We are on the cusp of what commentators are calling a commodity super cycle.

At Property Sharemarket Economics (PSE) we refer to this as the Long Wave, or the Kondratiev wave (or K-wave for short).

It was so named after Russian economist Nikolai Kondratiev – he discovered the 50 to 60-year commodity wave that drove Western societies through periods of technological development and periods of boom and bust.

He correctly worked out the economic peaks and busts experienced in democratic societies was intricately linked to a ‘wave’ of rising and falling commodity prices.

The key advantage here for PSE members however is our ability to combine this with our 18.6-year Real Estate Cycle knowledge to best determine which commodities will outperform and more importantly when.

But have you ever wondered what type of commodities will really explode during the current upswing of the K-wave?

And provide you with gains only dreamed of at the same time?

Then read on.

Look at commodities tied to the future.

When people think about commodities, they may be thinking mainly of oil, iron ore and coal.

And no doubt they are all important in maintaining the lifestyle and economic growth we all want during our lives.

Nor will you get any arguments from me if those same people are happy to expose their capital to stocks such as Rio Tinto, BHP, Woodside Petroleum and so on.

But for today they are not what we are after.

Today we want to research specific commodities, and stocks exposed to them that should the trend explode as we think it will, can potentially allow us to retire early on the gains made.

So, the place to start is to research what we believe the future is going to look like, particularly by the time we reach the end of the decade.

That’s because we overlay the real estate cycle over this, and we expect an enormous peak then bust to come by this time.

What does the world look like then by the end of the current decade?

Are flying taxis the norm? Are the roads full of fleets of autonomous self-driving electric vehicles? Will virtual reality glasses have replaced your PCs monitor and allow you to work while you walk?

If you get sick and need a new organ, might a 3D-printed one be available as soon as you need it?

Honestly, its quite possible ALL of these will be commonplace in a decade. Technological progress is going exponential, and it cannot now be stopped.

Even if we wanted to.

So that’s the long term, but what does it take to get there?

Lots of commodities, that’s what.

And extremely specific ones too. Today we will focus on Australian listed companies in this space. Canada is also a major focus for smaller cap miners, something a future email will perhaps look at.

These will make the future come alive.

Let’s start with looking at two companies exposed to the emerging industry of industrial minerals using a rare mineral called Halloysite.

What is that you might ask.

Halloysite is a rare derivative of kaolin where the mineral occurs as nanotubes only a few microns across. It is in short supply and commands a large premium in the market. It has until now been mostly used in ceramics and as a petroleum catalyst.

Now, high tech industry is beginning to find new applications for these nanotubes such as food, drugs, insecticides, anticorrosion agents, and the like.

Arguably, though, it’s the use of Halloysite as an ingredient of synthetic sapphire that is its important use.

Synthetic sapphire is used in the manufacture of substrates for LED lights, semiconductor wafers used in the electronics industry, and scratch-resistant sapphire glass used for wristwatch faces, optical windows, and smartphone components.

There is no substitute for Halloysite in the manufacture of synthetic sapphire.

It is also a recognised key ingredient for lithium-ion batteries.

This means extremely high demand in industries crucial to our technological future.

