If you would like to receive weekly updates like this, sign up here.

It’s rare that I find a subject that encapsulates two of the most important concepts in our lives and melds them together.

And yet you can be forgiven for taking what is said at face value and genuinely believing this is a ‘Heaven on Earth’ moment.

How do the below italicized comments make you feel when you read them?

“IEG harnesses the very market forces that have intensified many social and environmental problems to instead create abundance, resilience…these assets are essential, making life on Earth possible and enjoyable.

They include biological systems that provide clean air, water, foods, medicines, a stable climate, human health, and societal potential.

We can tap this store of wealth and productivity to protect and grow nature and to transform our economy to one that is more equitable, resilient, and sustainable. The IEG toolset connects our social values with economic and ecological realities.”

This is how IEG (Intrinsic Exchange Group) explained its pioneering new asset class based on nature and the benefits that nature provides (termed an Ecosystem services)

Are you not compelled to discover what this is?

Does it read as a way to ensure a sustainable and ‘green’ future for us all to leave our kids?

Indulge me for a moment as I share the two words I feel best sum up my opinion.

Abhorrent and disgusted.

I will now lay out the reasons to you why this could be one of the most compelling investment cases this decade.

And why you should feel utter contempt for getting involved.

Intrigued yet? Read on.

Natural Asset Company

From the off, this is a brand-new investment fund.

So, what is this exactly?

In 2021, IEG began seeking regulatory approval to bring the first natural asset transactions to the capital markets.

They presented this as using carbon capture, soil fertility and water purification (amongst others) companies and rolling these into a new form of corporation called a Natural Asset Company.

IEG will liaise with the New York Stock Exchange (NYSE) to list these types of companies into something that’s tradable.

Now, if you have any prior experience with these types of companies, you’ll know that although they are all different, they do all share one thing in common.

More on this in a moment.

The idea is to list these initial tranches of Natural Asset Companies this year with a view to bring hundreds more to market via the same path.

So, you are looking at natural resources as diverse as climate stabilization, freshwater production, groundwater storage, erosion prevention, pollination, pest control, natural fertility from healthy soil etc.

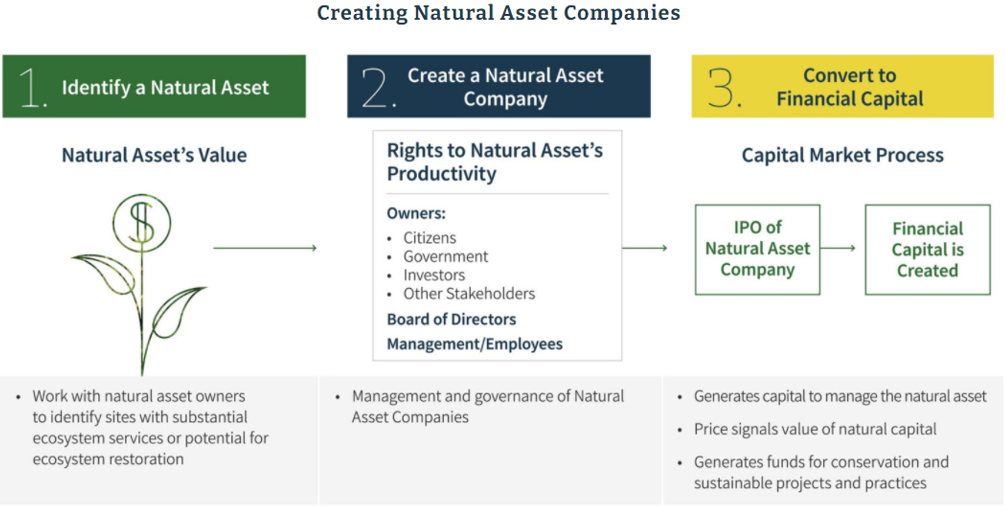

In effect, IEG works as a broker or middleman to facilitate the transfer. You can see this process via the image below.

You know I’ll be perfectly honest with you.

Even a few years ago I would have looked at the Intrinsic exchange website and figured that this was simply another way for Wall Street to make easy money for those on the inside.

But that was then.

