If you would like to receive weekly updates like this, sign up here.

I recently read an interesting article from the UK based Financial Times.

It was centered around the future near-term prospects of UK economic growth given that the International Monetary Fund (IMF) downgraded its forecast for the country.

From “the fastest growing economy in the G7” per the Prime Minister Boris Johnson’s proclamation of an expected growth rate of 3.7% this year, to the IMFs projection for next year of 1.7%.

The IMF’s view is that “consumption is projected to be weaker than expected as inflation erodes real disposable income.”

Ah, inflation.

Something every developed country is battling against.

What I’d like to talk about today is to why the IMF has such a dim view for UK growth next year.

And to demonstrate how a little knowledge can take you a long way.

Let’s take a look.

Does the UK have a growth problem?

So here’s the rub.

Not only do they see rising inflation, war in Europe and weaker economic growth, but the IMF also points out the inevitable raising of interest rates by the Bank of England to combat said inflation will cool down investment by business.

Now before I ask you to, once again, view this through your real estate cycle lens, there are a few simple truths to call out here.

For starters, this current conflict in Ukraine is an exceptional event, not something that countries in Europe need to expect every few years.

Neither is a one in 100-year global pandemic that caused so much havoc across the world’s logistical and supply chains.

So, for me, I believe it’s prudent to consider these events as true one-offs.

But these events also prevent one from understanding the more systemic reasons for below average growth in the UK.

The inability of the UK to start and then sustain average to above average economic growth has been elusive ever since the so-called global financial crisis.

The government response to the crisis was years of austerity measures which in hindsight exacerbated the damage caused by the crisis, instead of launching the UK economy into a new regime of growth and prosperity (as the government at the time thought they would).

Plus, the UK didn’t have a large tax base to draw upon.

Then we had the emotional Brexit vote which, according to think-tank the Centre for European Reform, has resulted in UK trade in goods dropping by 15%.

Given that recent history being able to achieve a growth rate of up to 3.7% in 2022 is quite the accomplishment.

However, like most countries around the world, the incredible amount of stimulus injected into economies to keep them going whilst humanity was locked away for most of 2020 has without doubt contributed to this outlier.

Another concern moving forward is the planned UK corporate tax rate hikes. This could make the country less attractive to overseas flows of funds and innovative companies from setting up on UK soil.

The obvious questions is: what happens next?

When push comes to shove, this is what every government does.

Got those real estate cycle lens ready now?

So, we can suggest that this corporate tax rate “could” be voted on and reduced.

It’s possible.

But I’ve got another theory.

And I believe it’s on point.

If you want business investment, start building infrastructure.

It is the ultimate playbook for governments everywhere who either need to be re-elected or striving to be elected.

And this is precisely what will occur now in the UK.

And that’s because, thanks to my knowledge of the 200-year history of the real estate cycle, this time right now is exactly when these type of projects either begin or get announced.

You can start with the Thames Tideway, a huge new underground sewer system.

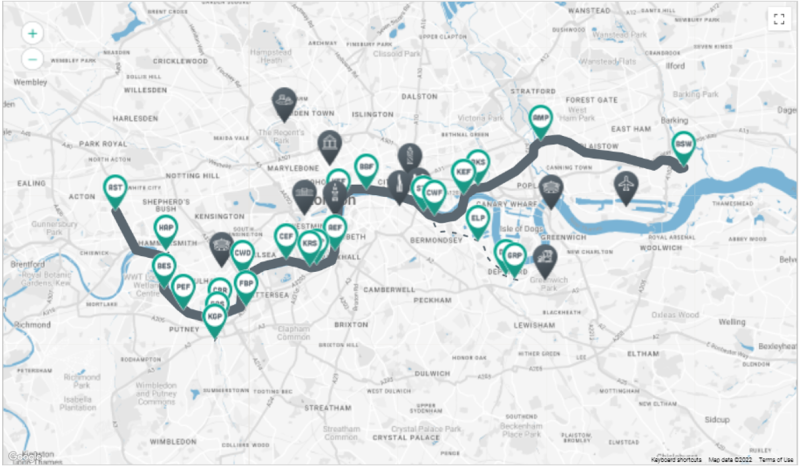

Here is a map of the 25km (about 15.53 mi) of new sewer system to give you an idea of the extent of the construction required.

