bandwidth remain the key hurdle to overcome. 5G’s frequency can only travel so far. And in urban and built-up areas there are plenty of obstructions those bandwidths need to overcome to deliver the expected service.

To fix this, more infrastructure will be required. Not only that but it will need to be built quite close to each other which risks backlash from residents who may not want multiple antennae towers every few blocks away from where they reside.

The problem, though, is that this is precisely what we are going to get. Why?

Because the sheer cost of having the government granting that spectrum licence means thatregardless of whether it’s good tech or not, we will be stuck with it.

You can’t come up with a better idea or new technology that can surpass what 5G promises now because the government won’t let you.

Great, so it seems that at the end of the day no-one is a winner?

Oh yes there is. It’s the landlord.

Because of all the investment, the efficiency that does eventuate from the mass adoption of this tech, once it manifests all the gains will be absorbed by the land.

My advice to our Indian readers: don’t worry about a cheap 5G handset, buy yourself some land.

And here’s some more advice, grab yourself a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this very day and guide you to the best opportunities as they present themselves.

It’s my knowledge of the land market that tells me how I stand to benefit should telco companies ever decide they need my land for one of these 5G towers.

Even better, take advantage of listed companies that have a government granted license. If this current cycle repeats like all the rest, then emerging markets like India are about to outperform all others.

You can look for companies that benefit from barriers to entry, guaranteeing profits. Or look for those companies listed on the Indian stock exchange contracted to maintain and service the multitude of 5G towers that Jio promise to roll out.

I can also use the timing of the real estate cycle peak to protect my profits and exit too.

This is the type of insights and guidance the Boom Bust Bulletin can provide.

Grab your market edge today.

Sign up now.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.