If you would like to receive weekly updates like this, sign up here.

I feel confident now to say that the results are now in.

At least from an Australian point of view, although it’s beginning to look similar in other markets like the US and the UK.

And what a ‘trend’ this was supposed to be too.

One of the real turning points from the 2020 COVID lock downs.

I’m talking of course about the trend of internal migration.

One which saw tens of thousands turn their back on city living and migrate away to more regional areas.

Well, the results are in. And it all turned out to be nothing but hot air!

Yes, there were a few winners here in Australia like the Northern Territory which witnessed record numbers on migrants.

But overall? The numbers suggest it was more business as usual than a new megatrend.

Read on now as we explore the results of a recent ABS survey.

After all, if COVID wasn’t responsible for this migration trend in Australia, it most definitely isn’t responsible for the same trends overseas either.

What’s the net result?

Here’s a fun fact about internal migration that almost everybody misses. At least from what I’ve been reading on the subject.

Measuring internal migration is a net result.

That is, for every person arriving at a regional area, there is one person leaving that same regional area too.

So, unless you know how a regional area can make 10s of thousands of new homes in a matter of weeks, it cannot be any other way than this.

Established homes are almost the only option for new arrivals to either rent or buy in a regional area.

It means those same established homes need their former owners to move somewhere else.

Across the globe this trend has been placed at the feet of the millennials.

Mostly city dwelling, with no lasting roots to their community.

As most of them have no children, it’s quite easy for them to simply pack their belongings and move somewhere else.

It is estimated in Australia, over 15,000 of these millennials called a regional city their new home during the COVID lockdowns here.

Interestingly, a similar number of millennials who did call a regional city or town home couldn’t move due to the COVID restrictions themselves and so stayed put.

One of the most important factors behind this however was the fact that most office workers were now allowed to work their normal shifts from home.

Therefore, there was little need at the time to stay within the combines of a city to attend work.

For these workers, you could literally live anywhere so long as you had a computer and Internet access.

Now, I’m aware that many of you reading this blog today are property investors, or indeed have a desire to become one.

So, you’d have been intimately familiar with reading pieces like the one below.

Source: Different Website

Source: Different Website

In fact, perhaps you did end up buying a regional investment property based solely on this trend continuing.

And on the surface, I couldn’t blame you.

Some of these regional cities and towns offered a fantastic yield on your investment with strong rent and long leases.

And a group of tenants who are all employed full-time with high paying jobs in the city also became an additional attraction for investors.

However, all is not as it seems on the surface.

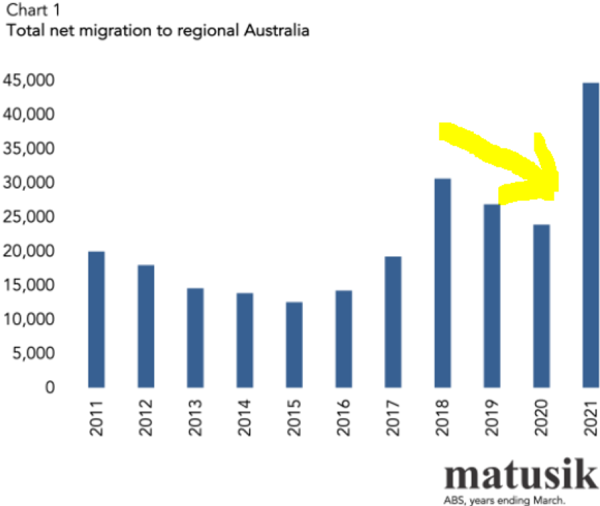

Because according to the table below, net migration to these cities had been falling for the previous few years.

Source: Matusik

Source: Matusik

It was only during the height of the COVID lockdown in 2021 that saw a massive spike in numbers.

So, if you brought in because of these types of numbers, you aren’t going to enjoy what I’m about to tell you.

You must develop this edge over the market yourself.

We are now witnessing the gradual unwinding of COVID lockdown era rules.

This means that right now, across the world, most of those city dwelling workers who migrated away from cities are now being asked, even if it’s only part time, to return to their work offices.

Which means for these same millennials their biggest issue now is the time spent traveling to and from their new regional homes to their old city offices.

And once part time becomes full time back at their office, the amount of time and money spent travelling simply becomes uneconomical to continue.

Consider now that the average price per liter for fuel in Australia exceeds $2, this could very quickly become a stampede back into the city.

Then there are those older regional residents who decided to move away. It was this cohort who sold their homes to many of these newly arrived millennials.

For them, the act of moving was the complete opposite experience.

They did have large and embedded roots to these towns, and they don’t have the necessary disposable income to simply move back to them when it pleases.

When they move, it’s for good.

So, you see, what the real trend is now, it is back to normal!

We can now expect that graph from Matusik to fall back into the trend first seen from 2018 to 2020.

How’s that regional investment property looking now?

In amongst all the noise and real estate propaganda that we were all bombarded with during those COVID lockdown years hid a simple truth.

One that, had you prior knowledge of the 18.6-year Real Estate Cycle, you would already have been familiar with and, most importantly, learnt to trust.

Indeed, you could have made a very important decision based on it.

And here it is.

Most young people who live in these regional towns were not allowed to move to the big city due to the COVID lockdowns.

Recall I said that internal migration is a net result?

This is why migration numbers to regional towns went up. Because those residents already living there couldn’t move even if they wanted to!

Thanks to a government mandate, simply add new arrivals onto those who can’t move = BIG INTERNAL MIGRATION NUMBERS.

It was a complete fabrication.

And now, thanks to the same dynamic, those net numbers will now fall, hard.

All those young people can now finally resume the actual trend expected at this stage of the cycle and move away.

And likely any investment made there based on this apparent “trend”.

Incredible to think what a little knowledge can provide you with and how easily it can cut through the noise to the heart of the matter.

Here’s how you do it; become a member of the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat (very pertinent in this case!) and show you the types of opportunities it presents as it turns.

Believe it or not, this migration pattern between city to regional area happens every 20 or so years.

With the knowledge of the real estate cycle, you would have already understood this truth and seen through the noise at the time to make better investment decisions.

I hate to say it, but an investment into these regional areas likely isn’t one of those better decisions one could have made.

Let the Boom Bust Bulletin teach you exactly what and where the real opportunities are for the rest of the decade.

And for the cost of a takeaway coffee a week!

Amazing value.

Sign up now.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.