Source: Tideway

Source: Tideway

It provides a nice idea of the intricacies of digging and building under and alongside the river Thames.

Next, is the HS2 railway link.

This is a brand-new high-speed rail network built in phases, beginning with the London to West-Midland’s route.

Phase One of HS2 will see a new high speed railway line constructed from London to the West Midlands, where it will re-join the existing West Coast Mainline. Services will travel onwards to places like Manchester, Glasgow, Liverpool, Preston and Wigan. Phase One will open between 2029 and 2033.

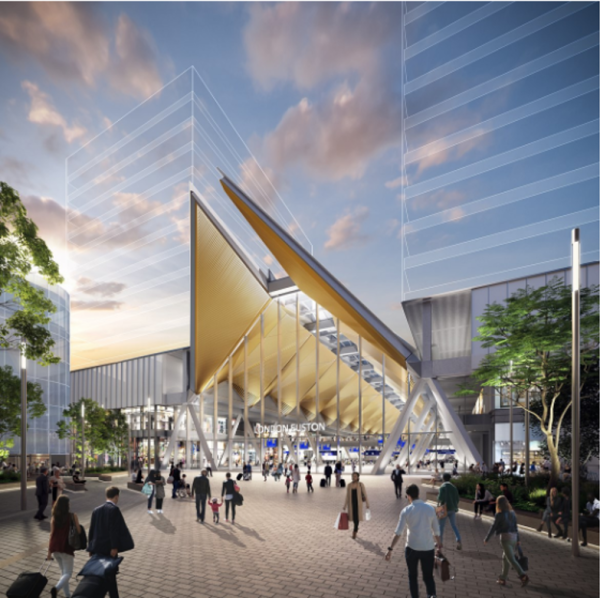

The designs for what the stations will look like are most impressive too.

Source: Media city

Source: Media city

This project will, once completed circa 2029-30, link up the south of England with the midlands and north of the country.

It will be rolled out over three separate phases.

Then there is the Hinkley nuclear reactor in the South West UK and associated power distribution network.

As part of this, around 8km of the network will be built underground to remove more than 90 pylons.

That’s just for starters, I could easily list other such massive infrastructure projects either beginning or proposed in the UK, like the Stonehenge tunnel.

This is how the UK government will attempt to create the economic growth the UK needs as it emerges from both Brexit and the Covid related lockdowns.

Not just that, but the last 200 years of real estate cycle history proves it!

At this exact time of each preceding real estate cycle, the world undergoes a massive building boom. And it is led by government via their myriad of infrastructure projects.

But something else occurs too.

An unintended consequence (although I’m beginning to doubt this is quite so “unintended”!) of this boom are the enormous unearned gains that manifest in the price of land.

This is what attracts the speculators and distorts the credit creation of the banks away from the productive parts of the economy into utter speculation in the land and stock markets.

This is what will drive the cycle to its absolute peak later in the decade.

Now we know what’s coming, it’s time to decide if you and your family would like to stake your own small claim of the billions worth of gains these projects will produce.

If so, then you need to know where to start.

Here’s my suggestion – a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat even after 200 years and help guide you to the many opportunities it presents as the cycle turns.

There will be many different ways you can take advantage of the myriad of building projects that are upcoming.

But that also means there’s plenty of ways to get your timing wrong and end up missing out.

Don’t be one of those; take your education to the next level and let the 18.6-year Real Estate Cycle guide you to the right investment decisions and more crucially at the correct time.

Sign up now.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.