If you would like to receive weekly updates like this, sign up here.

I wrote to you last week to bring to your attention one of the more impactful Boom Bust Bulletin (BBB) we have written.

And why it was so timely to read it.

The 18.6-year Real Estate Cycle is about to go into overdrive.

History shows us as much.

But what really powers it is the actions of the banks and their credit creation.

So, to really exploit this knowledge, you need to know what money creation is in the 21st century and ultimately where this credit ends up going and why.

Adding the study of the land market to this as well is the key to timing both the real estate peak and the peak of the stock market as well.

How amazing would knowing both be for your own personal investment goals.

The timing though is important. Things are set up to go way over the top for the rest of the decade.

Which means of course, the emotions involved will also increase.

One part of successful long-term investing is the emotional intelligence you apply to your decision making.

A clear and concise focus is paramount.

Now is the time to move ahead of the herd and future-proof your investment goals by leveraging over 200 years of real estate cycle history.

And there is no better way to start than by re-introducing PSE Director and co-founder Akhil Patel.

Akhil was my guest editor on the February edition of the BBB, entitled; “The true secret to money creation revealed”.

Last week I gave you exclusive access to some of his insights from that edition.

So overwhelming was the feedback from that blog that I’ve decided to provide even more of Akhil’s writing from that edition about how credit is created and how debts end up spiraling out of control.

Plus, a very special offer at the end for you to consider.

Without further ado, here is Akhil.

—————

Banks create money.

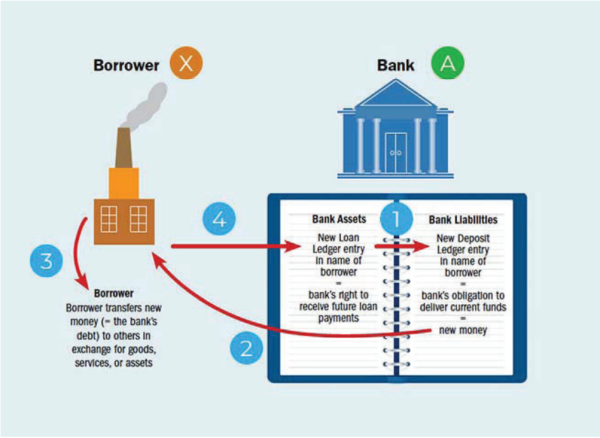

To understand this better [i.e. how banks create money], you need to see what happens on the balance sheet of a bank from an accounting point of view. Forgive me if this seems a bit dry but it’s really quite simple.

When a bank makes a loan, it records the asset, the loan, on its balance sheet.

Because balance sheets must balance, it also records a liability, the proceeds of the loan, which are typically deposited in the borrower’s bank account.

Here is a simplified illustration: the balance sheet of a bank, on the left side its assets and the right side its liabilities.

Note that the illustration comes from the International Monetary Fund – which is the “lender of last resort” to the world’s financial system.

In other words, hardly an illustration that has been made up

Figure 3. The bank’s balance sheet after a loan has been extended to a borrower

Source: International Monetary Fund

Borrower X needs a loan (let’s say, $100) and so applies to Bank A for a loan.

If approved, Bank A will record $100 (a new loan) on the asset side of its balance sheet.

As this is a deposit that the borrower can use it is recorded as a bank liability (or new deposit) of $100 (arrow #1).

To a bank a loan is an asset as it generates economic value. Bank A then credits Borrower X’s account with $100 (arrow #2).

Where did the original money come from for Bank A to make the loan to borrower X? From thin air. Or, perhaps to be more accurate, from the stroke of a banker’s pen of the click of a mouse.

It didn’t exist until Bank A made the loan. And once the deposit is available for Borrower X it will be spent into the economy.

The borrower will use that to buy something from someone (arrow #3) who will then deposit that in another bank account.

The bank then receives loan repayments (arrow #4) which explains why the loan becomes an asset for the bank.

We then end up with all this money circulating around the economy as a means of exchange that whenever people are doing business with each other.

The alchemists of the Middle Ages searched high and low for the magic substance that might create gold out of base metals. This was the study of alchemy.

The modern banking system can create gold (money) out of nothing.

Banks create around 90 per cent of the money in the economy. The rest of the money is created by the government (including the central bank).

This latter point has become a big issue in recent months. We are told that governments have printed their way out of the crisis, i.e., printed money.

And now we will get inflation, unless they stop doing it.

But how can this be true? Money is printed all the time, mostly by commercial banks. I will explain how inflation fits in below.

