If you would like to receive weekly updates like this, sign up here.

“We’re witnessing sections of society being shut out of parts of our city because they can no longer afford apartments,” Berlin Mayor Michael Mueller says. “That’s the case in London, in Paris, in Rome, and now unfortunately increasingly in Berlin.”

Wow, sounds bleak, doesn’t it?

The above quote was from a recent Bloomberg article (see below).

Source – Bloomberg

Source – Bloomberg

As one keeps reading, things continue to deteriorate.

I noted a quote from an Australian resident who is a medical doctor in the metropolitan Melbourne CBD.

He claims he is facing the reality of moving to a regional area simply to afford the rent.

While he acknowledges that once he becomes a specialist, he may well be able to afford to buy a home in Melbourne, he doesn’t hold back when explaining the chances of such for his non-doctor friends.

“… they have no chance of ever owning a home. My generation will be the first one in Australia that will be renting for the rest of their lives…”

Wow. Given Australia’s obsession with owning property, that’s a hard-hitting sentence.

And just to rub salt into the wound, news out of China seems to mark a tipping point.

Source – AFR

Source – AFR

I have spoken recently to you about emotional headlines.

And the kind of response they are designed to get from you.

Therefore, I have been motivated to provide you today a simple yet powerful way to best deal with news like that above.

Because, as the saying goes, there really is nothing new under the sun.

We all need this right now.

It’s called ‘perspective’.

An ability to interpret relationships between ideas and facts both past and present.

Personally, I call it my real estate cycle lenses.

It leads me to question headlines like the above this way: “Has this ever happened before in history? And if so, what was the outcome?”

I guarantee you will be told what the authors ‘opinion’ of what will happen in these types of stories.

But how closely related is that same opinion to the facts present within histories version of events?

Let’s look.

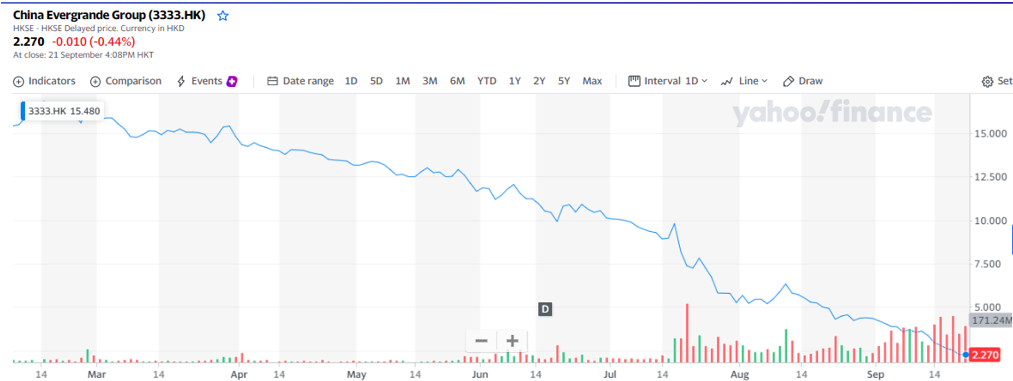

So Evergrande is in the news. And once again some of the news surrounding it and the cataclysmic damage it might unleash across the world is emotionally driven.

In case you didn’t know, Evergrande is China’s second biggest property developer, and is rumored to be the world’s most indebted developer.

The big driver of news is that, by the time you read this, it will need to have made good on a US $83 billion corporate interest bond payment.

So that’s the background, but I ask you, does this deserve such a write up from a recent ABC News article in Australia, below?

“For the first time since the collapse of Lehman Brothers in late 2008, there is a serious risk of global financial contagion.

That is, there is a possibility that investors, en masse, will withdraw their cash from major institutions around the world and those banks in turn will not be able to meet their own funding or lending obligations. It’s colloquially known as a “credit crunch”.

If that ensues, much economic activity will grind to a halt and unemployment will spike. You end up in a deep global recession, as happened during the global financial crisis of 2008, after Lehman Brothers collapsed.

This week we could see a development that has the potential to spark such a series of events.”

Oh dear, such sweeping lazy comparisons. Designed to make you read the rest of the article, yes?

Time for some perspective.

Does this chart look to you like it’s been completely caught off guard by these looming bond defaults?

Of course not! The insiders have known about this for all of 2021 and have discounted this news into the price. I’d say, the risk of shareholders potentially being wiped out has already occurred.

Ever heard of Enron?

20 years ago, this very month in fact, its stock chart looked very much the same as Evergrande’s.

Source – The New York Times

Source – The New York Times

“SOMETHING is rotten with the state of Enron.

Or so Wall Street suspects. On Jan. 1, shares in Enron, the giant energy trading company in Houston, stood at $83.13. On Friday, Enron closed at $31.57, down 9.7 percent for the week and 62 percent for the year. The slide has destroyed more than $38 billion in shareholder value.”

Enron was a US based energy company based in Houston Texas. It had deep connections with the then US president George W Bush and his family, along with then defence secretary Dick Cheney.

By October 2001, when the full extent of its credit rating became public, Enron became the biggest bankruptcy and the largest audit failure in the history of the country.