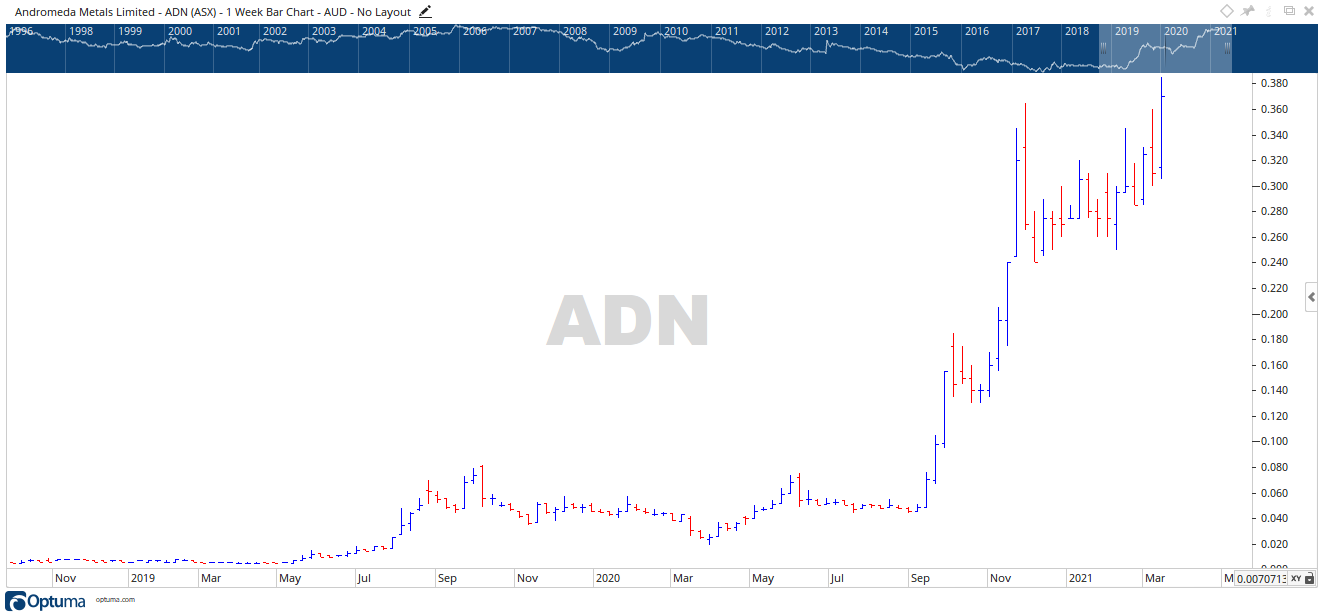

Look at the following charts.

Both companies are listed on the ASX; Andromeda Metals (ASX – ADN) & Latin Resources (ASX – LRS) are both involved heavily with mining for Kaolin’s and Halloysites.

LRS has recently brought new tenements and is due to drill these during the year.

AND has begun drilling its Mount Hope Kaolin project to help it produce an indicated resource estimate.

Both therefore have major drivers for future growth considering both are still involved in drilling and building out their resource base.

Another area which is a potential gold mine (pun not intended) are companies exposed to rare earth exploration (REE).

Already a very lucrative endeavor for mature producing mines, the political fallout of any potential Chinese clamp down on RE exports to the Western world would see an enormous re-rate higher for anything remotely exposed to this.

Vital Metals limited (ASX – VML) is due to begin rare earth mineral production later this year in Canada, making it only the second REE producer in North America.

Vital Metals aims to become the lowest cost producer of mixed rare earth oxide outside of China by developing one of the highest-grade rare-earth deposits in the world and the only rare earth project capable of beneficiation solely by ore sorting.

Beneficiation is any process that improves value of the ore by removing the unwanted minerals, which results in a higher-grade product.

It also has a REE resource in Tanzania.

In terms of being in the right place at the right time, VML ticks most boxes.

And then, we can’t forget the “Doctor” too.

Doctor copper that is. Copper is often looked to as an indicator of global economic health, due to its wide-spread use across most homes and economic sectors. Hence ‘Doctor copper’.

One of the best small cap miner names going around, Hot Chili Limited (ASX – HCH) is a copper and gold explorer with its exceptionally large resource at the Productora mine in Chile.

It hopes to further prove up the resource and could arguably become a takeover target itself should the indicated resource be large enough.

You must understand your downside risks here too.

Please understand, in no way shape or form are any of the above recommendations.

These are small and even micro-cap stocks. They will go up and they will go down. The speculative money that flows to them means any bad news, even a change in sentiment, for any of the minerals these companies are mining could see 40,50 and even 70% losses.

In a single trading day!

I should know, as I’ve seen it repeatedly.

Instead allow these charts to guide your own research to find the sectors that should outperform others and then find the leading stocks in those same sectors.

Is it a lot of work? Sure is.

Or you can always let your PSE team do the legwork for you.

And the way to do that is to subscribe to the Boom Bust Bulletin.

These editions will teach you about the history of the 18.6-year Real Estate Cycle, why it repeats and how to take full advantage of this knowledge.

Recently we have covered the best performing sectors and the leading stocks within them, like the ones here.

And all this incredible knowledge for less than a weeks’ worth of takeaway coffees.

So, don’t waste any more time.

This type of stocks continues to move, with or without you.

Best wishes

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.