When someone repays a loan to a commercial bank, the opposite of money creation happens: money destruction.

Since loans are being taken out and repaid all the time, the amount of money supplied by banks to an economy expands and contracts – like a beating heart expanding and contracting as it pumps blood around the body.

Money – bank credit – is the lifeblood of the economic system.

You may be worried by this sleight of hand. But this is how it should be.

It is the reason why we have, collectively, created economies of vast sophistication and wonder. Most of us have a standard of living that in absolute terms far surpasses that enjoyed by all of the kings and queens in history.

And it is because of how we can finance production and exchange.

This view of money almost defies belief or, as the public intellectual, J.K. Galbraith, once famously remarked, “The process by which money is created is so simple the mind is repelled.”

Why debts spiral out of “control”.

So where do problems arise? It’s not money printing per se that is the problem: it’s what is done with the printed money that is key.

As long as bank money creation supports the production and exchange of goods and services in a competitive economy, it is not inflationary in the slightest.

More money is needed because there is more production taking place. Inflation occurs when money is introduced into the economy without a corresponding expansion in goods and services.

In this scenario, you have more money chasing the available goods and services and so prices must rise as a result.

And how might this happen? The answer lies in the property market. Bank lending helps people pay for ever more expensive housing.

In this case, high house (land) prices do not imply a bigger economy. More money in the economy means more inflation.

In our economies – certainly in the Anglo-Saxon ones – most of the money created by the banking system goes towards mortgages so that people can buy property.

In fact, the more banks lend the higher prices go and so it feeds in on itself. High private sector debt is a bad thing if it grows more quickly than GDP (a clear sign it is being used to buy and sell property as opposed to productive credit).

That’s what we should worry about. The level of public sector debt is mostly irrelevant, at least for economies like the US, UK and Australia – which is probably why so much attention is paid to it in the media.

The important point: debt levels and the increase in land values are intrinsically linked (and grow together).

This process is highly lucrative for banks. They earn interest on the capitalized price of land. And as land is not destroyed, they can create money against land over and over.

Eventually the land cycle must peak and when it turns down banks find not only do they have no further business opportunities but the collateral against which all that money was lent is reducing in value.

They become insolvent and need rescuing.

The aftermath of the real estate cycle sees a standard bag of tricks opened to bail out banks:

- Inject liquidity into the system to prevent a run on the banks

- Take on non-performing (“toxic”) loans into the public sector

- Reduce interest rates to prevent a collapse in or support asset values

- Introduce measures to stimulate lending, which turns into more property lending.

The effect of these measures is a major increase in public debt. And to make up for it government reduces public spending on services that the least advantaged in society rely on. No wonder there is a lot of anger in the aftermath of a crisis.

But that’s to come at the end of the cycle after 2026.

————-

As a valued member of our free blog, you are always welcome to upgrade to our full Property Share market Economics (PSE) membership.

We will be covering in much more depth with our members over the next few years the importance of the banking systems as we approach the land market peak sometime after 2026.

If you want to experience how PSE members have benefitted from PSE research and would like to receive what PSE will do for our members in 2022, then I’ve an offer for you.

For 1 week only you can become a PSE member for the one-off price of $576USD for the first year.

That’s a 20% discount off our already discounted first year offer of $720USD.

Use the following coupon in the PSE cart to take advantage.

2022-newsub-20

Not only will you gain access to our world leading cycles and real estate research but a whole host of new additions to your membership starting this year.

This research will now include;

- Regular video blogs to members and exclusive invites to future webinars with the team.

- Our brand-new Grand investment cycles document and the ‘Book of cycles’ which compliments this research via an easy-to-read roadmap that visually fits all these cycles together.

- Exclusive access to our 2022 market forecasts via our stock market roadmap for the US, UK and Australian markets and commodity markets.

- A brand-new indicators page with quarterly updates, assisting us with our investment decisions and timing as we navigate the 2nd half of the cycle.

- Our brand new watchlist service covering the very best REIT, Bank, and commodity stocks (plus further sectors in the future) along with expert analysis on the best entry method should you wish to invest.

- PSE Director Philip J Anderson’s ongoing commentary and analysis on the work of W.D. Gann, one of history’s greatest traders.

As the release of our various stock watchlists are showing, now is the time to enter the market to take full advantage of the cycle turning.

Every day you delay the chance to profit diminishes.

Join us and let our world leading research guide you through to the eventual land market peak around 2026.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.