Though it was, a few months later, eclipsed by an even bigger one: the WorldCom scandal.

“Hello property share market. Just wanted to say I think your literature is spot on and I’m excited to absorb everything you have to offer.” – Carl

I recall this event. It truly was huge news when this broke.

Much like today, the absolute worst outcome was the only angle allowed as news media rushed to outdo one another on the likely damage and fallout.

Sound familiar?

Here’s something I didn’t know back then that I do now.

The timing of both Enron and Evergrande isn’t a coincidence!

In fact, you could have known this was coming years before it happened.

It is the outcome of the inherent timing of the 18.6-year Real Estate Cycle, the debt created which drives it and ultimately becomes public knowledge and exposed at the conclusion of the mid-cycle recession.

You could say even, this works like clockwork.

Property Sharemarket Economics have advised its members for a while now to look out for just such an occurrence this year.

And more importantly, what it meant.

They can’t see the forest for the trees.

You see, while Enron was a disaster for those bond holders and share investors, it did not involve the US land market.

And because in 2001 the real estate cycle timing told me the mid-cycle slowdown was close to ending (recall the recession that occurred in 2000 in the US was less than six months) Enron was not an ending, it was a beginning.

The start of the second more speculative half of the cycle was about to begin. The history of the real estate cycle taught me as much.

Hence events like this repeat, you can count on it, only the numbers get bigger.

From US $23 billion worth of liabilities for Enron to today an estimated US $300 billion for Evergrande.

I know what you’re now thinking: but surely, Darren, this time it is different?! That 300 billion dollars is an enormous amount of debt due?

It sure is a lot of money.

And should it default, there will be a litany of people directly or indirectly impacted, just like with Enron. A huge swath of employees, contractors, investors, and bond holders will bear the brunt.

And I feel for them.

But it will not be different this time. How do I know?

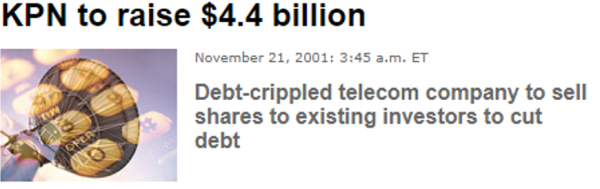

Do you remember this?

Source – CNN Money

Source – CNN Money

Because of paying far too much for then 3G spectrum licences and overinvestment in fibre optic cabling many telecommunication companies in Europe and the US could not make bond repayments on loans.

KPN was one and was forced to restructure about $23 billion worth of debt.

It placed a share offer worth $5 billion to institutional investors at a 50% discount. Those who took up this offer were fabulously rewarded for it just a few years later.

This is the real estate cycle turning before your eyes, and the start of the recovery out of the then 2000-01 recession lows.

This type of recapitalisation marks the bottom of the mid-cycle recession. It always has.

And it by and large doesn’t involve the land market. Particularly in the US which leads the cycle.

Seven years in the future from this though, the recapitalisation will involve the banks.

And that’s the time to be truly worried, but that time is not now.

So, when I read a recent Bloomberg article, can you get a sense of why perspective is so important?

From that Bloomberg article below.

“Saba Capital Management, Redwood Capital Management, Contrarian Capital Management and Silver Point Capital are among funds that have built positions in offshore bonds of China Evergrande Group’s ahead of a likely default of the real estate giant.

The four investors are among the credit funds that took a position in Evergrande’s $19 billion dollar-denominated notes in recent weeks, as prices fell to about 25% of face value…”

Ah, perspective.

What an incredible gift knowledge of the 18.6-year Real Estate Cycle can provide.

I think todays is the time to learn it for yourself. The best place to start is as a member to the Boom Bust Bulletin.

It can teach you this history, why the cycle must repeat and guide you to the best opportunities the cycle presents as and when they occur.

Don’t be swayed by click-bait headlines anymore when it comes to your understanding of the economy and the timing of your investments.

Members of the Boom Bust Bulletin are aware of what truly counts when it comes to indebted companies like Evergrande. And its best surmised with a question.

Does the default and bankruptcy of Evergrande dramatically affect the value of US land market?

The answer is no.

So, plan accordingly.

Which you can do for only $4USD a month. Simply amazing value.

Before I go though.

Remember those quotes I provided at the start?

They painted a bleak picture, right? Maybe even a personal one if you are trying to get yourself on the property ladder?

Here’s another one,

“It’s a gloomy moment in history…not for many years has there been so much grave and deep apprehension…. never has the future seemed so incalculable as at this time…. thousands of our fellow poorest citizens turn out for the winter with no prospect of employment

…in France the political cauldron seethes and bubbles…. Russia hangs like a cloud, dark and silent, upon the horizon of Europe…while all the energies and influence of the British are yet to be tried more sorely…”

This is a quote from an article detailing the massacre of emigrants by Mormon militiamen at Meadow mountains in Utah.

September 11, 1857.

Add 144 years to that date.

What is it with the United States and the month of September?

Somehow though, I think the US was able to move on back then.

Perspective. Get some.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.