Today, thanks to my knowledge of the 18.6-year Real Estate Cycle and its history, I can see right through the marketing spin plastered all over its website to the heart of this issue.

I can see the incredible opportunity this brokerage outfit have uncovered.

You may agree and decide to invest in these once listed. And I couldn’t blame you at face value.

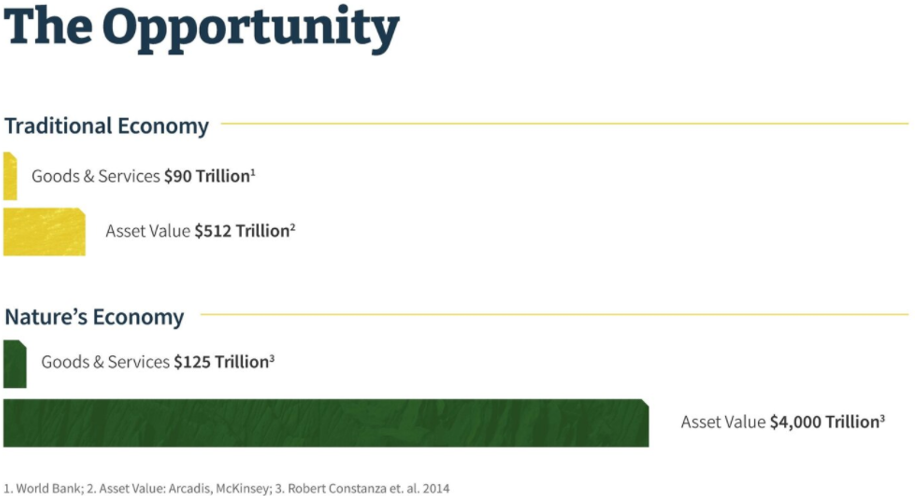

I mean, look at this apparent addressable market for this type of asset.

Add in the fact that land markets around the world are years away from peaking and the unleashing of credit that awaits the world, it now becomes an absolute home-run hit.

One that with no hyperbole could literally change your investing life.

Let me now explain what this will cost you, in fact all of us.

The ends do not justify the means.

I mentioned the type of companies that IEG is targeting for this listing have something in common with each other?

Almost all of them will be incorporated via a government granted licence.

I have spoken to you about these in previous blogs.

This is the way that IEG intends to capture the value of these companies per the below, from their website.

- Natural Asset Company: A corporate structure designed to hold the rights to and manage the Ecological Performance of natural assets, e.g., the productivity and health of natural assets.

This structure will lock out competition and means the enduring rights to what is naturally created is now privatised.

Look again at the addressable market. Can you see how this takes everything on earth and hands it to a select few on Wall Steet?

This has absolutely nothing to do with sustainable growth, reducing inequality and taking care of precious resources.

THIS IS YET ANOTHER LAND GRAB.

Only at a level never seen in history.

And I guarantee you one thing; this style of investment will fully exploit the economic rent that land naturally generates and allow massive credit creation against it.

All to enrich the few who own these assets at the expense of just about everyone on earth.

Don’t believe me? Look again at the website.

IEG converts natural asset value to financial capital.

This is how the financial world will one day own the earth we live on.

Imagine now the amount of lending this type of collateral will generate?

This is the tip of the iceberg.

The returns that IEG should experience in their first full year of listing will mean a mad rush to copy this model so other investment houses aren’t witnessing their own clients leave for them.

We seem intent on not leaving anything of the earth’s natural beauty to our children.

As an investor, you then must make a choice.

Invest your hard-earned capital into these new IEG Natural Asset Companies or take a stance and decide its not worth pulling the land upon which we live on from under yourselves and handing it to the financial system and the banks.

What should you do? Either decision will affect the future for you financially.

I suggest educating yourself to a level where this type of behaviour is fully understood, and you have the courage of your convictions to make the right choices.

You can do this by a membership to the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day and guide you to the best opportunities for you to benefit yourself and your family.

The value of the earths natural resources should be captured and enjoyed by all.

If you disagree though, then this IEG product is for you.

It’s a tough choice alright.

Time to get educated and arm yourself with the knowledge you need to make such decisions.

All for $4USD a month, that’s a couple of takeout coffees a week.

Incredible value!

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.